Gross Domestic Product by Industry, May 2024

August 12, 2024

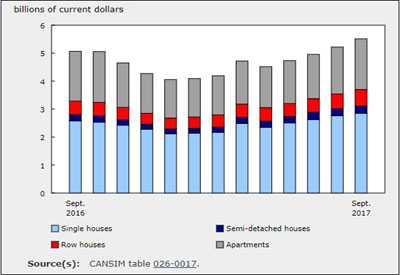

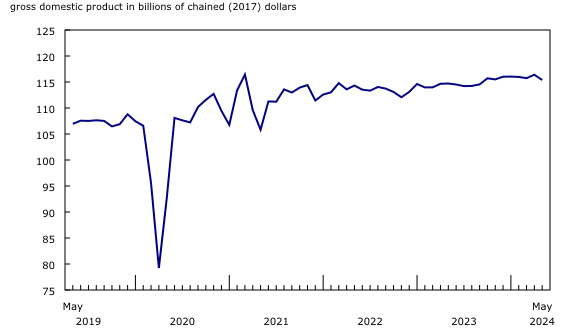

Real gross domestic product (GDP) grew 0.2% in May, following a 0.3% increase in April. The goods-producing industries grouping (+0.4%) was the main contributor to the overall growth with four of five sectors increasing in May. Services-producing industries edged up 0.1%. Overall, 15 of 20 sectors expanded in May.

Chart 1

Real gross domestic product grows in May

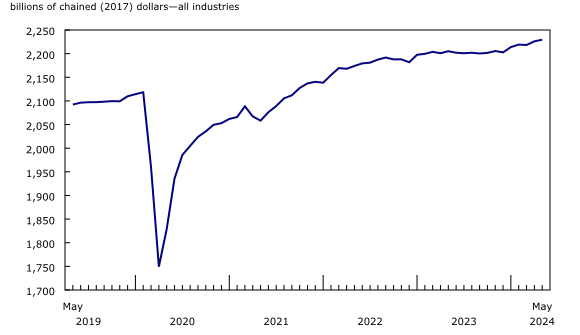

Manufacturing grows for a second consecutive month

The manufacturing sector (+1.0%) led the growth in May, up for a second consecutive month. The increase in May was the largest since January 2023 as both durable and non-durable manufacturing rose in May 2024.

Chart 2

Manufacturing sector led the growth in May

Non-durable goods manufacturing (+1.4%) recorded its largest growth rate since November 2023, with over half of the increase stemming from petroleum and coal product manufacturing. The subsector rose 7.3% in May 2024, its largest increase since June 2021, as petroleum refineries (+7.9%) more than offset a 5.0% decline in April 2024. The rebound in May comes after many refineries across the country were undergoing maintenance in April.

Durable goods manufacturing expanded 0.7% in May as 6 of 10 subsectors increased. The furniture and related products (+4.6%) and miscellaneous manufacturing (+4.7%) subsectors contributed the most to growth while the transportation equipment manufacturing subsector (-0.4%), affected by an automotive assembly plant in Ontario undergoing retooling activities, tempered growth.

The mining, quarrying, and oil and gas extraction sector down due to a decline in the oil and gas extraction subsector

Despite increases in two of three subsectors, the mining, quarrying and oil and gas extraction sector contracted 0.6% in May, partially offsetting a 2.1% increase in April.

The oil and gas extraction subsector (-2.1%) accounted for all of the contraction in the sector in May, following three consecutive monthly increases. Oil sands extraction was down 3.5%, its largest contraction since January 2024, as maintenance at some upgrading facilities in northern Alberta contributed to the decline. Oil and gas extraction (except oil sands) decreased 0.6% in May as lower natural gas extraction more than offset an increase in crude petroleum extraction.

Mining and quarrying (except oil and gas) rose 0.5% in May, up for the seventh time in eight months. Non-metallic mineral mining and quarrying (+2.7%) led the growth, buoyed by a 7.1% rise in potash mining as production rebounded at a mine in Saskatchewan that experienced a temporary shutdown in April.

