Canada Wholesale Trade for January 2021

March 16, 2021

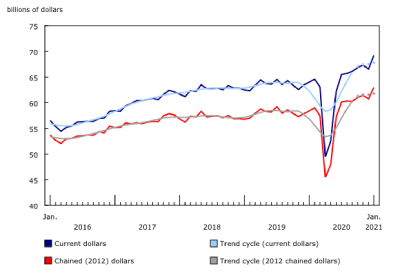

Wholesale sales maintain strong growth trend

Sales of wholesale products rose 4.0% in January to $69.2 billion, the eighth increase in the past nine months. This jump reflects growth of more than 10% in the machinery, equipment and supplies, and the building material and supplies subsectors. The last time the wholesale trade sector recorded growth that strong, other than the rebound following the COVID-19-induced decline in April 2020, was in December 2014.

Wholesale sales volumes grew 3.7% in January.

Double-digit gains in key subsectors

With in-person services and retail largely shut down due to public health orders, and government COVID-19 income support more than offsetting income losses (in aggregate), Canadians appear to have shifted their spending patterns in ways that continue to benefit the wholesale sector. In particular, demand for computer equipment, office materials, and lumber for renovations and housing starts remained much stronger than usual in January.

Sales in the machinery, equipment and supplies subsector grew 10.8% to $15.3 billion in January, the third increase in the past four months. The growth reflects a 27.9% increase in sales of computer and communications equipment and supplies in January. Demand for personal electronics and equipment for those working from home remained high beyond the usual holiday rush because supply chain disruptions in the subsector meant some consumers had to wait to make planned purchases.

Building material and supplies merchants reported a 12.1% increase in sales to $11.5 billion in January, the eighth increase in the past nine months. The gain is largely due to a 17.3% increase in sales of lumber, millwork, hardware and other building supplies. In particular, investment in residential construction rose 3.9% in January, which drove the price of wood products up 10.8%, according to the Industrial Product Price Index.

Growth in machinery, equipment and supplies and in building material and supplies subsectors accounts for roughly 90% of the changes in the wholesale sector over the past year. From January 2020 to January 2021 total wholesale sales grew $5.2 billion, with these two subsectors contributing $4.8 billion to the increase. As a result, these two subsectors made up 38.8% of the sector in January 2021, compared with 34.5% in January 2020.

The motor vehicle and motor vehicle parts and accessories subsector saw the largest decline over that period, falling from 17.4% in January 2020 to 15.7% in January 2021.

Sales increase in seven provinces

The value of wholesale trade sales increased in seven provinces, accounting for 92.7% of total wholesale sales nationally in January.

Sales grew 3.0% in Ontario, 5.5% in Quebec, and 7.0% in British Columbia in January, more than offsetting the decline in sales observed in December 2020. As a result, all three provinces reported the highest wholesale sales on record.

In Ontario, machinery, equipment and supply wholesalers reported $8.2 billion in sales, 15.3% higher than December 2020. The province also saw an 8.0% increase in sales of building material and supplies and 2.1% growth in food, beverage and tobacco sales.

In Quebec, sales of building material and supplies rose 17.1% to $2.4 billion in January, while sales of motor vehicles and motor vehicle parts and accessories saw an 18.6% increase from the previous month. While these subsectors were the largest contributors to month-over-month growth, all subsectors except personal and household goods reported some growth in sales.

Building material and supplies added $2.4 billion to monthly wholesale sales in British Columbia in January, an increase of 15.3% over the previous month and the biggest contribution of any subsector. All subsectors except miscellaneous reported some growth in sales.

Inventory levels continue to rise

Wholesale inventories increased by 0.7% to $90.9 billion in January, the second consecutive monthly increase and the strongest growth since June 2019.

The miscellaneous subsector was the largest contributor to this month’s growth, with inventories rising by 2.5% to $12.0 billion. The industry primarily engaged in wholesaling logs, wood chips, minerals and precious metals had the most substantial increase at 5.9% over December.

Inventories of building material and supplies rose by 1.5% to $14.8 billion. Consistent with the higher sales in this subsector, the largest contributor to this increase was lumber, millwork, hardware and other building supplies, with inventory rising to $7.2 billion.

Only one subsector, machinery, equipment and supplies, had falling inventory levels in January. This decline can be traced to the construction, forestry, mining and industrial machinery, equipment and supplies industry, and to the other machinery equipment and supplies industry (e.g., office or store). While the decrease was relatively small—this subsector saw a 0.8% decline from December to $25.9 billion—it countered a quarter of the increases in the other subsectors in January.

The inventory-to-sales ratio declined from 1.36 in December to 1.31 in January, the lowest ratio since November 2017. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Go HERE for more information