Canadian Survey on Business Conditions, Q1 2021

Mar 10, 2021

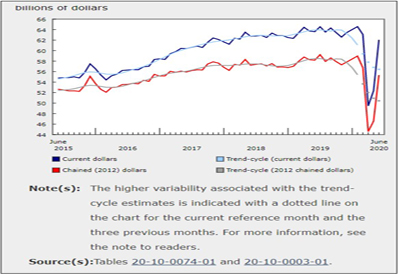

As a result of the widespread measures taken to contain the spread of COVID-19, the Canadian economy contracted by almost one-fifth (-18.2%) in March and April 2020, the steepest drop on record.

By the end of May, many businesses had begun to adapt to the new reality by shifting to teleworking, reducing business hours, laying off staff, applying for government funding or seeking rent relief. With the gradual easing of pandemic-related restrictions, the business climate began to improve.

The subsequent months resulted in an improvement in economic activity. However, the resurgence of COVID-19 and a return to a partial shutdown in several provinces this winter meant that there remain challenges and uncertainty ahead for businesses. Real gross domestic product edged up 0.1% in December, the eighth consecutive monthly increase. Total economic activity in December was about 3% below the pre-pandemic level in February 2020.

From mid-January to mid-February, Statistics Canada conducted the Canadian Survey on Business Conditions. The survey collects information on the expectations of businesses moving forward and the ongoing impact of the pandemic on businesses in Canada.

Over the next three months (see note to readers), over two-fifths of businesses expected their profitability would decrease, close to one-third expected their sales would decrease, over one-tenth expected they would increase the prices they charge and nearly three-quarters expected their number of employees would remain the same. Compared with 2019, close to one-third of businesses saw a decline in revenue of 30% or more in 2020. Businesses are concerned with future survival and expect to face a variety of obstacles in the short term.

Many businesses anticipate decline in profitability in the short term

Over two-fifths (41.8%) of all businesses and almost three-fifths (56.4%) of businesses in accommodation and food services expected their profitability would decrease over the next three months. Conversely, 8.3% of businesses expected their profitability would increase, most notably in wholesale (13.3%) and retail (12.8%) trade.

Close to one-third (30.6%) of businesses expected their sales would decrease over the next three months. Nearly half of the businesses in accommodation and food services (49.2%) expected sales to fall.

Over one-tenth (14.0%) of businesses expected they would raise prices over the next three months, down from nearly one-fifth (18.1%) of businesses last cycle. Businesses in wholesale trade (27.5%), manufacturing (23.3%) and retail trade (21.2%) were the most likely to expect they would raise prices.

Slightly more than seven-tenths (70.6%) of businesses expected their number of employees to remain the same over the next three months, down from nearly three-quarters (74.1%) of businesses last cycle. Conversely, 11.7% of businesses expected their number of employees would decrease, relatively unchanged from 10.4% the previous cycle. Close to one-third (29.6%) of businesses in accommodation and food services expected a reduction in their number of employees over the next three months, up from nearly one-quarter (22.5%) in the previous cycle.

The vast majority of businesses in accommodation and food services and arts, entertainment and recreation experienced loss in revenue in 2020

The vast majority of businesses in accommodation and food services (86.4%) and arts, entertainment and recreation (78.3%) reported a decline in revenue in 2020 from a year earlier. Furthermore, approximately three-fifths of businesses in accommodation and food services (61.5%) and arts, entertainment and recreation (54.8%) had revenues fall 30% or more year over year. Three-fifths (60.5%) of all businesses reported that revenues were down in 2020 from a year earlier and nearly one-third (31.0%) reported that revenue fell by 30% or more.

Businesses are concerned with their survival over the next year

Over half (51.3%) of businesses did not know how long they could continue to operate at their current level of revenue and expenditures before considering closure or bankruptcy, while one-tenth (10.3%) of businesses reported they could continue for less than 12 months. Nearly one-quarter of businesses in accommodation and food services (24.9%) and arts, entertainment and recreation (23.3%) reported they could continue to operate at their current level of revenue and expenditures for less than 12 months before having to consider closure or bankruptcy.

Nearly half (46.4%) of businesses did not know how long they could continue to operate at their current level of revenue and expenditures before considering laying off staff, while over one-fifth (21.3%) reported they could continue for less than 12 months.

