Gross Domestic Product by Industry, September 2024

December 3, 2024

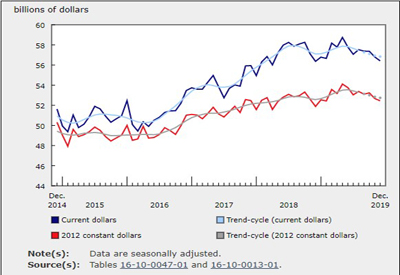

Real gross domestic product (GDP) edged up 0.1% in September, after remaining essentially unchanged in August.

Services-producing industries rose 0.2% in September, in large part driven by increases in the retail and wholesale trade sectors. This was the fourth consecutive month where the services-producing industries increased. Goods-producing industries contracted 0.3% in September, as the mining, quarrying, and oil and gas extraction and the manufacturing sectors contracted in the month. Goods-producing industries were down for a second month in a row. Overall, 11 of 20 sectors expanded in September.

Chart 1

Real gross domestic product edges up in September

Retail trade increases for third consecutive month

The retail trade sector increased 1.0% in September, representing its largest monthly growth rate since October 2023, as retailing activity in most subsectors grew in September 2024. The food and beverage stores subsector expanded 2.4% in the month, driven by higher retailing activity at the beer, wine and liquor retailers. Higher activity in gasoline stations (+3.8%) and building material and garden equipment and supplies dealers (+2.6%) further contributed to the growth. Meanwhile, motor vehicle and parts dealers, which was the largest driver of growth in the sector in the previous two months, contracted 0.8% in September, offsetting part of the gains recorded in July and August.

Wholesale trade up in September

Wholesale trade activity rose by 0.9% in September, more than offsetting August’s decline, despite five of nine subsectors contracting in the month. After being one of the largest detractors to growth in August, miscellaneous wholesalers (+4.6%) was among the largest drivers of growth in September. Motor vehicle and motor vehicle parts and accessories wholesaling (+3.2%) was another large contributor to growth in the month after recording a decline in August.

Transportation and warehousing rebounds in September

After wildfires contributed to a decline in July and railway lockouts tempered growth in August, the transportation and warehousing sector expanded 0.7% in September.

Chart 2

Rail transportation rebounds in September

Rail transportation partially rebounded from August’s contraction with a 6.3% increase in September. Commodity and container carloading activity bounced back in September resulting from a ramp-up of activity at Canada’s two main rail carriers after a multi-day lockout, and despite a four-day strike at grain terminals in British Columbia at the end of September.

Transit, ground passenger, and scenic and sightseeing transportation grew 3.7% in September, reflecting a 5.0% increase in urban transit as ridership reached a post-COVID-19 pandemic high.

Construction activity increases for second month in a row

The construction sector (+0.4%) rose for a second consecutive month in September, as three of four construction subsectors increased in the month.

Repair construction led the growth with a 1.0% increase in September, whereas residential building construction grew for the third consecutive month, up 0.4% in September and largely reflecting higher activity in single family home and multi-unit structures construction in Ontario in the month.

Non-residential building construction (+0.7%) rose for the second month in a row in September following a period of four monthly contractions. Industrial and commercial building construction drove the increase in September.

The finance and insurance and real estate and rental and leasing sectors expand

The finance and insurance sector increased 0.2% in September, up for a fourth month in a row, as most subsectors grew in the month. The increase was largely driven by credit intermediation and monetary authorities (+0.3%) on increased activity for both mortgage and non-mortgage loans at chartered banks following the Bank of Canada’s third consecutive cut in its policy rate in September.

Real estate and rental and leasing rose 0.2% in September, with offices of real estate agents and brokers and activities related to real estate (+3.0%) being the largest contributor to the growth. Home resale activity reached its highest level since June 2023, coinciding with lower borrowing cost following the cut in the policy rate at the beginning of September 2024.

Legal services, which derive most of their activity from real estate transactions, increased 0.5% in September.

Mining, quarrying, and oil and gas extraction down for the third consecutive month

The mining, quarrying, and oil and gas extraction sector contracted 1.4% in September, recording its third consecutive decline and its largest decline since January 2024. In September, two of three subsectors were down.

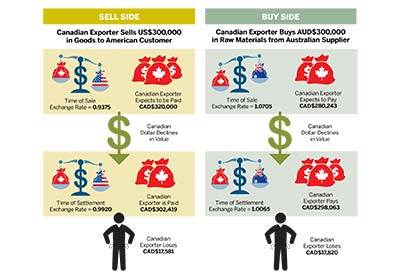

Chart 3

Mining, quarrying, and oil and gas extraction down for third consecutive month in September

The oil and gas extraction subsector was down 1.8% in September, reflecting lower output in both industries comprising the subsector. Oil sands extraction contracted 2.3%, reflecting lower crude bitumen extraction in Alberta as several facilities were undergoing maintenance in September. Oil and gas extraction (except oil sands) decreased 1.3% as a result of lower natural gas extraction, as some producers may have scaled back some production partly in response to low storage capacity and low prices for the commodity across North American markets.

