Rockwell Automation Reports Q3 Fiscal 2020 Results, Announces New Operating Segments for Fiscal 2021

July 28, 2020

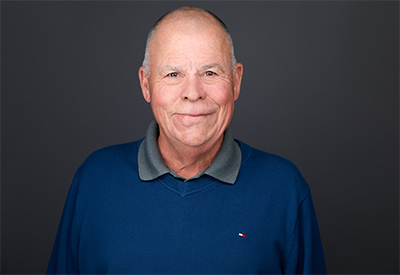

Commenting on the third quarter results and current business conditions, Blake Moret, Chairman and CEO, said “We continue to build resiliency for ourselves and for our customers. Year-over-year results are down, and conditions remain difficult, but our employees have responded extraordinarily well, and we remain focused on keeping them safe. Our earnings were higher than expected for the quarter, primarily driven by better organic sales.”

Moret also announced, “We are taking the next step in accelerating profitable growth by organizing our business in a way that better aligns us with the evolving needs of our customers. Beginning next fiscal year, we will operate with three operating segments – Intelligent Devices, Software & Control, and Lifecycle Services. These new segments will simplify our structure around essential offerings, leverage our sharpened industry focus, and add software talent, which will play a larger role in our future value.”

Moret continued, “We are confident that this model will enable us to provide even more value. Nobody is better positioned to bring Information Technology (IT) and industrial Operational Technology (OT) together than Rockwell and our partners.”

“This change builds on our success and accelerates our progress to bring the Connected Enterprise to life. It’s the right time to make these changes, as we strengthen the resilience of our business model. Our growth framework remains gaining share in our core, growing double digits in information solutions and connected services, and adding a point or more of growth through inorganic investments.”

Fiscal 2020 Q3 Financial Results

Fiscal 2020 third quarter sales were $1,394.0 million, down 16.3 percent from $1,665.1 million in the third quarter of fiscal 2019. Organic sales declined 17.6 percent, currency translation decreased sales by 1.9 percentage points, and acquisitions increased sales by 3.2 percent.

Fiscal 2020 third quarter net income attributable to Rockwell Automation was $317.8 million or $2.73 per share, compared to $261.4 million or $2.20 per share in the third quarter of fiscal 2019. The increases in net income attributable to Rockwell Automation and EPS were primarily due to fair-value adjustments recognized in the third quarter of fiscal 2020 and 2019 in connection with investment in PTC (the “PTC adjustments”), partially offset by lower sales. Fiscal 2020 third quarter Adjusted EPS was $1.27, down 47 percent compared to $2.40 in the third quarter of fiscal 2019, primarily due to lower sales. These results include restructuring charges of approximately $15 million, which are offset by a one-time gain from the sale of an asset.

Pre-tax margin was 24.0 percent in the third quarter of fiscal 2020 compared to 19.3 percent in the same period last year. The increase in pre-tax margin was primarily due to the PTC adjustments partially offset by lower sales volume leverage.

Total segment operating margin was 16.5 percent compared to 23.8 percent a year ago. The decrease in total segment operating margin was primarily due to lower sales. Total segment operating earnings were $229.4 million in the third quarter of fiscal 2020, down 42.1 percent from $395.9 million in the same period of fiscal 2019.

Cash flow provided by operating activities in the third quarter of fiscal 2020 was $346.2 million, compared to $351.2 million in the third quarter of fiscal 2019. Free cash flow was $310.9 million, compared to $323.4 million in the third quarter of fiscal 2019.

Outlook

The COVID-19 pandemic and global efforts to respond to it are rapidly evolving. Rockwell Automation’s projections assume that a gradual recovery continues, with no increase in pandemic-related facility closures or disruptions to the supply chain.

Based on the information available at the time of this release, the following table provides guidance for projected sales growth and earnings per share for fiscal 2020:

|

Sales Growth Guidance |

EPS Guidance |

|||||

|

Reported sales growth |

~ (5.5)% |

Diluted EPS |

$8.06 – $8.26 |

|||

|

Organic sales growth |

~ (8)% |

Adjusted EPS |

$7.40 – $7.60 |

|||

|

Inorganic sales growth1 |

~ 4% |

|||||

|

Currency translation |

~ (1.5)% |

|||||

1Estimate for incremental sales resulting from the formation of the Sensia joint venture and sales from other acquired businesses in fiscal year 2020.

