Building Permits, February 2025

April 11, 2025

In February, the total value of building permits issued in Canada increased by $371.3 million (+2.9%) to $13.1 billion. Gains in construction intentions were led by British Columbia’s non-residential sector.

On a constant dollar basis (2017=100), the total value of building permits issued in February grew 3.2% from the previous month and was up 5.6% on a year-over-year basis.

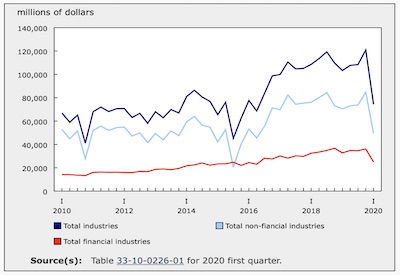

Chart 1

Total value of building permits, seasonally adjusted

Infographic 1

Building permits, February 2025

British Columbia’s construction intentions lead the growth in the non-residential sector

The national value of non-residential building permits increased by $618.7 million (+15.3%) to $4.7 billion in February, rebounding after four consecutive months of declines. British Columbia’s non-residential sector (+$657.7 million) led the growth, supported by gains in the commercial (+$390.0 million) and institutional (+$248.8 million) components. Major projects in the Vancouver census metropolitan area (CMA) significantly contributed to gains for the province’s commercial and institutional components.

The growth in Canada’s non-residential sector was spread across its three components in February, with gains in the commercial (+$481.8 million), industrial (+$86.2 million) and institutional (+$50.7 million) subsectors. The industrial component ticked up in February 2025, after trending downward since September 2024. In the summer of 2024, the industrial component drove the non-residential sector to a quarterly series high in the third quarter of the year.

Chart 2

Value of building permits for the single-family and multi-family components

Chart 3

Value of building permits for the residential and non-residential sectors

Chart 4

Value of building permits for the industrial, commercial and institutional components

British Columbia’s multi-family component drives the residential sector decline

Canada’s residential construction intentions declined by $247.4 million (-2.9%) to $8.4 billion in February 2025. Overall, the multi-family component fell by $224.8 million, while the single-family component decreased by $22.6 million.

British Columbia’s multi-family component (-$185.5 million) led the decline, with decreases concentrated in the Vancouver CMA. Quebec (-$131.5 million) and New Brunswick (-$105.4 million) contributed to the residential sector decrease in February, after helping to offset losses in the national residential sector the previous month. Quebec’s residential sector decline was driven by the multi-family component (-$107.9 million) and supported by the single-family component (-$23.6 million). New Brunswick’s residential sector decrease was led by the multi-family component (-$103.3 million). The decrease in the national residential sector was mitigated by Ontario (+$110.2 million).

Across Canada, 21,000 multi-family dwellings and 4,800 single-family dwellings were authorized in February, down 7.1% from the previous month.