Consumer Price Index, June 2024

July 16, 2024

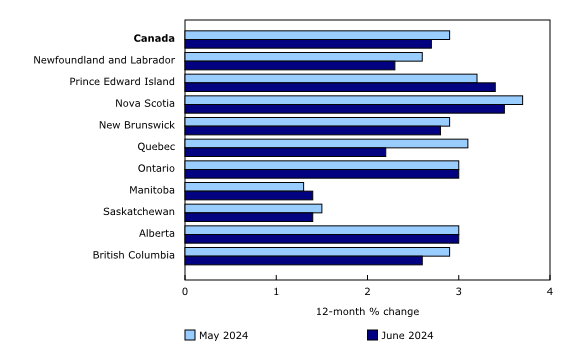

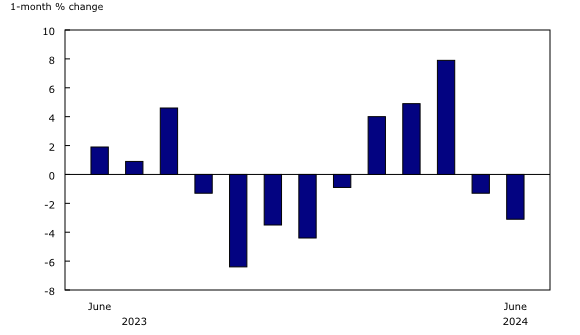

The Consumer Price Index (CPI) rose 2.7% on a year-over-year basis in June, down from a 2.9% gain in May. The deceleration was largely the result of slower year-over-year growth in gasoline prices, which rose 0.4% in June following a 5.6% increase in May. Excluding gasoline, the CPI rose 2.8% in June.

Year over year, lower prices for durable goods (-1.8%) also contributed to the slowdown in the all-items CPI in June. Moderating the deceleration was an increase in prices for food purchased from stores (+2.1%), as well as a smaller decline for cellular services in June (-12.8%) compared with May (-19.4%).

On a monthly basis, the CPI fell 0.1% in June, following a 0.6% increase in May. The monthly decrease was driven by lower prices for travel tours (-11.1%) and gasoline (-3.1%). On a seasonally adjusted monthly basis, the CPI rose 0.1% in June.

Chart 1

12-month change in the Consumer Price Index (CPI) and CPI excluding gasoline

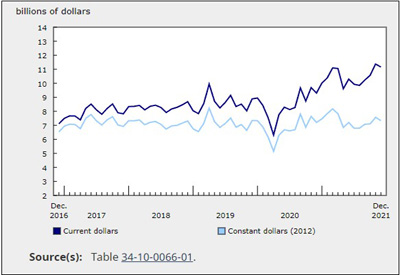

Chart 2

Slowdown in headline inflation led by transportation component

Gasoline prices rise at a slower pace

Year over year, gasoline prices rose at a slower pace in June (+0.4%) compared with May (+5.6%), stemming from a month-over-month decline of 3.1%. This monthly decrease coincided with an announcement from the Organization of the Petroleum Exporting Countries and its partners (OPEC+) to gradually phase out voluntary production cuts later this year and the restart of production for some refineries following shutdowns for spring maintenance.

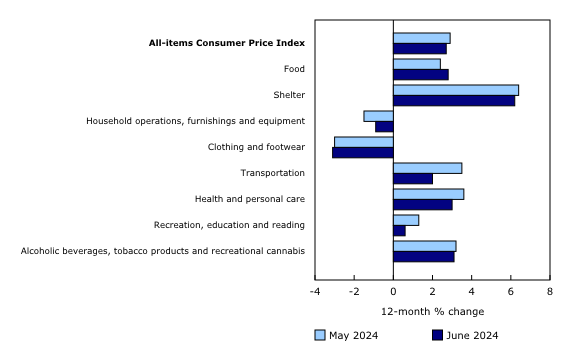

Chart 3

Gasoline prices fall month over month

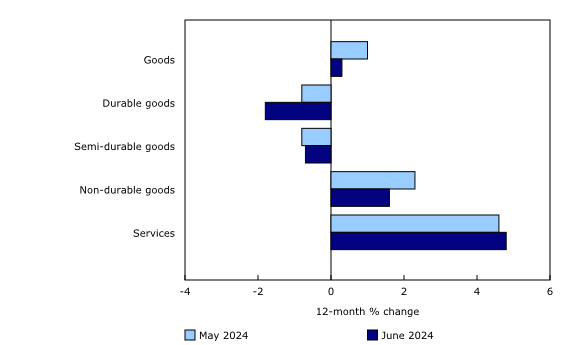

Prices for durable goods continue to decline

Prices for durable goods fell 1.8% year over year in June, following a 0.8% decline in May. The purchase of passenger vehicles index contributed the most to the decrease, falling 0.4% year over year in June, the largest yearly decline since February 2015. This decline was driven by a reduction in prices for used vehicles (-4.5%) amid improved inventory levels compared with a year ago.

Additionally, prices for furniture (-3.9%) fell on a year-over-year basis in June 2024, partly attributable to the easing of supply chain issues. Higher interest rates are also impacting the spending patterns of consumers, with many spending less on discretionary goods by delaying big-ticket purchases, which may be contributing to lower demand and therefore lower prices.

Chart 4

Price growth for goods slows but accelerates for services

Consumers pay more for groceries

On a year-over-year basis, consumers paid more for food purchased from stores in June (+2.1%) compared with May (+1.5%), marking the second consecutive month that grocery price growth accelerated. For comparison, from June 2021 to June 2024, prices for food purchased from stores increased 21.9%.

Price growth for some food items such as dairy products (+2.0%), fresh vegetables (+3.8%), non-alcoholic beverages (+5.6%), as well as preserved fruit and fruit preparations (+9.5%), accelerated year over year in June.

Moderating the increase in grocery prices were prices for fresh fruit, which fell to a greater extent in June (-5.2%) compared with May (-2.8%).

Chart 5

Grocery prices accelerate for the second consecutive month

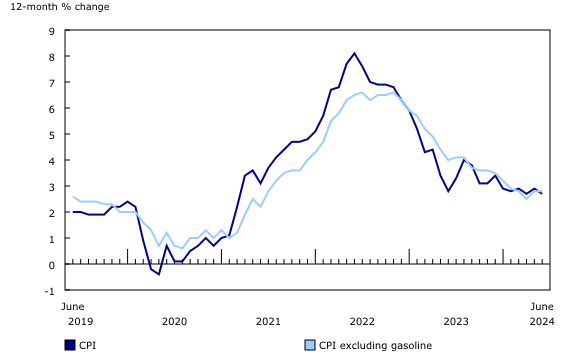

Regional highlights

Year over year, prices rose at a slower pace in June compared with May in six provinces.

Chart 6

The Consumer Price Index rises at a slower pace in six provinces