Canadian Survey on Business Conditions, fourth quarter 2021

Nov 29, 2021

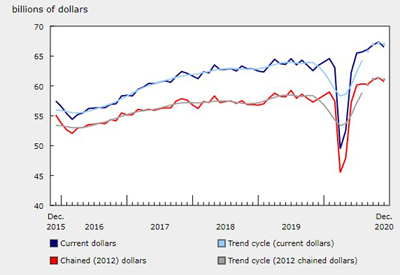

Real gross domestic product (GDP) rose 0.4% in August, following a 0.1% decline in July. The continued easing of public health restrictions and further reopening across the country increased demand across many close contact service industries.

From October to early November 2021, Statistics Canada conducted the Canadian Survey on Business Conditions. The survey collects information on the environment businesses are currently operating in and their expectations moving forward.

Businesses expect to face a variety of obstacles over the next three months (see Note to readers) related to the rising cost of inputs; uncertainty in consumer demand; hiring and recruitment as well as those related to supply chains. The majority of businesses that are facing challenges acquiring inputs, products and supplies, either domestically or abroad, expect these challenges to persist for six or more months. Over the next three months, over half of businesses expect their profitability to remain relatively unchanged, just over one-quarter expect to increase the prices they charge and over three-quarters expect their number of employees to remain about the same.

Businesses expect to face challenges related to rising costs and uncertainty in consumer demand

Businesses are faced with a variety of obstacles and future unknowns. The rising cost of inputs, including labour, capital, energy and raw materials, was the most commonly expected obstacle over the next three months (see Note to readers), with over two-fifths (42.5%) of businesses expecting it to be an obstacle, up from 38.5% of businesses that expected this to be an obstacle in the third quarter. The rising cost of inputs was expected to be an obstacle for the majority of businesses in manufacturing (70.6%); agriculture, forestry, fishing and hunting (68.4%); accommodation and food services (66.2%); and wholesale trade (62.5%).

Almost one-third (31.9%) of businesses expect the cost of insurance to be an obstacle over the next three months. This was expected by over half (53.2%) of businesses in transportation and warehousing and over two-fifths of businesses in agriculture, forestry, fishing and hunting (44.6%), construction (41.2%) and manufacturing (40.5%).

Over one-fifth (21.2%) of businesses expect fluctuations in consumer demand to be an obstacle over the next three months. This was expected by around one-third of businesses in accommodation and food services (35.4%), manufacturing (33.7%) and retail trade (30.3%).

Businesses facing supply chain issues expect these issues to be a medium-to-long term challenge

Over one-quarter (27.2%) of businesses expect difficulty acquiring inputs, products or supplies domestically. Of these businesses, over half (51.8%) expect these challenges to continue for six months or more, while over one-third (34.2%) are uncertain how long these challenges will persist. Over two-fifths of businesses in construction (45.9%), manufacturing (45.4%), agriculture, forestry, fishing and hunting (43.2%) and retail trade (40.6%) expect difficulty acquiring inputs, products or supplies domestically over the next three months.

Nearly one-fifth (17.5%) of businesses expect difficulty acquiring inputs, products or supplies from abroad. Of these businesses, nearly three-fifths (56.4%) expect these challenges to continue for six months or more, while almost one-third (30.3%) are uncertain how long these challenges will persist. Over half (52.1%) of businesses in wholesale trade and almost two-fifths (37.6%) of businesses in manufacturing expect difficulty acquiring inputs, products or supplies from abroad over the next three months.

Maintaining inventory levels is an obstacle expected by 18.4% of businesses. Of these businesses, over half (51.9%) expect these challenges to continue for six months or more, while one-third (33.0%) are uncertain how long these challenges will persist.

Businesses have recruitment, retention and training plans to address workforce related obstacles

Businesses expect to face obstacles related to the workforce. Recruiting skilled employees was expected to be an obstacle for over one-third (35.4%) of all businesses, led by businesses in accommodation and food services (53.1%) and manufacturing (48.9%). In addition, shortage of labour force was expected to be an obstacle for nearly one-third (32.7%) of businesses, while retaining skilled employees was expected to be an obstacle for over one-quarter (26.1%) of businesses.

