Canadian Gross Domestic Product by Industry, March 2021

June 1, 2021

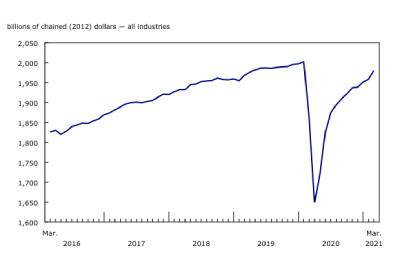

Real gross domestic product (GDP) grew 1.1% in March, following 0.4% growth in February. This 11th consecutive monthly increase continued to offset the steepest drops in Canadian economic activity on record observed in March and April 2020. However, total economic activity was about 1% below the level observed in February 2020, before the COVID-19 pandemic.

Both goods-producing (+1.1%) and services-producing (+1.1%) industries were up, as 18 of 20 industrial sectors posted increases in March.

Preliminary information indicates an approximate 0.8% decline in real GDP in April, the first decline since April 2020. Declines in retail trade and accommodation and food services reflect in part additional public health measures in some parts of the country. There are also notable declines in manufacturing, real estate and rental and leasing, and educational services. Owing to its preliminary nature, this estimate will be revised on June 30 with the release of the official GDP data for April.

Retailing up on favourable conditions

Retail trade increased 3.7% in March, following a 5.9% jump in February, as 10 of 12 subsectors were up.

Activity at building material and garden equipment and supplies retailers jumped 15.3% in March as the continued easing of restrictions and temperatures above the seasonal average in some parts of the country contributed to the growth. Clothing and clothing accessories retailing also posted a strong increase (+18.6%) in March, following a 34.1% jump in February.

Sporting goods, hobby, book and music stores (+7.4%), furniture and home furnishings stores (+5.1%), and other traditional brick-and-mortar stores benefited from regulations permitting in-store shopping. Food and beverage stores (-0.9%) and gasoline stations (-0.8%) offset some of the gains.

Strength in construction continues

Construction rose 2.2% in March, building up on increases in the previous three months, as all subsectors were up.

The residential building construction subsector contributed the most to the growth, with a 4.1% expansion in March, as all types of construction activities were up. Single-family home construction and alterations and improvements led the expansion, as strong demand continued into March. With the exception of November (-0.3%), the subsector has been continuously growing since May 2020.

Repair construction increased 1.8% in March, while non-residential building construction rose 1.3%, as all components increased. Engineering and other construction activities also grew (+0.3%).

Wholesale trade grows

Wholesale trade increased 1.8% in March, more than offsetting the 1.4% decline in February, as eight of nine subsectors were up. Building material and supplies wholesaling contributed the most to the growth, with a 5.6% increase in March, benefiting from heightened demand for products both domestically and internationally. Machinery, equipment and supplies wholesaling rose 1.0%, as activity in the majority of industries in the subsector increased. Only farm product wholesaling (-4.2%) was down in the month.

The public sector continues to grow

The public sector (educational services, health care and social assistance, and public administration) grew 0.8% in March, as all three components were up.

Educational services rose 1.6% in March, driven by a 2.9% gain at elementary and secondary schools. In 2021, the Government of Ontario moved the annual spring break from mid-March to mid-April to limit the spread of COVID-19. This decision resulted in an atypical increase in output from the extra week of classes in March.

Health care and social assistance rose 0.7%, led by ambulatory health care services (+1.7%), while public administration grew 0.3% in March.

Mining, quarrying, and oil and gas extraction increases

Mining, quarrying, and oil and gas extraction grew 1.9% in March, largely offsetting the 2.4% decline in February, as all three subsectors were up.

Oil and gas extraction, up for the sixth time in seven months, increased 1.6% in March. Oil sands extraction was up 0.6%, led by crude bitumen extraction in Alberta. Oil and gas extraction (except oil sands) increased 2.8%, as both crude petroleum and natural gas extraction were up.

Mining and quarrying (except oil and gas) rose 2.9% in March, more than offsetting the 1.3% decline in February, as export-driven increases in metal ore mining led the growth. Indeed, the latter industry rose 5.8%, as copper, nickel, lead and zinc ore mining (+6.9%), iron ore mining (+6.1%), and gold and silver ore mining (+4.7%) all recorded growth. Non-metallic mineral mining declined (-0.7%) for a third month in a row, mainly because of a fall in diamond mining. Coal mining was down for the first time in 10 months, decreasing 3.0% in March.