Pipeline transportation increases as expanded Trans Mountain pipeline comes online

Pipeline transportation increased 0.6% in May. The crude oil and other pipeline transportation industry rose 1.5%, reflecting in part commencement of the expanded Trans Mountain pipeline as the first tankers carrying Western Canadian oil departed from the Port of Vancouver in late May. A contraction in pipeline transportation of natural gas (-0.2%) tempered the growth in the pipeline transportation subsector, as natural gas distribution (-4.2%) contracted in the month.

Retail trade the largest detractor to growth in May

Chart 3

Retail trade is the largest detractor to growth in May

The retail trade sector was the largest detractor to growth in May, contracting 0.9% and more than offsetting the increase recorded the month before.

Most subsectors were down in May. The food and beverage stores (-2.3%), health and personal care stores (-1.4%) and the general merchandise stores (-1.4%) subsectors were among the main contributors to the decline. Activity at motor vehicle and parts dealers tempered the decline in the overall retail trade sector with a 0.8% increase, reflecting an uptick at new and used car dealers’ lots.

Wholesale trade falls in May

The wholesale trade sector contracted 0.8% in May, following a 1.4% increase in April, with five of nine subsectors decreasing in the month. Motor vehicle and motor vehicle parts and accessories merchant wholesalers (-4.0%) drove the decline in May, partially offsetting the 8.6% increase seen in April and coinciding with decreases in imports of passenger cars and light trucks and lower production of motor vehicles and parts manufacturing in May.

Machinery, equipment, and supplies wholesalers (-1.2%) and miscellaneous wholesalers (-1.7%) further contributed to the sector’s decline.

Accommodation and food services and arts, entertainment and recreation expand in May

Accommodation and food services grew for the second consecutive month, increasing 0.9% in May. The growth was largely driven by food services and drinking places (+1.2%), which saw its largest increase since January 2023.

Arts, entertainment and recreation (+0.3%) rose for the third consecutive month in May, largely driven by performing arts, spectator sports and related industries, and heritage institutions (+1.3%) as higher than usual attendance levels for spectator sports occurred over the course of the month. Three Canadian National Hockey League teams continued playing in the playoffs throughout the month of May, contributing to increased activity in the sector.

Finance and insurance increases for third time in four months

Finance and insurance grew for the second consecutive month, increasing 0.2% in May, mainly driven by the financial investment services, funds and other financial vehicles subsector (+0.9%). Bond market activity and mutual funds drove the increase, supported by higher activity on the long end of the yield curve for Canadian government bonds along with strong foreign investment in Canadian debt securities.

Public sector grows

The public sector (comprising educational services, health care and social assistance and public administration) increased for the fifth consecutive month, up 0.4% in May.

All three components rose in the month. Public administration (+0.4%) was the largest contributor to growth in the grouping in May, driven by an increase in local, municipal and regional public administration (+0.8%). Educational services (+0.5%) was another large contributor to growth in May, led by elementary and secondary schools which posted its fifth increase in a row following the declines in November and December 2023 that resulted from the impact of the public sector strike in Quebec.

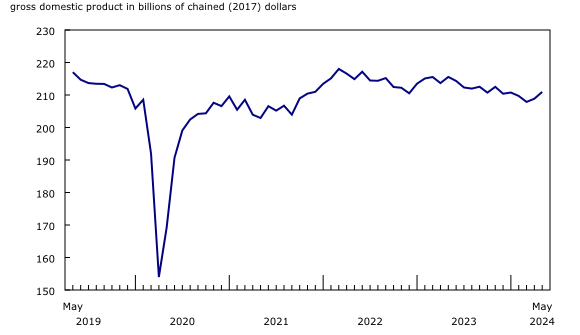

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in May

Advance estimate for real gross domestic product by industry for June 2024

Advance information indicates that real GDP increased 0.1% in June. Increases in construction, real estate and rental and leasing and finance and insurance were partially offset by decreases in manufacturing and wholesale trade. Owing to its preliminary nature, this estimate will be updated on August 30, 2024, with the release of the official GDP by industry data for June.

With this advance estimate for June, information on real GDP by industry suggests that the economy expanded 0.5% in the second quarter of 2024. The official estimate for the second quarter will be available on August 30, 2024, when the official estimate of GDP by income and expenditure is released.