Collectively, We Know Everything: Electrical Business Confidence Index

Collectively, we know everything. This phrase is based on a simple theory from the book Wisdom of the Crowds by James Surowiecki. Individually, we all know something; we all take little bits of information, add them together, and collectively we all know everything. Sounds simple, but the tough part is extracting the “all-knowing” right answer out from the crowd.

Using this crowd-sourcing approach works well in a number of areas. One of the best ways this method is used is in sports betting. With sports betting, thousands of individuals bet what they know, for their own self-interest. They may be wrong individually, but if you average out the total bets you get another story. Collectively, by averaging the answers, you get the most accurate predictions on the games — in fact, often more accurate predictions than the experts themselves.

An example of how we use this approach in our industry is as follows.

Each quarter, we ask a key group of our industry executives how they feel about the economy, how it relates to them now, and how they feel about their immediate future.

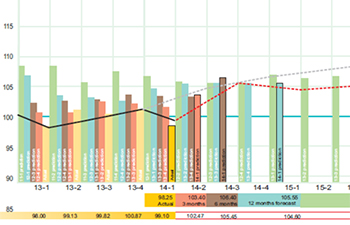

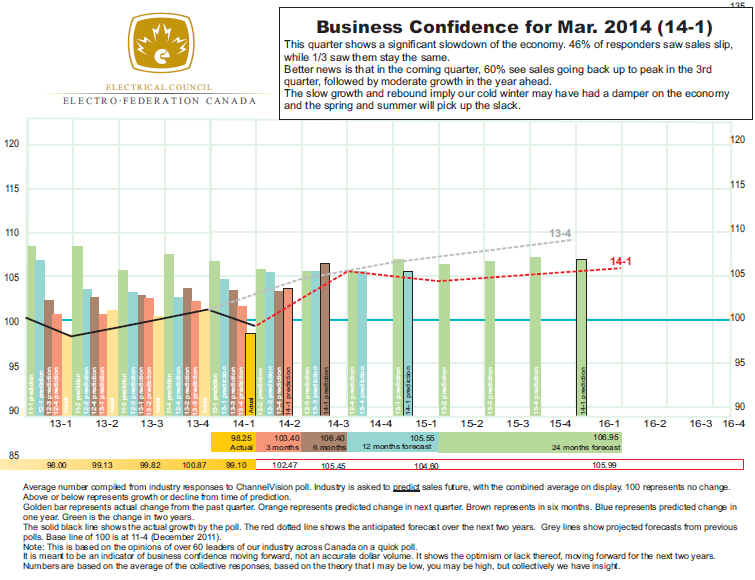

We ask a series of questions that help determine our members’ opinions of forthcoming quarters — will the next quarter, next six months, next year and next two years, be better, the same, worse or a lot worse? We then average each of the five questions and lay it out on a chart (see chart below).

Using blocks, we show where the industry thinks it will be over a two-year period. Each quarter moves the blocks out another section and allows us to track our changes in forecast. Looking at the chart: in the four quarters of 2103 (13-1, 13-2, 13-3 and 13-4), you will notice the green bars (two-year-out predictions) pegged our economy to be much better than it has turned out. Actual sales in yellow were down considerably from forecast. In general, most economists had predicted that the economy would turn around faster than it has.

The black line shows compounded growth. Starting with 12-4 as the base of 100, sales have gone down in the first quarter of 2013,then back up by the end of the year. During the first quarter of 2014, the industry has gone down again below the 2012 base. Members are predicting a quick return to increased sales as the dotted red line indicates, but it still tapers off from the grey dotted line, which shows last quarter predictions.

Bottom line sales are flat in 2013, down in the first quarter of 2014, and rebounding quickly with slow growth after that.

Surowiecki’s best example of this crowd-sourcing approach comes from England. A contest was held to guess the weight of a cow after it had been dressed. Over 300 responses from butchers, farmers, school kids and factory workers were all wrong. But when the guesses were averaged out, the answer was exactly correct to the decimal.

Sometimes crowds can provide bad answers. This is best seen when groups have been together for too long and “groupthink” comes into play. Surowiecki found that when committees are formed, individuals participate from their own self-interest. The committee is dynamic. Over time, individuals learn from each other and become smarter. Paradoxically, at the same time the committee becomes less dynamic, more singular in response and “groupthink” sets in.

The way to avoid this phenomenon is to limit collaboration. You have to allow individuals to vote from their perspective, not from lengthy discussions.

If you are interested in participating in the Electrical Council’s quarterly survey on business confidence please drop me a line at rmccarten@electrofed.com and I will get you involved. You do not have to be an expert, although we encourage experts too, we are just looking for a little bit of knowledge.

After all, if we get enough responses, we will get a little closer to knowing everything.