Consumer Price Index, April 2024

May 31, 2024

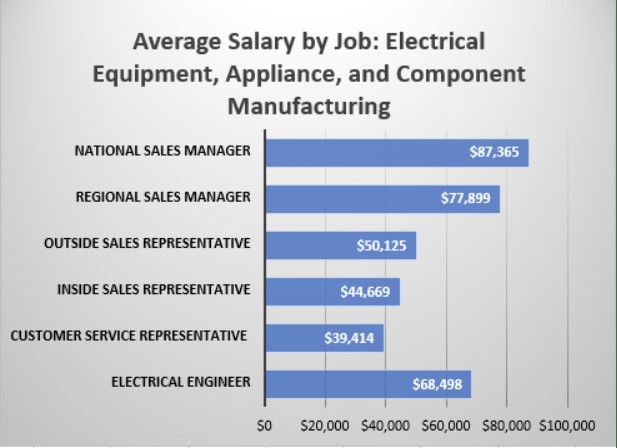

The Consumer Price Index (CPI) rose 2.7% on a year-over-year basis in April, down from a 2.9% gain in March. Broad-based deceleration in the headline CPI was led by food prices, services and durable goods.

The deceleration in the CPI was moderated by gasoline prices, which rose at a faster pace in April (+6.1%) than in March (+4.5%). Excluding gasoline, the all-items CPI slowed to a 2.5% year-over-year increase, down from a 2.8% gain in March.

On a monthly basis, the CPI rose 0.5% in April, mainly driven by prices for gasoline. On a seasonally adjusted monthly basis, the CPI rose 0.2% in April.

Chart 1

12-month change in the Consumer Price Index (CPI) and CPI excluding gasoline

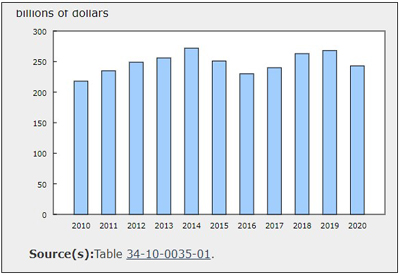

Chart 2

Consumer prices decelerate in four components

Food prices lead the deceleration in the Consumer Price Index

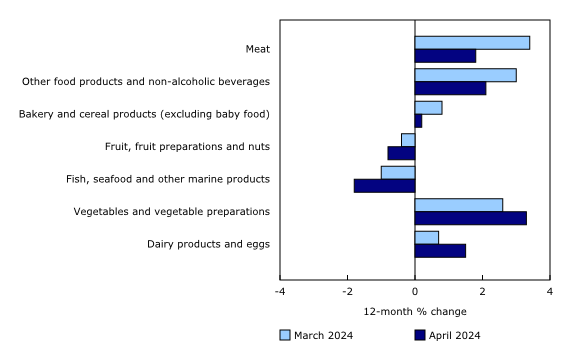

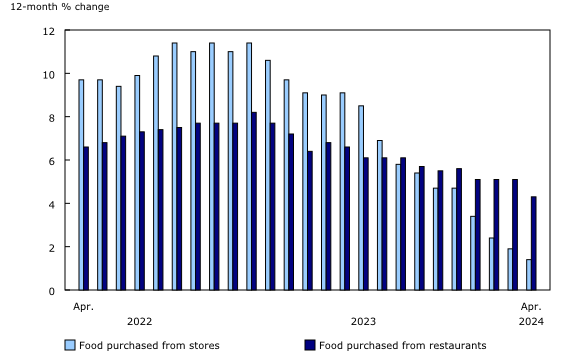

While prices for food purchased from stores continue to increase, the index grew at a slower pace year over year in April (+1.4%) compared with March (+1.9%). Meat contributed the most to slower price growth, largely due to a base-year effect in prices for fresh or frozen beef (+4.4%) as a result of a monthly increase in April 2023 which fell out of the 12-month movement. Other contributors to the slowdown in grocery prices included other food products and non-alcoholic beverages (+2.1%), bakery and cereal products (+0.2%), fruit, fruit preparations and nuts (-0.8%) and fish, seafood and other marine products (-1.8%). From April 2021 to April 2024, prices for food purchased from stores increased 21.4%.

Chart 3

Mostly decelerations and declines in prices for grocery items

Price growth for food purchased from restaurants also eased on a yearly basis, rising 4.3% in April 2024 following a 5.1% increase in March. The index was unchanged month over month in April, however a 0.8% monthly increase from April 2023 fell out of the 12-month movement and put downward pressure on the index.

Chart 4

Price growth for food from stores and restaurants trends down since January 2023

Gasoline prices moderate deceleration in the Consumer Price Index

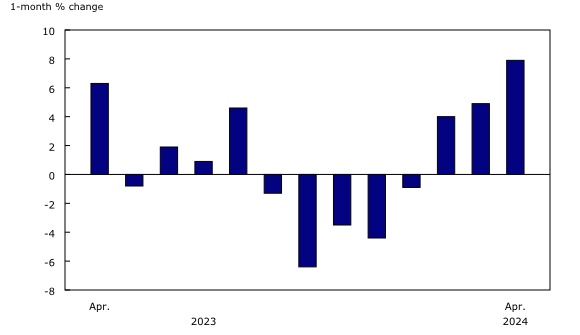

Consumers paid 6.1% more at the pump year over year in April, following a 4.5% increase in March. Faster growth was driven by a 7.9% month-over-month increase in April. Higher costs associated with switching to summer blends, higher oil prices due to supply concerns and an increase in the federal carbon levy all contributed to the increase in prices.

Chart 5

Gasoline prices increase month over month in April

Regional highlights

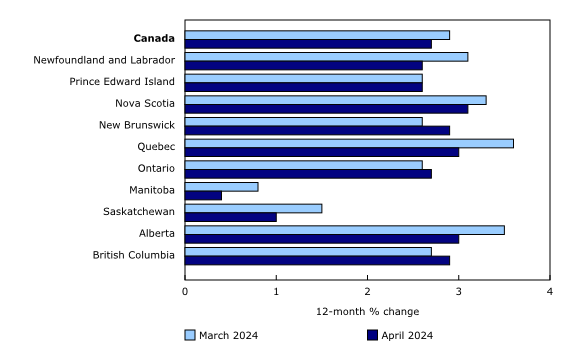

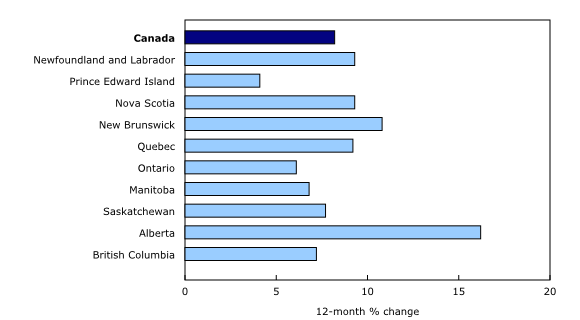

Year over year, prices rose at a slower pace in April compared with March in six provinces.

Chart 6

The Consumer Price Index rises at a slower pace in six provinces

Chart 7

Largest year-over-year rent increase in Alberta in April

Alberta inflation slows, but shows largest rent increases in Canada

The CPI in Alberta decelerated year over year in April partly due to prices for electricity and natural gas. Partially offsetting this were higher prices for rent, which rose 16.2% year over year in April, up from a 14.2% increase in March. Rent in Alberta increased at a higher rate than it did at the national level (+8.2% in April) for the eighth consecutive month, which coincides with strong demand from high net interprovincial migration to Alberta.