Canada’s Balance of International Payments $1.2 billion for First Quarter 2021

May 31, 2021

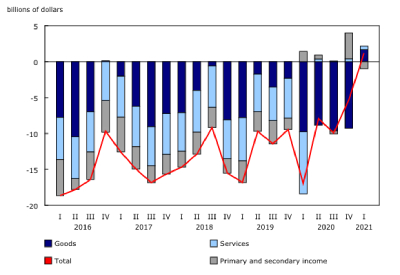

Canada’s current account balance (on a seasonally adjusted basis) posted a $1.2 billion surplus in the first quarter after recording a $5.3 billion deficit in the fourth quarter of 2020. This was the first surplus since the third quarter of 2008. The surplus in the first quarter mostly reflected the first positive trade in goods and services balance since 2008, which was partially offset by a lower investment income surplus.

The goods balance posted a slight surplus in the first quarter, while the services balance remained in an unusual surplus position in the context of the COVID-19 pandemic. In comparison, the last surplus, observed in the third quarter of 2008, reflected a much stronger goods surplus, moderated by a services deficit to which travel services were the main contributor.

In the financial account (unadjusted for seasonal variation), portfolio investment was the main contributor to the net lending activity, generating the largest outflow of funds since the fourth quarter of 2007. Strong Canadian acquisitions of foreign shares, combined with a decline in foreign holdings of Canadian debt securities, contributed to this activity.

Direct investment in Canada exceeded direct investment abroad by the largest amount since the second quarter of 2013, resulting in a net inflow of funds totalling $9.3 billion. Direct investment in Canada rebounded in the first quarter, following lower activity in 2020. Meanwhile, direct investment abroad slowed on weaker merger and acquisition transactions.

Current account

First trade in goods and services surplus in more than 12 years

The trade in goods and services balance recorded a $2.1 billion surplus in the first quarter, the first positive balance since 2008. This surplus was led by higher exports of goods. Meanwhile, the trade in services balance remained in an unusual positive position from a historical perspective.

Exports of goods were up by $11.8 billion to $152.7 billion in the first quarter. The largest contributors were energy products (+$6.8 billion) and forestry products and building and packaging materials (+$1.4 billion), mostly on higher prices, as well as aircraft and other transportation equipment and parts (+$2.3 billion), mainly on higher volumes.

Imports of goods edged up by $0.9 billion to $151.0 billion, led by higher imports of energy products (+$1.0 billion). The largest declines were in imports of consumer goods (-$1.2 billion) and motor vehicles and parts (-$1.1 billion).

On a geographical basis, the goods surplus with the United States was up by $9.8 billion in the first quarter on stronger exports. The deficit with countries other than the United States narrowed by $1.2 billion, led by stronger trade balances with Mexico, Saudi Arabia and Hong Kong, which partially offset the deterioration of the balance with the United Kingdom.

The trade in services surplus edged up $52 million to $458 million, posting a positive balance for a fourth straight quarter. By type of service, the transport services deficit narrowed as imports of sea transport were down in the quarter. The travel surplus increased as Canadians reduced their expenses on travel abroad compared with activity recorded in the fourth quarter of 2020. On the other hand, the commercial services surplus decreased by $416 million, mostly on higher imports, moderating the overall increase in the services surplus.

Profits on foreign direct investment in Canada increase

The investment income surplus declined by $4.9 billion to $1.0 billion in the first quarter. This reduction largely resulted from stronger payments related to profits earned by foreign direct investors in Canada. These profits were up by $4.7 billion to $12.0 billion, a level closer to the values recorded in 2019. Interest payments on foreign holdings of Canadian debt securities were down for a seventh consecutive quarter, moderating the overall increase in payments. Lower borrowing costs, a stronger Canadian dollar and a recent decline in foreign demand for these instruments all contributed somewhat to this reduction over the period.

Financial account

Direct investment in Canada exceeds direct investment abroad

Direct investment in Canada amounted to $19.6 billion in the first quarter, the highest level since the second quarter of 2019. Foreign parents’ injection of funds in existing Canadian affiliates accounted for the largest part of the activity in the quarter. Meanwhile, merger and acquisition activity totalled $5.7 billion. Direct investment in Canada was mainly in energy and mining, as well as in manufacturing, in the first quarter.

Direct investment abroad slowed to $10.5 billion in the first quarter, compared with a $20.1 billion investment in the fourth quarter of 2020. The investment was predominantly with the United States. Merger and acquisition activity slowed, with Canadian sales of existing assets abroad ($6.3 billion) exceeding acquisitions of such assets ($5.8 billion) for the first time in almost 10 years.

Canadian investment in foreign securities remains strong

Canadian investors acquired $37.4 billion of foreign securities in the first quarter, following a significant investment of $42.5 billion in the previous quarter. Canadian investors increased their holdings of foreign shares by $31.9 billion, largely shares of large capitalization technology firms and investment fund shares tracking broad market indices. Over the first quarter, the US stock market, as measured by the S&P500, grew by 5.8%.

On the other side of the ledger, foreign investment in Canadian securities slowed to $12.7 billion in the first quarter, compared with a $21.9 billion investment in the previous quarter. Non-residents significantly invested in Canadian shares, but reduced their holdings of debt securities. This was the first divestment in Canadian debt securities since the fourth quarter of 2018, and it followed foreign acquisitions totalling $122.0 billion in 2020.

Go HERE for more information