Business Openings Increased 1.6% in March

June 28, 2021

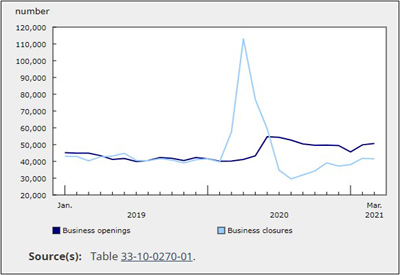

In March 2021, the number of business openings increased by 1.6%, as public health restrictions were less restrictive in many provinces compared with earlier in the year. After rising steadily over the previous three months, the number of business closures edged down 0.7% in March. The number of active businesses in March was 1.3% below the level observed before the COVID-19 pandemic.

The decrease in business closures from February to March 2021 was relatively widespread across provinces and territories, with the exception of Yukon, Saskatchewan and British Columbia, where closures increased slightly. The largest decrease in business closures was observed in Alberta, where there were 11.7% (-740) fewer closures than in the previous month.

In Canada, the number of business closures in the first months of 2021 was close to the 2015-to-2019 monthly average, with most provinces and territories having fewer business closures than average. However, they were higher in Ontario and Quebec compared with the 2015-to-2019 monthly average; in March 2021, there were 8.5% more business closures than average in Ontario and 4.5% more than average in Quebec.

Business closures continue to increase in the tourism sector but remain below business openings

In most industries, business closures in March 2021 were consistent with typical monthly fluctuations. A large decrease in the number of business closures since February 2021 was observed in manufacturing (-29.8%; -359), where business closures were at their lowest since January 2015, the earliest month for which the data are available. In contrast, in the tourism sector, the number of business closures continued to increase (+8.5%; +275). This was largely due to more closures in accommodation and food services (+8.5%; +209) relative to the previous month.

Nevertheless, the tourism sector continued to experience an increase in business openings (+2.3%; +99), entirely driven by reopening businesses. In accommodation and food services, 3,160 businesses reopened in March 2021, the highest level observed since July 2020. While in-person dining remained closed in certain regions in Ontario, Quebec, and Newfoundland and Labrador in March, public health measures were less restrictive in several other regions throughout the country, allowing businesses to reopen.

The number of active businesses continued to increase in March 2021, albeit at a slow pace. Compared with the pre-pandemic level of February 2020, there were 12,250 fewer businesses in March 2021. In most industries, the number of active businesses remained below the February 2020 level, with the largest gaps observed in arts, entertainment and recreation (-7.2%) and in accommodation and food services (-6.7%), which are the industries most affected by public health restrictions.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210628/dq210628a-eng.htm?CMP=mstatcan