Train Slowing Down Around the Corner

March 15, 2022

By David Gordon, President, Channel Marketing Group

2021 represented the best of times and the worst of times. Companies reported record sales, record sales growth, many had record profits and backlogs grew. And then there were supply chain issues, labor shortages, rising costs of goods and the persistence of COVID.

Coming into the year many have seen a continuation of 2021 with some looking forward to continued success in the industrial sector, due to continued reopening’s, fulfilling backlogs and preparing to support the Infrastructure program.

This is the challenge with looking at economic environments with blinders … you only see what is close or within a limited scope.

Each month DISC Corp, the electrical industry’s pre-eminent resource for electrical industry marketplace intelligence, produces its Flash report for its subscribers. This month, DISC’s Christian Sokoll and Leah Lentz shared a synopsis from its recent report.

Watch out for the oncoming train

“The train is slowing down as we look ahead into the second half of the year.

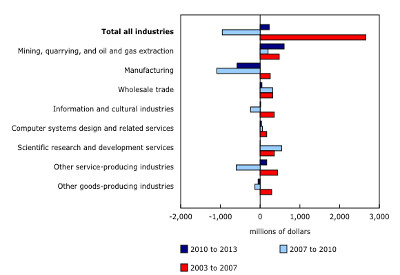

Looking back, we saw 2021 as a recovery year with pent-up demand and inflationary prices pushing sales to new heights. By year’s end, we saw all sectors experiencing double-digit growth. DISC Corp estimates the 2021 year to report with just over 20% year over year growth.

Looking at the vertical markets we had record growth YoY:

- the construction industry being up 19% year over year

- the industrial market to be up short of 27% year over year

- and the institutional and utility both up 15% year over year.

The headwinds we face in 2022 are substantial. Supply chain disruptions, labor shortages, inflationary pressures, and the uncertainty surrounding midterm elections will all exert negative pressure on performance.

DISC Corp is forecasting continued YoY growth in the double digits in the 1st and 2nd quarters of 2022. However, in the second half we anticipate growth to take on a more historical YoY rate around 2%.

After developing such high growth rate expectations, the question becomes how to continue to beat the market growth rates and deliver stakeholder value. Finding new opportunities to innovate and entering new markets will be the differentiator between breakout performance and riding the market.

Supply chain disruptions will continue throughout the first half of the year. Daniel Yergin, vice chairman of IHS Markit says, “What is unfolding in supply chains globally is not only disruptive, it is also historic.” “Moreover, the intense new focus on inflation adds to the urgency to understand what is ahead for supply chains in 2022.” Not only are the cost of containers severely inflated, but containers are spending more time on their journeys and waiting in port. The chart below indicates the average number of days by country.

Supply chain disruptions will also become a ballot issue this year as midterm elections approach. Consumer Brands/Morning Consult polled key states Arizona, Georgia, Nevada and New Hampshire to find that, 9 in 10 feel it’s important to expand trucking capacity next year to meet supply chain demands and 8 in 10 expect to see trucking actions from their senators. “Once invisible to consumers, the pandemic and holiday shipping crunch have unmasked the supply chain and made it kitchen table conversation,” said Geoff Freeman, president, and CEO of Consumer Brands, in a press release. “Voters have exhausted their patience with years of government inaction, and elected officials can’t afford to lose sight of the supply chain after New Year’s Day.” “There has been significant attention on the ports in recent months, offering a playbook for how government can play a role in easing supply chain pressure,” said Freeman. “However, too much focus on one link in the chain only serves to relocate bottlenecks, not solve problems.”

Employee shortages through quits and retirements continue to be problematic and not just for the electrical industry. The U.S. Chamber of Commerce reported that over 47 million people quit their jobs last year, with the close of December alone at 4.3 million. Retirements and early retirements are contributing to these numbers. PEW Research reports that 50.3% of US adults 55 and older have retired. The U.S. Chamber of Commerce states that the manufacturing industry alone lost 1.4 million jobs at the onset of the pandemic. Reports show unemployment down in December of 2021 at 3.9%. This compares favorably to the pre pandemic unemployment rate in January 2019 of 4%. DISC is forecasting unemployment to remain relatively steady throughout 2022.

The electrical industry has faced unprecedented price increases in copper, conduit and wiring devices, among others. While we foresee prices to remain elevated and more inflation in the near term, we forecast an easing of price increases in the 2nd half of the year. The price increases have added to top line sales and growth numbers. Prior year growth pace and sales targets will not be as easy to maintain as prices stabilize.

The wildcard that most are focusing on is the uncertainty of the 2022 midterm elections. As Joe Biden’s administration continues to downplay the high inflation numbers, Republicans seem poised to take back substantial ground in Washington which may lead to the return of more manufacturing-friendly policies and returning some consumer confidence. Depending on Washington’s ability to counter recent inflation trends, and encourage the workforce to return to productivity, the bottle neck in supply chains could be either eased or further challenged in 2022. “It needs to feel like 2019, not 2021,” says Liam Donovan, a Republican strategist. Regardless of which side of the aisle you are looking to the future from, further growth seems to be tied to one thing, “a return to normalcy.”

In summary, labor shortages will remain steady while supply chain disruptions and inflationary pressures should begin to ease as we head into the last half of 2022. However, the outcome of midterms could prove to either relieve or reinforce the challenges we’ve been facing in the manufacturing and wholesaling sectors resulting from the unprecedented circumstances of the last 2 years. Looking at new markets and opportunities along with management innovation will drive winning strategy.”

Remember, this is a synopsis of their most recent report. An annual subscription is only $895. Mention you read their posting in ElectricalTrends to receive a $100 discount. And if you want only this month’s copy, the cost is $100. Inside tip … all of the national chains and the largest distributors, as well as many leading manufacturers, subscribe.

You know what they say about insights? They lead to intelligent decisions.