Over one-tenth (12.3%) of businesses have plans to expand or restructure their business, or to acquire or invest in other businesses in the next year. Conversely, 3.2% of businesses have plans to transfer or sell their business within the next year and 2.4% have plans to close their business, similarly to last cycle. Businesses in manufacturing (6.6%) and accommodation and food services (6.0%) were most likely to have plans to sell over the next year.

Businesses expect to face a variety of obstacles

Approximately one-third of all businesses expected fluctuations in demand (31.4%) or insufficient demand (29.2%) to be obstacles for their business over the next three months, while around one-quarter expected rising cost of inputs (25.5%), maintaining sufficient cash flow or managing debt (24.2%), and recruiting and retaining skilled employees (24.1%) to be obstacles.

During these uncertain times, businesses are faced with a variety of obstacles and future unknowns. Fluctuations in consumer demand was a common obstacle expected over the next three months among businesses in accommodation and food services (45.5%), retail trade (43.3%), wholesale trade (39.6%), manufacturing (35.2%), construction (31.9%) and arts, entertainment and recreation (30.1%). Apart from fluctuations in consumer demand, key obstacles expected by businesses vary by industry.

Around two-fifths of businesses in wholesale trade (46.9%), manufacturing (44.2%), construction (42.2%) and retail trade (37.3%) expected supply chain challenges to be an obstacle over the next three months.

A substantial proportion of businesses in accommodation and food services (50.5%), transportation and warehousing (37.2%), mining, quarrying, and oil and gas (36.0%), information and cultural industries (35.0%) and wholesale trade (34.9%) expected insufficient demand would be an obstacle.

Over two-fifths (42.5%) of businesses in accommodation and food services expected maintaining sufficient cash flow or managing debt would be an obstacle. Over half of businesses in this sector stated they do not have the ability to take on more debt (52.7%).

In light of continuous reopenings and shutdowns because of fluctuations in the number of COVID-19 cases during different waves, government regulations posed an expected obstacle for around two-fifths of businesses in arts, entertainment and recreation (43.6%) and accommodation and food services (38.1%).

As a result of the widespread measures taken to contain the spread of COVID-19, the Canadian economy contracted by almost one-fifth (-18.2%) in March and April 2020, the steepest drop on record.

By the end of May, many businesses had begun to adapt to the new reality by shifting to teleworking, reducing business hours, laying off staff, applying for government funding or seeking rent relief. With the gradual easing of pandemic-related restrictions, the business climate began to improve.

The subsequent months resulted in an improvement in economic activity. However, the resurgence of COVID-19 and a return to a partial shutdown in several provinces this winter meant that there remain challenges and uncertainty ahead for businesses. Real gross domestic product edged up 0.1% in December, the eighth consecutive monthly increase. Total economic activity in December was about 3% below the pre-pandemic level in February 2020.

From mid-January to mid-February, Statistics Canada conducted the Canadian Survey on Business Conditions. The survey collects information on the expectations of businesses moving forward and the ongoing impact of the pandemic on businesses in Canada.

Over the next three months (see note to readers), over two-fifths of businesses expected their profitability would decrease, close to one-third expected their sales would decrease, over one-tenth expected they would increase the prices they charge and nearly three-quarters expected their number of employees would remain the same. Compared with 2019, close to one-third of businesses saw a decline in revenue of 30% or more in 2020. Businesses are concerned with future survival and expect to face a variety of obstacles in the short term.

Many businesses anticipate decline in profitability in the short term

Over two-fifths (41.8%) of all businesses and almost three-fifths (56.4%) of businesses in accommodation and food services expected their profitability would decrease over the next three months. Conversely, 8.3% of businesses expected their profitability would increase, most notably in wholesale (13.3%) and retail (12.8%) trade.

Close to one-third (30.6%) of businesses expected their sales would decrease over the next three months. Nearly half of the businesses in accommodation and food services (49.2%) expected sales to fall.

Over one-tenth (14.0%) of businesses expected they would raise prices over the next three months, down from nearly one-fifth (18.1%) of businesses last cycle. Businesses in wholesale trade (27.5%), manufacturing (23.3%) and retail trade (21.2%) were the most likely to expect they would raise prices.

Slightly more than seven-tenths (70.6%) of businesses expected their number of employees to remain the same over the next three months, down from nearly three-quarters (74.1%) of businesses last cycle. Conversely, 11.7% of businesses expected their number of employees would decrease, relatively unchanged from 10.4% the previous cycle. Close to one-third (29.6%) of businesses in accommodation and food services expected a reduction in their number of employees over the next three months, up from nearly one-quarter (22.5%) in the previous cycle.

