A Copper Retrospective and Planning for 2022

Dec 13, 2021

David Gordon

Copper is typically one of an electrical distributor’s top three product categories. It can represent 10-25% of a distributor’s sales, based upon their business focus.

Over the past year, as all know, the price of copper has increased significantly, contributing to distributor sales growth as well as an increase in gross margin dollars. This can “color” a distributor’s performance as the key to judging performance is tracking “unit” sales, typically expressed in pounds.

A leading copper authority is John Gross who publishes The Copper Journal Weekly Report and consults to the metals industry (on copper and more).

In his recent report John shared an interesting copper observation:

“The big deal is the price of copper and how it has recovered from key low points. That is to say, on December 24, 2008, Spot copper closed at $1.2475, after getting kicked down the stairs during the financial crisis. On September 10, 2010, 430 trading days later, copper closed at $3.3970, up $2.1495 from the low.

Last year, on March 23rd, copper fell to $2.1195 when the world was shaken by the arrival of Covid. This past Friday, December 3rd, 430 trading days from the low, copper closed at $4.2665, up $2.1470.

Thus, the current recovery is within 25 points of the prior recovery that began 13 years ago. The attached chart lays out the trends, so you can see it for yourself. As an aside, copper continued advancing to reach a new record high on February 14, 2011, at $4.6230, up $3.38, or 271% from the low. The current run has copper up 101% from the low last year, so we’ll see how this saga from the Twilight Zone continues playing out. And if this isn’t enough, it’s almost tantamount to when copper did its ‘Pi routine’, when it closed at $3.14 on (3/14) March 14, 2018.”

Coincidental that the change from low to high was almost $2.15.

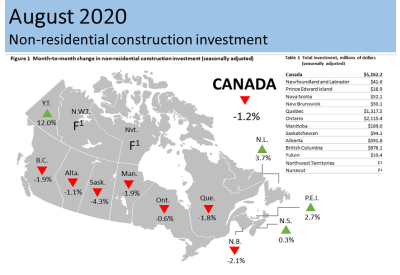

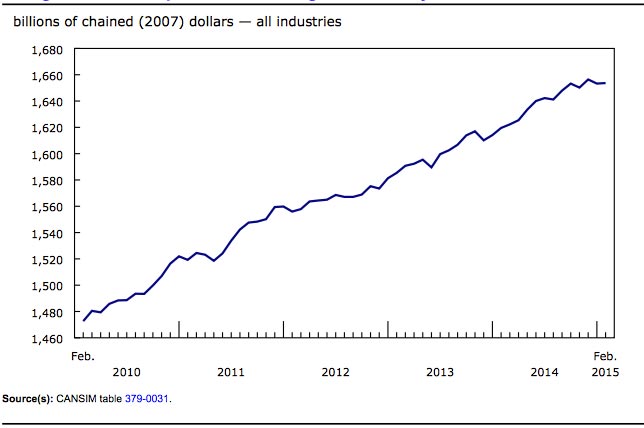

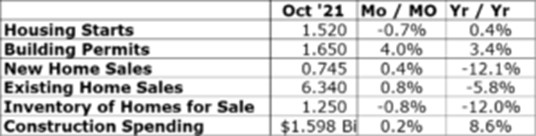

He also shared a review of building and construction activity.

And observed:

“Interestingly, while home building and real estate activity remains well below levels of 15 years ago, construction spending is running at record highs. If nothing else, this shows the difference between ‘volume and value’.”

The 43-page report has much information regarding the construction and metals markets. One of the things John also tracks is material (i.e., copper and steel, among other, inventories.)

With planning for 2022, some things to consider:

• While companies can forecast copper increases, the broader market will be the determinate with macroeconomics also involved.

• The supply of copper is not expected to meet the demand levels, hence helping to keep copper pricing high. While reportedly there is some worldwide activity to open new mines, this takes time, plus it is all imported, so we know what that means from a transportation / supply chain viewpoint.

• Electric vehicles, the “green” economy and the recently passed infrastructure bill will all add to the demand for copper.

• While wire / cable companies would like distributors to plan, the reality is this business flows based upon market demand … can not create the need for more wire / cable in projects. It’s a market share game. While it can be won on price, that is a fool’s game. Inventory availability and service are the keys to supporting customers in this area.

2022 Wire / Cable Planning

From a strategy viewpoint,

• Conduct a customer gap analysis

• Evaluate your wire / cable services versus your competitors

• Review your wire / cable sales and identify what percent of sales are in different product categories. Ask your suppliers what their product category mix is and then compare yours to theirs. Understand why there are gaps and if you can, or want, to close those gaps.

• Determine your inventory service levels and decide what you are comfortable affording. This comes down to how much inventory you are willing to fund.

• Focus on units, not dollars, to determine if you are growing your business and taking share.

• To ensure your net profitability in this category, review your sales compensation model for this product category.

• Wire can be marketed … it does not always need to be a sales loss leader

• And unless you have a defined wire / cable strategy, do not budget for much more, if any, than organic market growth as no one knows what price of copper will do throughout the year.

And if you do not subscribe to John Gross’ newsletter, it may be something to consider if you are responsible for wire / cable. He also does some interesting historical copper research and can be a resource on the overall copper ecosystem.

Source: https://electricaltrends.com