CEW Survey of Electrical Companies: What You Told Us

June 29, 2018

By CEW Editorial Team

To gain a broader understanding of the Canadian market as a whole, CEW recently conducted a survey of electrical companies from across Canada. As always, our readers rose to the occasion, providing the data that we discuss below.

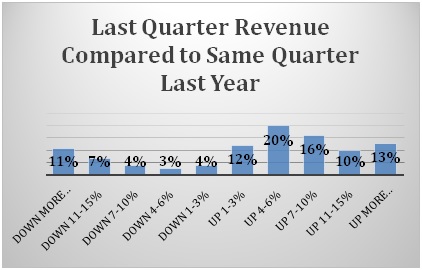

In our initial question we asked respondents to compare their last quarter results from 2018 against those from the same quarter last year. The survey results show a promising upward trend of growth, which in some cases has shown substantial gain. The largest growth revealed that 20% of respondents report revenue up 4-6% over the same quarter last year. In total 71% of respondents identified growth over last year.

The positive results reflect the stability of the electrical market and general economic stability of the country, as new construction and renovation projects continue to rise. The growth may also result from an expanding electrical industry in terms of product offerings and deliverables. The push for a greener economy, the rising adoption of renewables, EVs, Low-voltage products and various other popular avenues are driving market growth that is having a positive impact on the year over year growth rates for electricians and electrical contractors. However, the survey was conducted prior to the current ongoing trade dispute escalation between Canada and the U.S.

Some respondents did reveal negative results, with 11% identifying a loss greater than 15%. In total 29% of respondents noted a loss in this quarter over last quarter, and although the results overall demonstrate a positive growth trend the negative results are also revealing about the direction of the industry. As companies continue to grow competition will increase, inevitably resulting in losses for some business. However, with a rapidly growing industry and new directions available to companies (renewables, automation, etc,), those that advance their capabilities and offerings are likely to remain on the growth side of the chart.

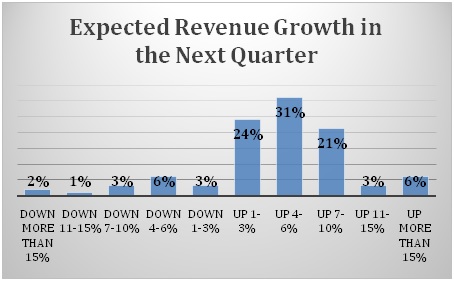

Thinking forward will help companies maintain a competitive edge in the marketplace. And for those surveyed there is a high expectation of growth in the next quarter. This positive outlook is also held by a number of companies that showed a loss the last quarter. Figure 2 shows that 24% of respondents expect to see revenue growth of 1-3%, while 31% expect to see growth of 4-6% and 21% a growth of 7-10%. The expected revenue growth reveals a positive industry outlook for the future of the market. When we include the 9% of respondents that expect revenue growth of more than 11% in the next quarter 85% of those surveyed expect to see growth. The numbers reveal that 14% of respondents that identified a loss in the last quarter expect to rebound in the next quarter, leaving only 15% of companies expecting to continue seeing a drop in revenue growth.

Thinking forward will help companies maintain a competitive edge in the marketplace. And for those surveyed there is a high expectation of growth in the next quarter. This positive outlook is also held by a number of companies that showed a loss the last quarter. Figure 2 shows that 24% of respondents expect to see revenue growth of 1-3%, while 31% expect to see growth of 4-6% and 21% a growth of 7-10%. The expected revenue growth reveals a positive industry outlook for the future of the market. When we include the 9% of respondents that expect revenue growth of more than 11% in the next quarter 85% of those surveyed expect to see growth. The numbers reveal that 14% of respondents that identified a loss in the last quarter expect to rebound in the next quarter, leaving only 15% of companies expecting to continue seeing a drop in revenue growth.

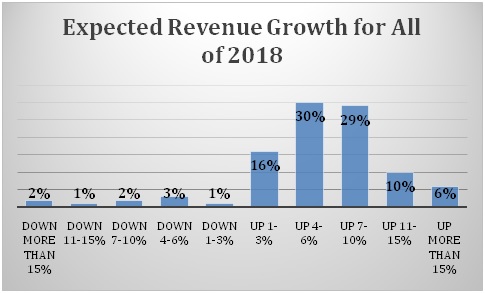

Finally, in terms of revenue growth we asked companies to consider their expected revenue growth for all of 2018, and again received positive results that reveal a promising outlook for the year. The most promising expectations have 59% of companies anticipating annual revenue growth between 4 and 10%, with a further 10% expecting growth between 11 and 15%, and 6% expecting growth greater than 15%. In total, 91% of companies are expecting to see growth in their annual revenue. This number is quite high but keep in mind this is an expectation of growth rather than retrospective figures.

