Building Permits, August 2024

October 15, 2024

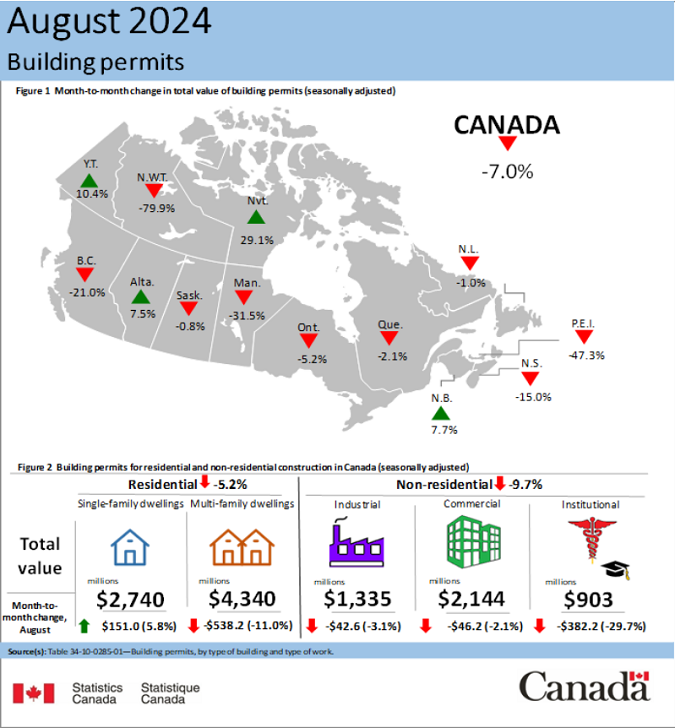

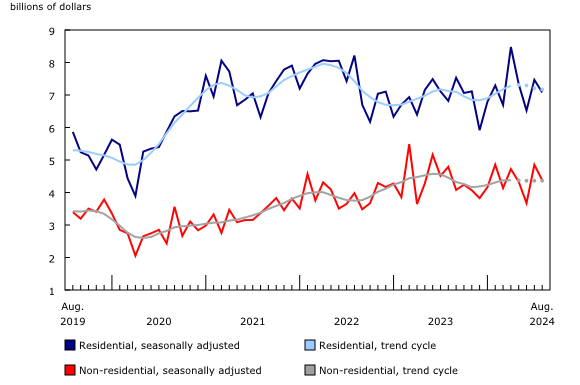

The total value of building permits in Canada decreased by $858.1 million (-7.0%) to $11.5 billion in August, following a strong July during which construction intentions rose sharply (+20.8%). The residential and non-residential sectors contributed to the decrease in August.

On a constant dollar basis (2017=100), the total value of building permits decreased 7.6% in August.

Chart 1

Total value of building permits, seasonally adjusted

Infographic 1

Building permits, August 2024

The non-residential sector declines in all three components despite sustained industrial permit level

The value of non-residential building permits decreased by $471.0 million (-9.7%) to $4.4 billion in August, driven by declines in institutional (-$382.2 million) construction intentions. Both the commercial (-$46.2 million) and industrial (-$42.6 million) components also contributed to the decline in the non-residential sector.

The industrial component’s monthly decline in August followed strong growth in July. Despite the monthly decline in August, the industrial component was the fourth-highest value in the series and experienced a year-over-year growth of 49.0%, a second consecutive year-over-year increase. The industrial component’s relatively high level was driven by battery plant permits that were valued at over $900 million in St. Thomas, Ontario. The permits follow a series of construction intentions to build up the battery supply chain in municipalities including Windsor, Ontario, and Bécancour, Quebec. Construction plans for battery manufacturing are a part of the federal government’s and the Ontario and Quebec provincial government’s efforts to develop Canada’s electric vehicle supply chain.

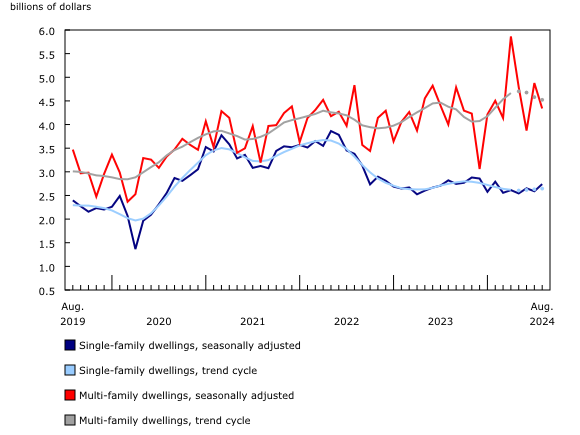

Chart 2

Value of building permits for the single-family and multi-family components

Chart 3

Value of building permits for the residential and non-residential sectors

Reductions in multi-unit construction intentions slow down the residential sector

Residential building permits fell by $387.2 million (-5.2%) to $7.1 billion in August, driven by the multi-unit component (-$538.2 million), while the single-family component (+$151.0 million) tempered the decline. Ontario (-$308.3 million) and British Columbia (-$127.4 million) led the declines in multi-unit permit values. For the single-family component, Alberta (+$102.8 million) and Ontario (+$75.3 million) were the major contributors to the growth recorded in August.

Across Canada, 18,500 new multi-family dwellings and 4,700 new single-family dwellings were authorized in August, representing a 4.1% decrease in the total number of units approved through permit issuance. Despite a decrease in the total number of units authorized in the month, the 12-month cumulative total of units authorized from September 2023 to August 2024 grew 2.8% to 268,200, compared with 260,900 having been units authorized from September 2022 to August 2023.