Consumer Price Index, March 2024

April 18, 2024

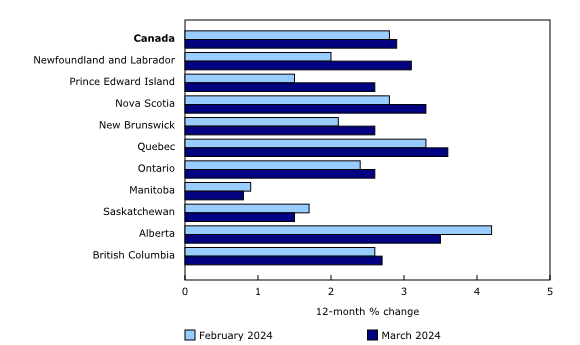

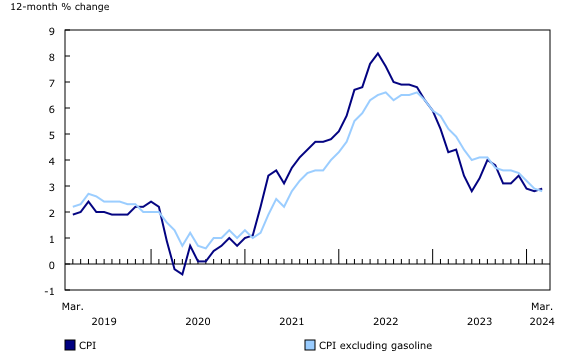

The Consumer Price Index (CPI) rose 2.9% on a year-over-year basis in March, up from a 2.8% gain in February. Gasoline prices contributed the most to the year-over-year headline acceleration, as prices at the pump rose faster in March compared with February. Excluding gasoline, the all-items CPI slowed to a 2.8% year-over-year increase, down from a 2.9% gain in February.

Shelter prices continued to apply upward pressure in March, with the mortgage interest cost and rent indexes contributing the most to the year-over-year gain in the all-items CPI.

Prices for services (+4.5%) continued to rise in March compared with February (+4.2%), driven by air transportation and rent, outpacing price growth for goods (+1.1%) which slowed compared with February (+1.2%) on a yearly basis.

On a monthly basis, the CPI rose 0.6% in March. Month-over-month price growth was broad-based.

On a seasonally adjusted monthly basis, the CPI rose 0.3% in March.

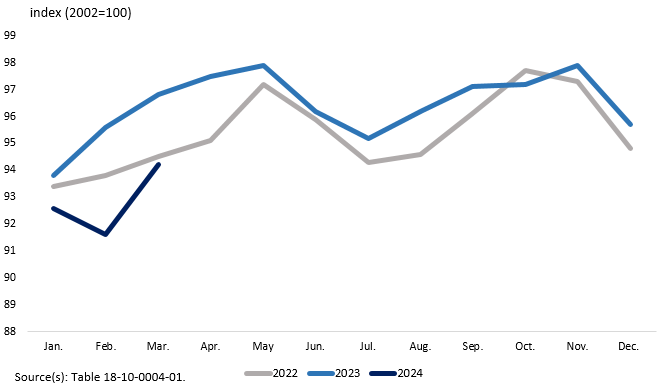

Chart 1

12-month change in the Consumer Price Index (CPI) and CPI excluding gasoline

Chart 2

The clothing and footwear; transportation; and recreation, education and reading components accelerate in March

Shelter prices continue to put upward pressure on the Consumer Price Index

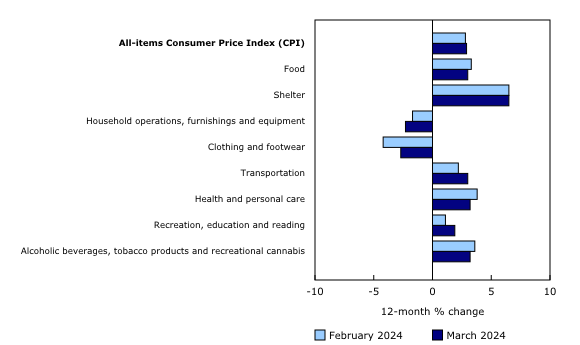

Shelter prices increased 6.5% year over year in March, rising at the same rate as in February.

The mortgage interest cost index rose 25.4% on a year-over-year basis in March, following a 26.3% increase in February. The homeowners’ replacement cost index, which is related to the price of new homes, declined less in March (-1.0%) compared with February (-1.4%) on a year-over-year basis.

Rent prices continued to climb in March, rising 8.5% year over year, following an 8.2% increase in February. Among other factors, a higher interest rate environment, which can create barriers to homeownership, put upward pressure on the index.

Chart 3

The mortgage interest cost index remains elevated

Gasoline prices rise

Year over year, gasoline prices increased 4.5% in March, following an 0.8% rise in February. Higher global prices for crude oil stemmed from supply concerns amid geopolitical conflict and continued voluntary production cuts, leading to higher prices at the pump.

Month over month, prices for gasoline increased in March (+4.9%). On a monthly basis, gas prices rose at a slower pace in March compared with February in Eastern Canada, whereas prices rose at a faster pace in Western Canada.

Prices for clothing and footwear increase on a monthly basis

On a seasonally adjusted monthly basis, the clothing and footwear index rose in March (+1.4%) following declines in January (-1.8%) and February (-2.3%), the two largest declines since the onset of the COVID-19 pandemic. Clothing and footwear is one of the most seasonal components in the CPI because different types of clothing and footwear become available to buy at different times of the year.

On a not seasonally adjusted monthly basis, prices for clothing and footwear rose 2.8% in March after falling 1.1% in February, due to fewer promotions compared with previous months.

Despite the month-over-month price increase, the clothing and footwear index fell year over year, though to a lesser extent in March (-2.7%) compared with February (-4.2%), putting upward pressure on the all-items CPI.

Infographic 1

Clothing and footwear prices rise on a monthly basis in March following price declines in early 2024

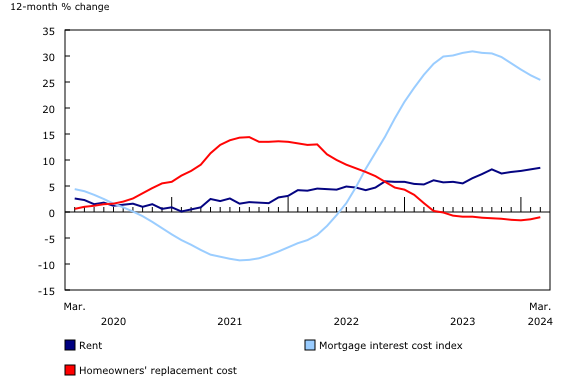

Regional highlights

Year over year, prices rose at a faster pace in March compared with February in seven provinces.

Prices rose at a faster rate in March compared with February in Atlantic Canada primarily due to an acceleration in prices for fuel oil and other fuels, which fell less on a year-over-year basis in March (-2.7%) compared with February (-10.9%). In Atlantic Canada, furnace oil is commonly used as a home heating source.

Chart 4

The Consumer Price Index rises at a faster pace in seven provinces