The vast majority of businesses in accommodation and food services and arts, entertainment and recreation experienced loss in revenue in 2020

The vast majority of businesses in accommodation and food services (86.4%) and arts, entertainment and recreation (78.3%) reported a decline in revenue in 2020 from a year earlier. Furthermore, approximately three-fifths of businesses in accommodation and food services (61.5%) and arts, entertainment and recreation (54.8%) had revenues fall 30% or more year over year. Three-fifths (60.5%) of all businesses reported that revenues were down in 2020 from a year earlier and nearly one-third (31.0%) reported that revenue fell by 30% or more.

Businesses are concerned with their survival over the next year

Over half (51.3%) of businesses did not know how long they could continue to operate at their current level of revenue and expenditures before considering closure or bankruptcy, while one-tenth (10.3%) of businesses reported they could continue for less than 12 months. Nearly one-quarter of businesses in accommodation and food services (24.9%) and arts, entertainment and recreation (23.3%) reported they could continue to operate at their current level of revenue and expenditures for less than 12 months before having to consider closure or bankruptcy.

Nearly half (46.4%) of businesses did not know how long they could continue to operate at their current level of revenue and expenditures before considering laying off staff, while over one-fifth (21.3%) reported they could continue for less than 12 months.

Over one-tenth (12.3%) of businesses have plans to expand or restructure their business, or to acquire or invest in other businesses in the next year. Conversely, 3.2% of businesses have plans to transfer or sell their business within the next year and 2.4% have plans to close their business, similarly to last cycle. Businesses in manufacturing (6.6%) and accommodation and food services (6.0%) were most likely to have plans to sell over the next year.

Businesses expect to face a variety of obstacles

Approximately one-third of all businesses expected fluctuations in demand (31.4%) or insufficient demand (29.2%) to be obstacles for their business over the next three months, while around one-quarter expected rising cost of inputs (25.5%), maintaining sufficient cash flow or managing debt (24.2%), and recruiting and retaining skilled employees (24.1%) to be obstacles.

During these uncertain times, businesses are faced with a variety of obstacles and future unknowns. Fluctuations in consumer demand was a common obstacle expected over the next three months among businesses in accommodation and food services (45.5%), retail trade (43.3%), wholesale trade (39.6%), manufacturing (35.2%), construction (31.9%) and arts, entertainment and recreation (30.1%). Apart from fluctuations in consumer demand, key obstacles expected by businesses vary by industry.

Around two-fifths of businesses in wholesale trade (46.9%), manufacturing (44.2%), construction (42.2%) and retail trade (37.3%) expected supply chain challenges to be an obstacle over the next three months.

A substantial proportion of businesses in accommodation and food services (50.5%), transportation and warehousing (37.2%), mining, quarrying, and oil and gas (36.0%), information and cultural industries (35.0%) and wholesale trade (34.9%) expected insufficient demand would be an obstacle.

Over two-fifths (42.5%) of businesses in accommodation and food services expected maintaining sufficient cash flow or managing debt would be an obstacle. Over half of businesses in this sector stated they do not have the ability to take on more debt (52.7%).

In light of continuous reopenings and shutdowns because of fluctuations in the number of COVID-19 cases during different waves, government regulations posed an expected obstacle for around two-fifths of businesses in arts, entertainment and recreation (43.6%) and accommodation and food services (38.1%).

Businesses shift to increase online sales capabilities

The onset of the COVID-19 pandemic, combined with temporary store closures and physical distancing measures, prompted many Canadian retailers to open or expand their e-commerce presence, quickly changing the retail landscape. Retail e-commerce rose from 3.5% of total retail sales in 2019 to 5.9% in 2020. In December alone, online sales were up by over two-thirds (+69.3%) year over year to $4.7 billion.

Almost one-fifth (16.7%) of businesses had an online sales platform or had plans to implement one. Businesses in retail trade (39.5%), wholesale trade (30.9%) and finance and insurance (30.9%) were most likely to have an online sales platform or plans to implement one.

One-tenth (10.0%) of businesses made half or more of their total sales online in 2020, up from 6.8% in 2019. The largest increase (+9.5%) was in finance and insurance, where the share of businesses with half or more of their total sales online almost doubled from 11.8% in 2019 to 21.3% in 2020.

[IT]Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210305/dq210305b-eng.htm?CMP=mstatcan

Photo by Scott Graham on Unsplash[IT]