Investment in Building Construction, December 2023

February 15, 2024

Investment in building construction edged up 0.3% month over month to $19.8 billion in December. The residential sector grew 0.3% to $13.8 billion, and investment in the non-residential sector rose 0.3% to $6.1 billion.

On a constant dollar basis (2017=100), investment in building construction was unchanged (+0.0%; +$5 million) at $12.2 billion in December.

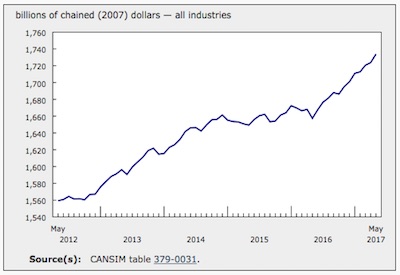

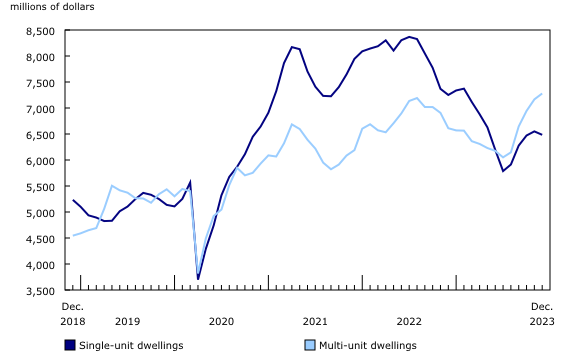

Chart 1

Investment in building construction, seasonally adjusted

Residential investment edges higher

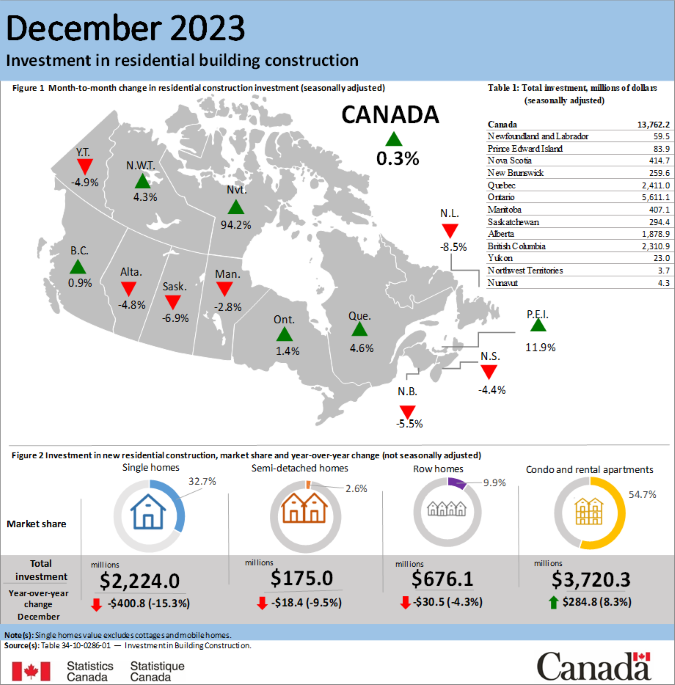

Investment in residential building construction grew 0.3% to $13.8 billion in December. Gains in Quebec (+4.6%; +$107 million), Ontario (+1.4%; +$78 million), British Columbia (+0.9%; +$21 million) and Prince Edward Island (+11.9%; +$9 million) were partially offset by declines in the other six provinces, where the pace of new construction slowed from earlier in the year.

Meanwhile, investment in detached single-family homes declined 1.0% to $6.5 billion, while investment in multi-unit buildings, which includes apartments, semi-detached and row homes, increased 1.6% to $7.3 billion.

