Data, Forecasting and Planning in the Electrical Industry

Aug 25, 2020

By David Gordon

As we get ready to turn the page on summer and companies begin to either complete, accelerate to complete or begin development of their 2021 planning cycle, we thought it pertinent to check in with DISC for an electrical industry market update and 2021 forecast.

Forecasting is like meteorology. They gather information, run it through models and then project the future. The challenge with “projecting” is that “things” happen. They could be natural disasters (hurricanes), “man made / political ‘errors’” (2008) recession and Black Swan events such as our current environment. Some are localized (especially natural disasters), whereas others can be widespread or national in scope. So, it’s not best guess, but a prediction based on input aggregated from varied sources. And yes, no one can be 100% accurate on capital inflows into market segments (and projects) as projects get delayed and cancelled.

But you need to start with something and, using the same source repeatedly that has a solid track record is a good place to start. We asked Christian Sokoll, president of DISC, to share his thoughts.

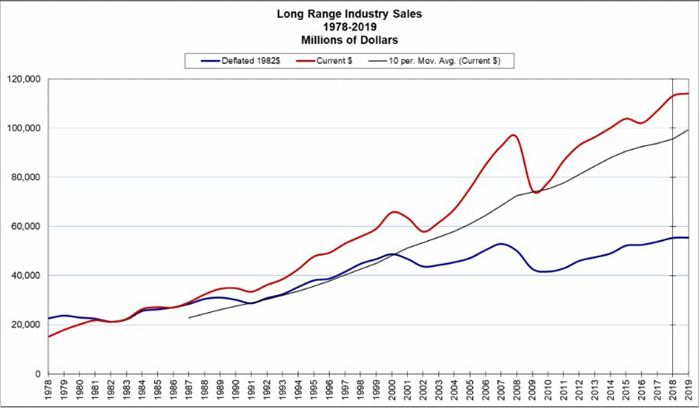

41 Years of Electrical Industry Sales

Courtesy of DISC Corp, 2020

What value do you place on data? Are they a key part of your business and how you measure performance? Right now, and more than ever we need to understand our relationship with our company, our customers, and the potential of each. Data can deliver these insights. Internal business intelligence data combined with external economic forecasts become very powerful tools.

Economic forecasting uses reliable information from both the current and the past and then applies mathematical modeling to make a reasonably accurate prediction of the future. Dependable forecasting models are truthful, use numerous and consistent inputs from period to period, consider changes in policies that impact our industry, are normalized for inflation and are traceable back to the source data. There are many resources available for you to gather this information. My company, DISC Corp., has been researching and forecasting the electrical industry since 1985. Jim Lucy and Electrical Wholesaling do an outstanding job of market research and forecasting. The Census Bureau, The Bureau of Labor and Statistics, and the FRED — are excellent, reliable resources. Today we are bombarded with non-industry specific information from all sides. It is important to be able to recognize bad data. Unreliable data and forecasts are generally opportunistic, easily manipulated and hard to verify. In 1954, Darryl Huff authored How to Lie with Statistics, his guidance on “how to look a phony statistic in the eye and face it down; and no less important, how to recognize sound and usable data in [the] wilderness of fraud” is more relevant today than it was then.

DISC Corp is currently forecasting electrical distribution national sales of $93 billion dollars in 2020, this follows 2019 sales of US$111 billion. Our current expectation is a recovery to 2019 pre-pandemic sales volumes by 2023. As an electrical distributor, manufacturer, or agent I would want to have and use these numbers to calculate my percentage of market share as we move through recovery.

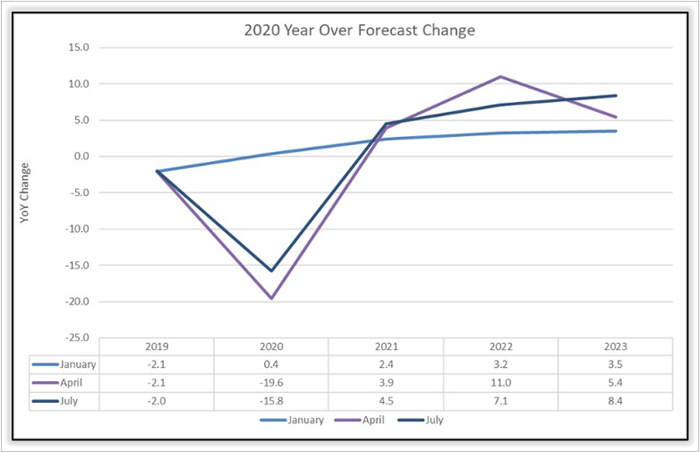

Economic forecasts are currently a moving target. Looking at our January forecast, we went into the year with some optimism for growth over 2019. What we could not see was the impact of the two Black Swan events, the COVID-19 pandemic and the oil and gas price war, on the electrical distribution community. These grim realities, along with uncharted political climate and partisan media reporting have the entire country set in an uneasy uncertainty.