Support activities for mining, and oil and gas extraction decreased 3.1% in September, as all types of services were down. The mining and quarrying (except oil and gas) subsector edged up 0.1% in September, driven by increases in coal mining (+8.7%) and non-metallic mineral mining and quarrying (+1.5%). Broad-based declines across the metal ore mining industry (-1.6%) tempered the growth in the subsector.

Manufacturing sector contracts for fourth consecutive month

The manufacturing sector (-0.3%) was down in September, as higher durable goods manufacturing was more than offset by a decline in activity in non-durable goods manufacturing. This was the fourth consecutive month where the manufacturing sector was down.

Non-durable goods manufacturing recorded a fourth consecutive monthly decline (-0.8% in September) as six of nine subsectors contracted in the month. Food manufacturing (-1.5%) contributed the most to the decrease in the month, partially offsetting the increases recorded in the previous two months. Chemical manufacturing (-1.8% in September) declined for a third month in a row, driven in large part in September by a contraction in pharmaceutical and medicine manufacturing (-2.8%).

Durable goods manufacturing rose 0.2% in September as 7 of 10 subsectors were up in the month. Transportation equipment manufacturing (+1.0%) led the growth, as production at motor vehicle (+3.2%) and motor vehicle parts (+2.1%) manufacturing plants rose even as retooling activities continued in the month.

Advance estimate for real gross domestic product by industry for October

Advance information indicates that real GDP increased 0.1% in October. Increases in real estate and rental and leasing, transportation and warehousing and retail trade were partially offset by decreases in construction and mining, quarrying, and oil and gas extraction. Owing to its preliminary nature, this estimate will be updated on December 23, 2024, with the release of the official GDP by industry data for October.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in September

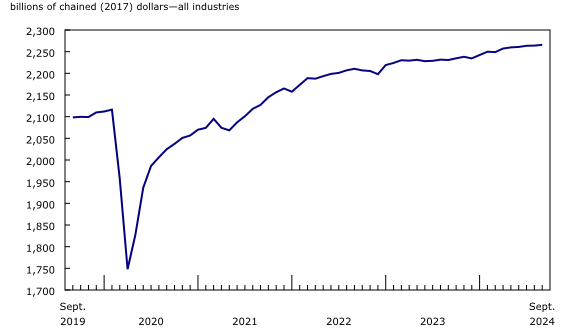

Real gross domestic product by industry continues expanding in the third quarter

Real GDP by industry rose 0.2% in the third quarter following a 0.5% increase in the previous quarter. Services-producing industries (+0.5%) drove the increase in the third quarter, continuing the uninterrupted quarterly increases that began in the third quarter of 2020. Goods-producing industries contracted 0.4% in the third quarter of 2024, partially offsetting the increase recorded in the previous quarter. Overall, 12 of 20 industrial sectors grew in the third quarter.

The public sector (consisting of educational services, health care and social assistance and public administration) was the largest contributor to growth, expanding 0.8% in the third quarter and up for a third consecutive quarter. All three components comprising the public sector expanded in the third quarter. Public administration was the largest contributor to the increase within the public sector aggregate. Local, municipal and regional public administration (+2.1%) led the growth in public administration for a second quarter in a row. Health care and social assistance increased 0.6% while educational services rose 0.5%, led by an increase in elementary and secondary schools.

Finance and insurance was up 1.2% in the third quarter, posting its highest quarterly growth rate since the fourth quarter of 2021, as financial investment services, funds and other financial vehicles led the growth in the third quarter of 2024 (+4.3%). Interest rate announcements, market expectations about future interest rate announcements and geopolitical instability contributed to volatility and increased activity in financial markets.

The real estate and rental and leasing sector increased 0.6% in the third quarter, up for the eighth consecutive quarter. Offices of real estate agents and brokers and activities related to real estate increased 5.2% in the third quarter, while the policy rate was cut in July and September 2024.

Utilities rose 1.8% in the third quarter after rising 0.4% during the previous quarter. Electric power generation, transmission and distribution (+1.8%) accounted for most of the increase in the third quarter as a warmer than usual summer in parts of the country led to increased demand for electricity for cooling related purposes.

The manufacturing sector was down 1.5% in the third quarter and was the largest detractor to growth for a third consecutive quarter. This was the fifth consecutive quarterly decline for the manufacturing sector. Durable goods manufacturing decreased 2.1% in the third quarter on broad-based declines across most subsectors. Machinery (-3.4%) and transportation equipment (-1.9%) manufacturing were the largest contributors to the decline in the third quarter, continuing downward trends that began in the second half of 2023. Non-durable goods manufacturing was down 0.8%, with chemical manufacturing (-2.6%) contributing the most to the decline after three consecutive quarterly increases.

Mining, quarrying, and oil and gas extraction was down 0.5% in the third quarter, with the oil and gas extraction subsector contracting 1.0%. Lower activity in oil sands extraction (-2.1%) and natural gas extraction contributed to the decrease as maintenance activity at several facilities impacted production throughout the quarter.

Chart 5

Main industrial sectors’ contribution to the percent change in gross domestic product in the third quarter