Darkest Before the Dawn

Apr 15, 2020

By John Kerr

At times like this I miss my father. Those men of his time were thrust into uncertainty and challenged so greatly. They survived and thrived and lived on… just like the Canadian electrical industry will.

My father at times like this would always have the right thing to say. Given our team perspective and if he were here, he would say, “It’s always darkest before the dawn.”

These are troubling times, confusing times, and times we would like behind us now.

The team at Kerrwil and Canadian Electrical Wholesaler wanted a Canadian perspective on where we are, and we wanted a view from the perspective of the agent, the electrical distributor and electrical manufacturer for the past several weeks.

Last week our friends at Electrical Trends, under the leadership of David Gordon along with DISC Corp., launched a US-focused survey which was very insightful and some of what we have done is based on their approach to allow a Canada-US perspective. Their survey had 429 respondents across distributors, agents and manufacturers.

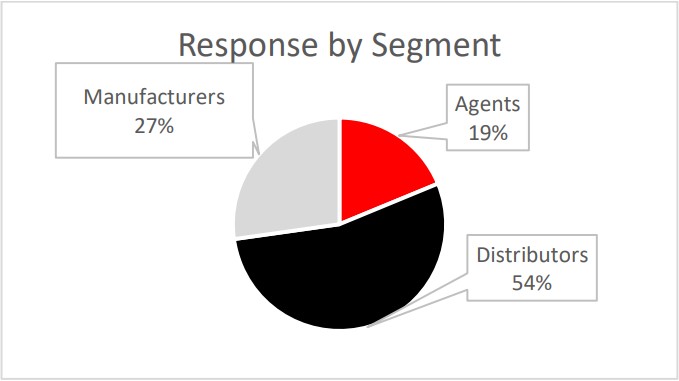

We wanted to understand the impact and the actions taken by the Canadian electrical industry over the past several weeks. Herein we built three specific studies targeted to the audiences but with as many common questions as we could. With 223 responses in total, we had a solid cross section of the industry: 54% electrical distributors, 27% manufacturers, and 19% agents.

Table 1: Responses by Segment

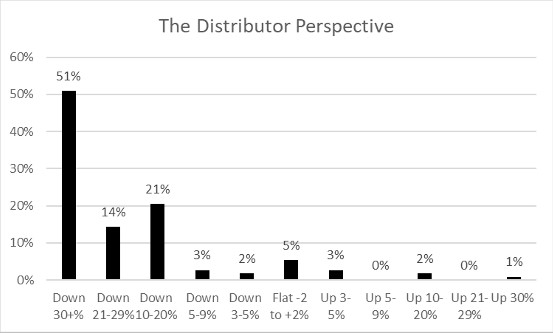

The electrical distributor perspective

Overall, across Canada electrical wholesalers are down on average 21.4%, with 51% reporting a decline of 30% or more. 86% of the distributors that responded reported over 10% or more.

Table 2: The Distributor Perspective

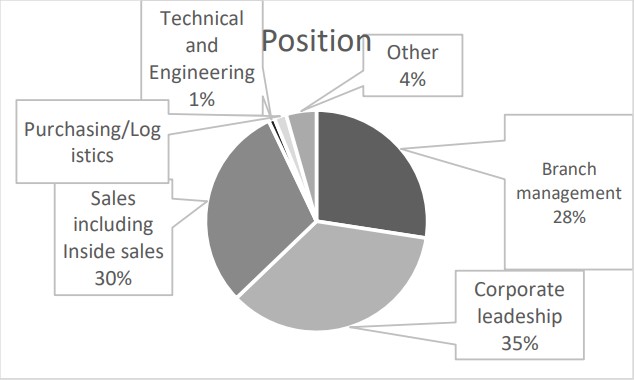

The survey does represent a solid cross section of multinational, national and regional distributor brands, with 62% representing senior leadership, corporate and branch management.