Three-fifths (60.3%) of businesses indicated having plans over the next 12 months related to recruitment, retention and training. Nearly half (48.3%) of businesses plan to increase wages offered to existing employees over the next 12 months, with around three-fifths of businesses in accommodation and food services (62.9%), manufacturing (57.5%) and wholesale trade (55.1%) planning to do so.

One-quarter (25.1%) of businesses plan to increase wages offered to new employees. In terms of training, over one-quarter (27.0%) of businesses plan to encourage employees to participate in on-the-job training and 16.0% of businesses plan to provide employees with paid time to engage in learning and development programs.

Majority of businesses expect profitability to remain relatively unchanged over the next three months

Over half (52.9%) of businesses expect profitability to remain relatively unchanged. Just over one-third (33.6%) of businesses expect their profitability to decrease over the next three months, while 10.4% of businesses expect their profitability to increase. Expectations on future profitability differ by industry. Nearly three-fifths (57.6%) of businesses in accommodation and food services and over two-fifths of businesses in agriculture, forestry, fishing and hunting (41.4%) and transportation and warehousing (40.1%) expect profitability to decrease. Meanwhile, over three-fifths of businesses in professional, scientific and technical services (65.7%) and finance and insurance (62.5%) expect profitability to remain relatively unchanged.

Just over one-quarter (25.9%) of businesses expect to raise prices over the next three months, up from 21.7% of businesses that expected to do so in the third quarter, with those in wholesale trade (58.5%), manufacturing (47.8%) and retail trade (47.2%) most likely to expect to do so.

Over three-quarters (77.4%) of businesses expect to retain about the same number of employees over the next three months, similar to 78.2% during the third quarter. Conversely, 9.7% of businesses expect their number of employees to decrease, up from 7.1% in the previous quarter. In accommodation and food services, 21.4% of businesses expect a decrease in the number of employees over the next three months, up from the previous quarter (16.0%).

In terms of vacant positions, 8.6% of businesses expected to have more job vacancies over the next three months. However, nearly one-fifth (19.2%) of businesses in accommodation and food services expect to have more vacant positions.

Businesses foresee challenges in repaying government loans over the next 12 months

Over the next 12 months, 15.1% of businesses foresee major challenges in repaying funding received from repayable government support programs that were put in place because of the COVID-19 pandemic. Nearly two-fifths (38.7%) of businesses in accommodation and food services, and around one-quarter of businesses in arts, entertainment and recreation (25.2%) and transportation and warehousing (23.5%) foresee major challenges in repayment.

When asked how the absence of government support programs would impact the survival of the business over the next 12 months, one-third (33.3%) of businesses reported the level of impact would be medium-to-high. Most likely to indicate a medium-to-high level of impact on survival were businesses in accommodation and food services (63.7%) and arts, entertainment and recreation (59.0%).

Over three-quarters (77.8%) of businesses had the cash or liquid assets required to operate over the next three months. Nearly one-fifth (19.4%) of businesses reported that they could not take on more debt. Of businesses that could not take on more debt, the most commonly reported reasons were lack of confidence or uncertainty in future sales (46.8%), cash flow (45.1%), unfavourable terms and conditions (15.6%) and loan request would be turned down (15.6%).

Over 1 in 10 (12.7%) businesses have plans to expand or restructure or to acquire, merge with, or invest in other businesses in the next year. Similar to the third quarter, 3.5% of businesses have plans to transfer or sell their business within the next year. Meanwhile, 2.1% of businesses have plans to close, up from 1.6% in the third quarter.

Two-fifths of businesses expect sales to be about the same as pre-pandemic levels over the next three months

Over one-quarter (28.8%) of businesses expect sales to be lower from October to December 2021 when compared with pre-pandemic sales from October to December 2019. Of these businesses, over one-quarter (26.3%) expect it to take more than 12 months before sales return to pre-pandemic levels, while 15.8% expect it to be unlikely that sales will ever return to pre-pandemic levels. Meanwhile, over one-third (35.8%) of businesses expect sales to be about the same, while almost one-fifth (19.0%) expect sales to be higher from October to December 2021 compared with October to December 2019.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/211126/dq211126b-eng.htm?CMP=mstatcan