“While we, as a company, are managing well in this environment, we are highly sensitive to the toll this is taking on our employees during this time. Beyond the fear of a loved one getting sick, racial injustice is on our minds as we develop actions as a company and as individuals that will help put a permanent end to the denial of fundamental human rights. Additionally, thousands of employees continue to work under very difficult conditions, including the temporary pay cuts we implemented in May. These actions were necessary to better align our costs to current business conditions while preserving jobs, and we intend to reverse them by the end of December, hopefully sooner. Additionally, we are making another recognition payment to our manufacturing associates worldwide, who are on the front lines of maintaining our essential operations,” Moret concluded.

Architecture & Software

Architecture & Software quarterly sales were $621.4 million, a decrease of 16.9 percent compared to $747.9 million in the same period last year. Organic sales decreased 15.9 percent, currency translation decreased sales by 1.8 percentage points, and an acquisition increased sales by 0.8 percentage points. Segment operating earnings were $147.8 million compared to $222.9 million in the same period last year. Segment operating margin decreased to 23.8 percent from 29.8 percent a year ago.

Control Products & Solutions

Control Products & Solutions quarterly sales were $772.6 million, a decrease of 15.8 percent compared to $917.2 million in the same period last year. Organic sales decreased 18.9 percent, currency translation decreased sales by 2.0 percent, and inorganic investments increased sales by 5.1 percent. Segment operating earnings were $81.6 million compared to $173.0 million in the same period last year. Segment operating margin decreased to 10.6 percent from 18.9 percent a year ago.

Supplemental Information

General Corporate Net – Fiscal 2020 third quarter general corporate-net expense was $26.4 million compared to $23.8 million in the third quarter of fiscal 2019. The increase was primarily due to benefit-related adjustments.

Purchase Accounting Depreciation and Amortization – Fiscal 2020 third quarter purchase accounting depreciation and amortization expense was $10.6 million, up $6.5 million from the third quarter of fiscal 2019, resulting in a year-over-year decrease in Adjusted EPS of $0.03.

Tax – On a GAAP basis, the effective tax rate in the third quarter of fiscal 2020 was 6.1 percent compared to 18.7 percent in the third quarter of fiscal 2019. The lower effective tax rate in the third quarter of fiscal 2020 was primarily due to the PTC adjustments. The Adjusted Effective Tax Rate for the third quarter of fiscal 2020 was 13.6 percent compared to 17.3 percent in the prior year. The lower Adjusted Effective Tax Rate in 2020 is primarily due to discrete items.

Share Repurchases – During the third quarter of fiscal 2020, the Company repurchased 0.3 million shares of its common stock at a cost of $48.5 million. At June 30, 2020, $853.7 million remained available under existing share repurchase authorization.

ROIC – Return on invested capital was 27.9 percent.

Non-GAAP Measures – Organic sales, total segment operating earnings, total segment operating margin, Adjusted Income, Adjusted EPS, Adjusted Effective Tax Rate, free cash flow, and return on invested capital are non-GAAP measures that are reconciled to GAAP measures in the attachments to this release.

New Operating Segments

Beginning in fiscal year 2021, the company will report revenue and operating earnings based on three operating segments: Intelligent Devices, Software & Control, and Lifecycle Services. This change simplifies their structure around essential offerings, leverages a sharpened industry focus, and recognizes the growing importance of software in delivering value to our customers.

The Intelligent Devices segment will be led by Fran Wlodarczyk, currently the Senior Vice President of the Architecture & Software segment, and will include drives, motion, safety, sensing, industrial components, and configured-to-order products.

The Software and Control segment will be led on an interim basis by Chris Nardecchia, currently Senior Vice President of Information Technology and Chief Information Officer, while an external search is conducted for a new Senior Vice President for this segment. This segment will include control and visualization software and hardware, information software, and network and security infrastructure.

The Lifecycle Services segment will be led by Frank Kulaszewicz, currently Senior Vice President of the Control Products & Solutions segment, and will include consulting, professional services, connected services, and maintenance services, as well as the Sensia joint venture with Schlumberger.

In addition, to accelerate the evolution of their culture, Becky House has taken the role of Chief Administrative and Legal Officer, which includes leadership of talent, legal, ethics and compliance, and environmental, health and safety teams.

Rockwell will begin to operate under the new segment structure effective Q1 fiscal 2021. Rockwell expects to announce its financial results for the fiscal first quarter in late January 2021 and will report financial performance based on these three operating segments. To aid investors with the transition, revenue and segment operating earnings for fiscal 2019-2020 will be provided by our fiscal Q4 2020 earnings call.