Support activities for mining, and oil and gas extraction grew 0.5% in March, attributable to higher rigging services.

Accommodation and food services are up

Accommodation and food services rose 5.0% in March, led by an 11.1% increase in accommodation services. Starting late February, all travellers entering Canada by air, regardless of citizenship, have been required to follow testing and quarantine measures, with a mandatory stopover at a government-authorized hotel at the travellers’ expense, resulting in an uptick in activity.

Food services and drinking places were up for a third consecutive month, rising 2.9% in March.

Professional services keep growing

Professional services expanded 1.0% in March as the majority of industries were up. Contributing the most to the growth were computer systems design and related services (+0.9%) and other professional, scientific and technical services, including scientific research and development services (+1.1%).

Legal services, which derive much of their activity from real estate transactions, grew 1.2% in March. Continued increases in home resale activity in Ontario and Western Canada pushed the level of activity at offices of real estate agents and brokers (+2.6%) to yet another all-time high.

Other industries

The manufacturing sector grew 0.5% in March, as an increase in durable manufacturing (+1.4%) more than offset a contraction in non-durable manufacturing (-0.6%).

Transportation services rose 1.3% in March, after declining in the previous two months, as the majority of subsectors were up. Truck transportation (+2.3%), support activities for transportation (+1.3%) and rail transportation (+1.2%) contributed the most to the growth.

Utilities were down 1.0%, as electric power generation, transmission and distribution (-0.6%) and natural gas distribution (-4.8%) decreased in March.

Finance and insurance edged up 0.2%. Increases in financial investment services, funds and other financial vehicles (+1.3%) and depository credit intermediation and monetary authorities (+0.2%) offset declines in non-depository credit intermediation and activities related to credit intermediation (-0.3%) and insurance carriers and related activities (-0.3%).

First quarter of 2021

Economic activity continued to grow in the first quarter of 2021. Overall, 15 of 20 sectors recorded gains in the quarter as both goods-producing (+2.2%) and services-producing (+1.4%) industries were up. This third consecutive quarterly increase continued to offset the historic drop in output in the second quarter of 2020.

Construction expanded for a third consecutive quarter, rising 3.8% in the quarter, as most types of construction activity were up. Residential building construction jumped 7.6%, as all components increased, led by single-family home construction and home alterations and improvements. Repair construction (+3.5%) and engineering and other construction activities (+0.9%) rose, while non-residential building construction remained unchanged (0.0%).

Mining, quarrying, and oil and gas extraction increased 5.5%, as all subsectors recorded growth. Mining and quarrying (excluding oil and gas) expanded 9.1%, as metal ore (+9.8%), non-metallic mineral (+6.4%) and coal (+11.3%) mining were all up in the first quarter. Oil and gas extraction grew 2.4%, led by a 4.4% increase in oil sands extraction activity. Oil and gas extraction (except oil sands) edged up 0.1%, as a decline in crude petroleum extraction was more than offset by higher natural gas production.

The largest contributor to the increase in the services-producing industries was a 2.1% rise in the public sector (educational services, health care and social assistance, and public administration), as all three components rose. Health care and social assistance grew 2.8%, driven by ambulatory health care services (+5.2%) and hospitals (+1.1%). Public administration rose 1.8%, while educational services were up 1.7% in the quarter.

The real estate and rental and leasing sector rose 1.3% as increases in the majority of subsectors contributed to the growth. Continued strong home resale activity in many markets across the country pushed activity at the offices of real estate agents and brokers (+8.4%) to record-high levels in the first quarter of 2021.

The professional, scientific and technical services sector increased 2.2% in the first quarter, up for the third consecutive quarter. Legal, accounting and related services (+3.0%) and computer systems design and related services (+2.3%) led growth in the sector.

Retail trade rose 1.5% in the first quarter of 2021. The continued lifting and easing of lockdown measures in the latter part of the quarter, in many parts of the country, contributed to the sector’s growth, as activity increased at non-essential retailers. Building material and garden equipment and supplies dealers (+8.1%), non-store retailers (+9.3%) and general merchandise stores (+3.4%) led the growth.

The finance and insurance sector rose 1.0% in the first quarter of 2021 and has grown for eight consecutive quarters. Depository credit intermediation and monetary authorities (+0.8%), financial investment services, funds and other financial vehicles (+2.2%) and insurance carriers and related activities (+1.2%) were all up.

Go HERE for more information