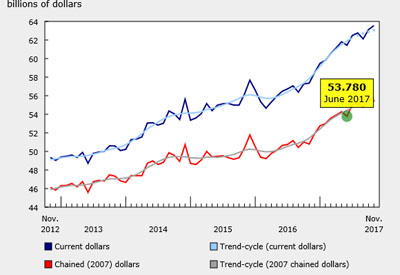

Canadian Dollar: Time for a Change?

July 3, 2017

By Paul Eitmant

The Canadian dollar has slipped below 80 cents US for the first time in almost six years… The Canadian dollar closed at 77.10 cents US on Friday… The Canadian dollar’s tumble accelerated just after the U.S. Federal Reserve reiterated it will be patient in raising rates from record lows and noted that the U.S. economy continues to improve… Canadian dollar could fall to 75 cents on weak oil prices, experts say… Canadian dollar slump hikes cost of U.S. imported goods…

This last statement immediately sent the value of the U.S. dollar up against many major of the world’s currencies, including the Canadian dollar.

“The strong divergence of the Fed having a tightening bias, regardless of how much they end up tightening, is likely to keep the [U.S.] dollar supported versus most currencies,” Robert Tipp, a chief investment strategist at Prudential told Bloomberg.

The Bank of Canada shocked the markets and caught both investors and the big banks by surprise with its rate cut last week, he said. “The Bank of Canada not having a clear path of how it will precede breeds uncertainty,” he said.

There could be a “butterfly effect” from events in China or Europe where economies have turned downwards that would create further expectations of a rate cut in Canada and hurt the dollar, he said.

A low dollar makes Canadian exports more competitive and the stronger U.S. economy will improve demand. But it could take a year for the benefit of a declining dollar to take effect, Madhavji said. He forecasts a recovery in the Canadian dollar to the 87-cent level if oil bounces up closer to US$60 a barrel.

Goldman Sachs is predicting a 76-cent Canadian dollar in the near term, but says the Canadian dollar will continue its slide and could fall to 71 cents US by 2017. It also is forecasting $30 barrel oil.

“The Fed is leaning towards rate hike mode, while the [Bank of Canada] is in a rate cut mode. It is a tale of two worlds,” wrote Rahim Madhavji of Knightsbridge Foreign Exchange in an emailed commentary. “The trend is the friend for the U.S. dollar. The next few months could get ugly for the loonie.”

Economists have forecast that the Canadian dollar could drop to 75 cents US or even lower, depending on a number of factors, including the length of the current oil price slump. Lower oil prices are considered a negative for the loonie’s value.

Crude oil prices dropped $1.78 to close at $44.45 US a barrel on Wednesday. That was the lowest close for crude futures since March of 2009. The U.S. Energy Department reported earlier in the day that oil inventories had risen to their highest levels ever recorded.

As we all know, we need strength in the Canadian dollar to grow our electrical industry. Hopefully Prime Minister Trudeau can rally all the party’s influences to make a major course correction.

Paul Eitmant is President and CEO of IP Group International, which serves the needs of business-to-business enterprises in over 30 countries worldwide by adding specialized expertise to the business planning and implementation process; Tel: 480.488.5646; paulipgroup@cox.net.