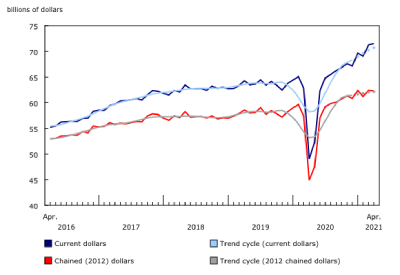

Canada Wholesale Trade, April 2021

June 16, 2021

Sales by Canadian wholesalers rose 0.4% in April to $71.5 billion, the third increase in the past four months. Activity in the sector was mixed in April, with continued strong growth in the sale of building materials and supplies largely offset by lower sales in the motor vehicle and motor vehicle parts and accessories subsector and the miscellaneous subsector.

Wholesale volumes fell 0.2% during the month.

Sales of building material and supplies continue to grow

Sales in the subsector rose 8.7% in April to $13.1 billion, the highest level on record. Sales in April 2021 were 26.5% higher than in December 2020. The demand for housing and home renovations has generated both an increase in the volume of building materials and supplies sold, and in their prices. Exports of lumber and sawmill products rose 7.8% in April, largely to meet the demand of American home builders. The number of new housing starts fell in both Canada and the United States in April, however, there is usually a several month lag between the start of a new home build and the use of lumber. As a result, sales in April reflect the fact that new home builds have been trending higher for the past several months. In April, the price of softwood lumber (the largest component of the building material and supplies subsector) rose 10.1% and was 169.4% higher than one year ago in April 2020, according to the Industrial Product Price Index.

Sales of motor vehicles and motor vehicle parts and accessories fell 4.4% in April, reflecting the ongoing shortage of microprocessors required to build automobiles. This was the third decline in the past five months. Across North America, assembly plants have been forced to cut back production or completely close operations for periods of time because of a lack of semiconductor chips. Because of this, total output in the North American automotive industry has been down by several hundred thousand units over the past few months. Sales in the subsector were at their lowest level since June 2020.

Sales in the miscellaneous subsector fell 3.4% to $9.3 billion. It was the first decline after two months of gains. Most of the decline came from the other miscellaneous wholesale products industry which includes wholesaling of many mining and forestry products.

Sales rise in seven provinces

Wholesale sales rose in seven provinces and one territory in April, representing 45% of national wholesale sales.

The largest increase in April was in Alberta, where wholesalers reported $7.6 billion in sales, 5.3% more than in March. This was the second consecutive increase in wholesale sales for Alberta and the highest value on record. The building material and supplies wholesalers reported the largest growth in sales (+20.5% to $1.5 billion). Residential building permits in Alberta increased by 15.4% in April. The subsector with the next largest change was machinery, equipment and supplies, which reported $2.1 billion in sales in April, an increase of $81.8 million (+4.0%) compared with March.

All subsectors in Alberta reported higher sales, except for farm product wholesalers, who reported $121.5 million in sales—$6.3 million (-4.9%) less than in March.

Although wholesale sales were higher in April overall, the largest change was in Ontario, where sales were 1.9% (-$678.1 million) lower than they were in March, for a total of $35.1 billion. Lower sales in Ontario accounted for more than 90% of the month-over-month change for all provinces that had lower sales in April.

Ontario’s decline largely reverses the province’s growth in 2021 so far, as monthly sales have dropped to within $100 million of December 2020’s level. Half of the decrease in Ontario was caused by lower sales in the motor vehicle and motor vehicle parts and accessories subsector, which was affected by the ongoing semiconductor shortage. Subsector sales fell 8.4% to $6.4 billion. A third of the decrease came from the miscellaneous subsector, which reported an 8.3% decrease in sales.

The largest increase in sales in Ontario was reported in the building material and supplies subsector, which reported a 5.3% rise in sales, with growth in all three industries.

No change in inventories

The value of wholesale inventory in April was unchanged from March at $93.4 billion. Higher inventories in four of the seven subsectors were offset by lower inventories in the other three subsectors. Inventory levels for this month were the highest on record for the second consecutive month.

The largest increase in inventories came from the building material and supplies subsector (+5.3% to $15.9 billion). This was the largest inventory value on record, and marked the seventh consecutive increase as there continued to be high demand for building materials. The lumber, millwork, hardware and other building supplies industry contributed half of the increase—the fourth consecutive record-breaking month for this industry.

The largest decrease in inventories was in the machinery, equipment and supplies subsector (-3.5% to $25.6 billion). Half of this decrease was from the other machinery, equipment and supplies industry, which, among other professional establishments, includes health care supply wholesalers.

The inventory-to-sales ratio remained constant at 1.31 in April, as it has been for three of the four months in 2021. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.