Considering that 71% of companies recorded revenue growth in the last quarter, 85% expect to see growth in the coming quarter and 91% plan to see annual growth, the outlook from within the industry appears positive and progressive.

Considering that 71% of companies recorded revenue growth in the last quarter, 85% expect to see growth in the coming quarter and 91% plan to see annual growth, the outlook from within the industry appears positive and progressive.

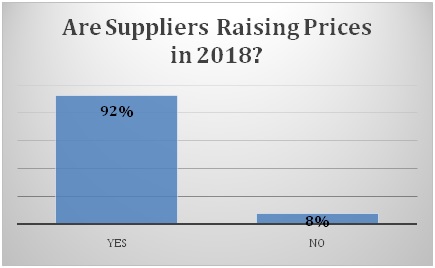

One of the key components to successful growth is determined by product prices. Cost has a major impact on competition among electricians and electrical contractors who often bid on the same projects but use different suppliers. We asked if suppliers were raising their product costs in 2018. Not surprisingly, 92% of respondents identified a raise in product prices by their suppliers.

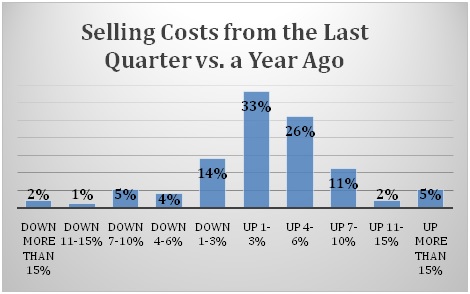

What is most interesting however are the results we received when we asked companies to compare their selling costs from the last quarter versus the selling costs from the same quarter last year. And keep in mind that 92% of these respondents noted that prices in 2018 have risen. In the last quarter 33% of respondents raised prices by 1-3% and a further 26% went up by 4-6% over the same quarter last year. This was the expected response, with most companies implementing a gradual increase of selling costs in line with increases by manufacturers and distributors. A further 18% identified higher increases over last year, with a total of 77% of respondents increasing their selling costs.

What is most interesting is that 92% of respondents identified that suppliers were raising costs but only 77% of the same respondents have increased their selling costs. In total 26% of respondents noted a decrease in their selling costs. There are a number of variables that be the driving force behind some company’s lower costs at the same time that suppliers are raising prices, including savings made in other areas to offset the raise in prices, the need to maintain competitive, expanding the business into new avenues or simply using various suppliers to ensure the lowest costs possible. Either way it is worth noting that not all electricians and electrical contractors seem to feel the need to make immediate selling cost increases as a result of suppliers raising prices.

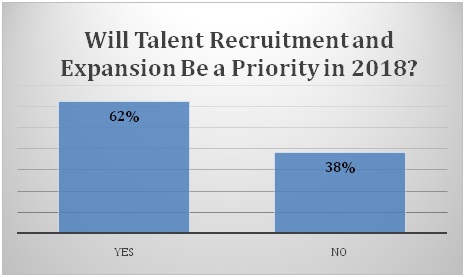

As we noted above expansion may play a role in the ability to offset raising costs, particularly if that expansion reaches into new areas with products that are more competitively priced or that have a wider product offering. To gain insight into the potential for expansion, we asked companies if talent recruitment and expansion will be a priority in 2018. 62% of companies responded that they will be making talent recruitment and expansion a priority. With the continued broadening of the electrical industry to include focuses such as automation and control many companies are expanding their services into these areas. The expansion is opening the industry to new talents and a wider customer base that means companies moving in these directions can increase revenue and offset raising product costs within heir traditional offerings.

As we noted above expansion may play a role in the ability to offset raising costs, particularly if that expansion reaches into new areas with products that are more competitively priced or that have a wider product offering. To gain insight into the potential for expansion, we asked companies if talent recruitment and expansion will be a priority in 2018. 62% of companies responded that they will be making talent recruitment and expansion a priority. With the continued broadening of the electrical industry to include focuses such as automation and control many companies are expanding their services into these areas. The expansion is opening the industry to new talents and a wider customer base that means companies moving in these directions can increase revenue and offset raising product costs within heir traditional offerings.

Overall 2018 is proving to be a growth year within the electrical industry, with positive results and expectations.