Accounting for Slower Productivity Growth After 2000: Do Measurement Issues Matter?

Nov 13, 2018

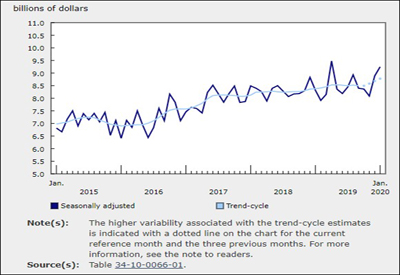

Labour productivity growth and multifactor productivity (MFP) growth have slowed in Canada and in other advanced countries since 2000. In Canada, MFP, measured as output per unit of combined labour and capital inputs, declined an average 0.18% per year in the business sector from 2000 to 2015, compared with an average 0.43% increase per year from 1980 to 2000, a deceleration of 0.61 percentage points.

Previous studies have suggested that the movement towards greater use of intangible capital in the digital economy and other measurement factors may be able to explain the slowdown in productivity growth.

A new study released today focuses on issues associated with the measurement of capital and examines the possible roles of intangible capital, natural capital, public infrastructure capital and capacity utilization in explaining slower MFP growth in Canada since 2000.

The study finds that about one-quarter of the decline in multifactor productivity growth in the Canadian business sector between the 1980-2000 and the 2000-2015 periods was due to the depletion of natural resources and to a decline in the utilization of capital in the manufacturing sector. Moreover, the decline in labour and multifactor productivity growth since 2000 was not related to intangible capital and public infrastructure capital.

The effects of natural capital and variable capacity utilization

The existing MFP measure in the oil and gas extraction and the mining sectors does not take into account the depletion of natural resource stock. Neither is it corrected for the effect of the change in the utilization of capital, which affects the short-run variation in MFP growth.

To take into account the depletion of natural resource stock in the MFP measure, natural capital input needs to be included in the measure of inputs. Once natural capital is included, the decline in MFP growth between the 1980-2000 and the 2000-2015 periods is not as large because part of the decline is attributable to the increasing amount of inputs needed to extract natural resources with declining ore quality.

The inclusion of natural capital is found to increase MFP growth of the business sector by 0.04% per year from 1980 to 2000 and to increase MFP growth by 0.13% per year from 2000 to 2015.

As well, the utilization of capital in manufacturing declined in the early 2000s, a period that was associated with slower export and output growth because of the appreciation of the Canadian dollar and slower growth in Canada’s largest trading partner, the United States. Therefore, a decline in the MFP of the business sector since 2000 could be partly due to a decline in the utilization of capital in the manufacturing sector.

A correction for the changes in the utilization of capital input in the manufacturing sector is found to increase the MFP growth of the business sector by 0.02% per year from 1980 to 2000 and to increase the MFP growth by 0.09% per year from 2000 to 2015.

Overall, 0.16 percentage points or about one-quarter of the 0.61 percentage point decline in multifactor productivity growth in the business sector since 2000 was due to the depletion of natural resource and to the decline in the utilization of capital in the manufacturing sector from 2000 to 2015.

The effects of intangible knowledge capital and public infrastructure capital

Intangible capital (innovative property, economic competencies, and computerized information) is an important source of output and capital input growth. However, in 2015, only 28% of the intangibles (namely, mineral exploration, software and research and development) were classified as investment in the existing MFP measure. The impact of improving the coverage of intangible capital on MFP is difficult to judge because it affects both measured output and capital.

The study finds that increasing the coverage of intangibles adds 0.13 percentage points to measured MFP growth from 1980 to 2000 and subtracts 0.01 percentage points from 2000 to 2015, thus increasing the decline in measured MFP growth between the two periods.

Public infrastructure capital contributes to productivity growth in the business sector as it reduces transportation and production costs. However, public infrastructure capital is normally not included in the growth accounting for the business sector.

Growth in public capital accelerated between the 1980-2000 and the 2000-2015 periods. When included in the growth accounting framework, this led to a negative 0.15 percentage point adjustment in MFP growth because output growth that was once attributable to MFP is now attributable to public capital.

The positive 0.16 point adjustment to MFP growth between the 1980-2000 and the 2000-2015 periods from natural capital and capacity utilization adjustment was more than offset by the 0.29 point reduction in the MFP growth from intangible capital and public infrastructure capital between those two periods. The net effect of all those adjustments was an even larger decline in MFP growth between the two periods. MFP growth with the adjustments declined by 0.75 percentage points from the 1980-2000 and the 2000-2015 periods, compared with a 0.61 percentage point decline before the adjustments.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/181029/dq181029b-eng.htm. Download the study here.

Photo: Rawpixel on Unsplash.