Infographic 1

Investment in residential building construction, December 2023

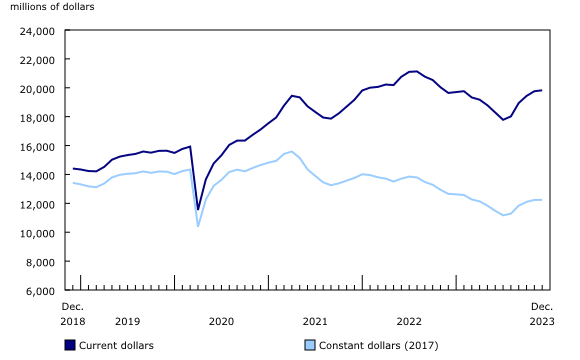

Chart 2

Investment in residential building construction, seasonally adjusted

Non-residential investment increases slightly

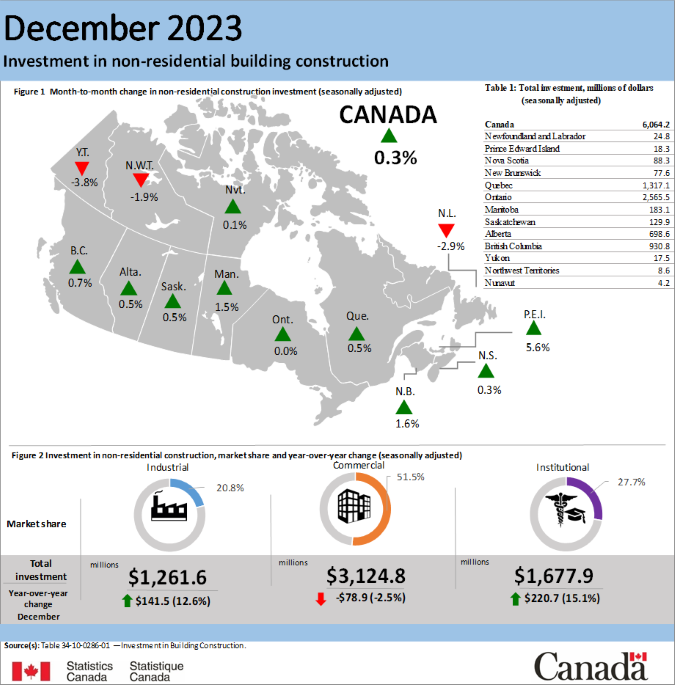

Investment in the non-residential sector rose 0.3% to $6.1 billion in December. Increases were recorded in nine provinces, with only Newfoundland and Labrador (-2.9% to $24.8 million) reporting a decline.

Gains in the institutional (+3.4% to $1.7 billion) and industrial (+0.4% to $1.3 billion) components were mostly offset by a decline in commercial investment (-1.3% to $3.1 billion).

Infographic 2

Investment in non-residential building construction, December 2023

Fourth quarter summary

In the fourth quarter of 2023, investment in building construction grew 7.8% to $59.0 billion.

This quarterly increase was led by growth in the residential sector (+11.1% to $40.9 billion), which was responsible for over 95% of the total increase in investment for the quarter. Additionally, the increase in investment was broad-based, with eight provinces reporting strong gains. Prince Edward Island (-1.5% to $233.9 million) and Newfoundland and Labrador (-7.0% to $197.4 million) were the only provinces that reported declines in the fourth quarter.

Investment in the non-residential sector grew 1.1% to $18.1 billion in the fourth quarter. This marked a new high for the series and the 12th consecutive quarterly gain for the sector in Canada. Gains in the non-residential sector were driven by institutional (+7.5% to $4.9 billion) and industrial (+2.9% to $3.8 billion) investments, which were partially offset by the decline in commercial investment (-2.5% to $9.5 billion).

Annual summary for 2023

Year over year, investment in building construction declined 6.6% to $229.1 billion in 2023.

On a constant dollar basis (2017=100), the total value of investment in building construction fell 11.6% to $143.9 billion for the year.

The remainder of this release will be presented in constant dollars (2017=100) to focus on real changes to the value of investment in building construction.

The residential sector cooled off from 2022, declining 16.9% to $94.0 billion in 2023. This retreat was broad-based, with nine provinces posting declines. New Brunswick recorded a modest growth of 1.5% to $2.1 billion. This decline was led by the drop in the single-dwelling component (-22.7% to $46.2 billion), while investment in the multi-dwelling component declined at a lower rate (-10.6% to $47.7 billion).

The non-residential sector edged up 0.6% to $49.8 billion in 2023, the second consecutive annual increase. The gain in the industrial component (+11.5% to $9.5 billion) was mostly offset by declines in investment in the commercial (-1.9% to $27.1 billion) and institutional (-1.1% to $13.9 billion) components.