Quarterly Forecast Changes …Dark Blue is Current (July)

Because of these and other factors, the underlying dynamics propelling the electrical economy are more complex today than they were a few short months ago. Market data is key to making complex strategic and tactical decisions in this environment. Our Q3 2020 forecast is now anticipating less depth and a slightly attenuated recovery from the April forecast.

But this only tells part of the story. The competitive spirit in our distribution DNA wants us to understand the score at a much deeper level. What is my share by region? By market segment, by branch, by county, by postal code, by salesperson and product? Where do I look for future opportunity to grow my share? Are my resources in the correct places to ensure I have the right amount of coverage to meet the demand?

To answer these questions, you need to dive as deeply as possible into the big four economic drivers of the electrical industry. By understanding historical trends and doing some mathematical “What If” modelling of future performance you can develop a deep understanding of your market while building a roadmap to success. Thoughtful consideration of the contractor, utility, institutional and industrial markets in the areas you serve can provide these vital insights. By measuring performance against these markets, you can find not only performance metrics but also new opportunity.

Pressure to perform and bring in bottom-line results in today’s environment is intense, to say the least. How do you as a leader get there faster? Are you leveraging your business intelligence data (internal from your ERP and other systems) and combining it with external data to perform analytics? Have you built or are you building a data driven culture centered on analytics? Do you share results and expectations across your organization?

Start by understanding your sales versus the market size to get current market share. Measure sales and margin over time against market data to see if you have a trend. You should break it down by region, territory, branch, and salesperson. This analysis provides a map of not only performance but also territory alignment. To better understand your marketplace, you can take this to the next step and look at market size by verticals, industry segments and product categories. Here are some examples:

• Construction — residential, commercial, industrial, buildings

• Industrial — manufacturing and transportation/warehousing niches

• Commercial/Institutional — campuses, malls, hospitals, media, etc.

• Utility — wastewater, power, and communications

Sales teams face unique challenges because the definition of a sales call has undergone profound change. The most recent DISC Corp./CMG market survey found that sales and customer behaviour is fundamentally shifting toward protectionism, with people fearing exposure to a potentially deadly virus with no current effective treatment or vaccine. The near-term effect be on years of relationship-based selling are unknown. How should we change the training we provide the next generation?

Gauging sales performance by merely looking at revenue, margin growth and activities listed on an expense report no longer tells the complete story. We need to be far more analytical, benchmarking against leading and trailing indicators. Understanding market share, along with measuring web-based sales presentations, e-mail send and open rates, phone meetings, marketing campaigns, lead generation, and new contacts should be a part of the sales manager’s effectiveness toolkit. These factors require some retraining as well as a data-based mindset. Those who are hyper-aware of managing targeted market penetration and are pursing it with dedication and persistence with data will be the ones who survive today and prosper tomorrow.

Data are nice but data aggregated becomes information. Information analyzed becomes insightful and knowledge. Knowledge applied turns into power to create/influence strategy and accelerate sales and profitability. The question becomes, “Is it preferable to drive blind or have a guide?”

As Mark McGready from SPARXiQ recently said, “You need a game plan.” To develop a plan, you need to know what field you are playing on so you can determine competition and your strategy. This is important whether you are a manufacturer, distributor or rep, as well as whether you are large, medium or small in size.

It’s not too late to start and there is still a little time. Last month we talked about how July kicks off the second half sprint. There is still time to finalize Phase 2 plans and to begin Phase 3, which is planning. We’re currently working with manufacturers, distributors, and reps in helping them with their plans. Some will be high level strategies and essentially helping them with “guideposts,” others will get pretty detailed about short-term and longer-term strategy and, in some we’ll be involved in helping with being a “guide.” If you need help, or want a third-party perspective of industry observations, or could benefit from some ideas (or a sounding board), or… give us a call!

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. Channel Marketing Group does not engage with clients on detailed pricing strategies, however, given that pricing is a critical element of sales, marketing and growth planning, we do get asked about the topic and can share opinions and refer to those who focus on the area as well as share anecdotes. David Gordon can be reached at 919-488-8635 or dgordon@channelmkt.com