Table 3: Role of Distributor Respondents

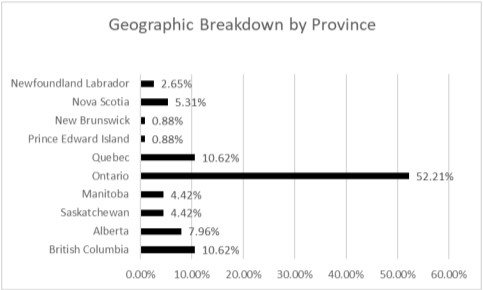

While Ontario dominates the responses — Ontario and Quebec represent 58% of the market in Canada — both markets have tended to report the largest declines. The west has been impacted somewhat less.

Table 4: The Distributor Respondent by Province

The distributor response

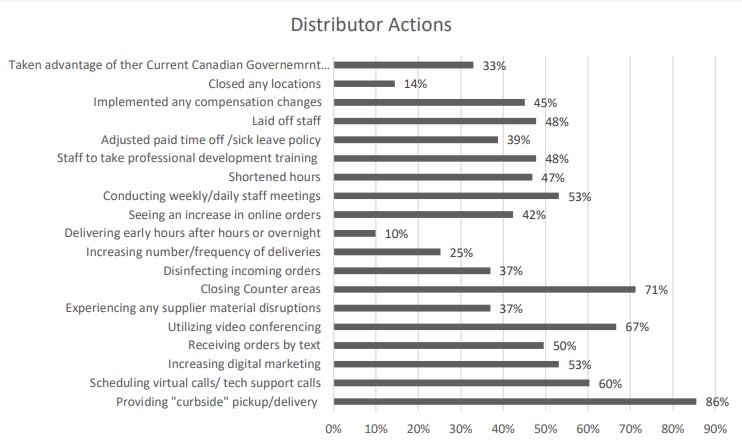

Adapting to the current reality, electrical distributors are offering numerous responses to support their businesses. 86% implemented curbside pick ups alongside closing counter areas while 14% are closing branches. We noted several comments where some electrical distributors are in fact keeping their current planned purchasing in place and not reducing inventory alongside those who are preparing work sharing programs and some even extending their hours, creating shifts for order preparation as they are reacting to electrical contractors who also are spreading out their work to minimize staffs on site at any one time.

Table 5: Canadian Distributor Actions

Another key thing to note was that staff has been impacted on many fronts through implementation of work-at-home strategies, compensation adjustment, and layoffs. We are surprised to see how in Canada 48% of the respondents indicated a move to professional development training while that number was just over 30% in the U.S. study mentioned earlier.

Finally, on the distributor front 42.8% of respondents indicated that they have been asked by customers to extend credit and defer payments.

The manufacturers’ view

Overall, at this stage the manufacturers have faired a little better at 17.5% down, but comments made alongside the study anticipated greater decreases closer to May. The sentiment of many was that sales though the third week of march held up well compared to last year, with a definite softening in week 4 and through mid April.

The profile of respondents show a solid cross section of manufacturers from the larger multinationals through to the smaller local manufacturers. As one might expect, Ontario-based manufacturers dominated the response at 76% with Quebec at 17%.

88% of the responses were from senior management, ownership.

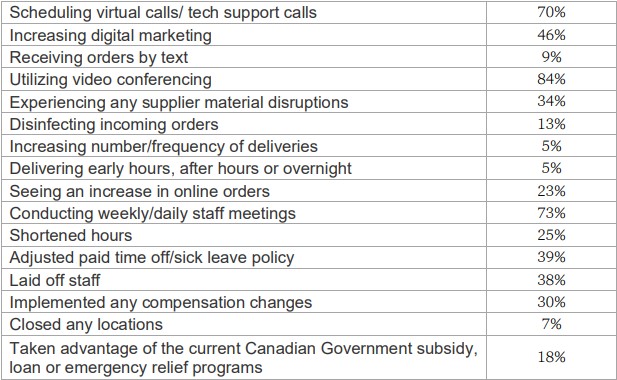

The manufacturers seem to have jumped on the video conferencing method and moved to weekly or daily staff meetings. Increased spending in online strategies seems to have taken hold as well, while 38% have had to address staff levels.

Of note only 18% had take advantage of Canadian government programs at this point. The table below details all actions taken by manufacturers.

Table 6: Manufacturer Actions

The agents’ view

The agents fall right in the middle of the negative impact at 21.4% down so far. 45% of the respondents were from Ontario and Quebec, with Western canada representing 33%, Senior management corporate leadership and ownership.

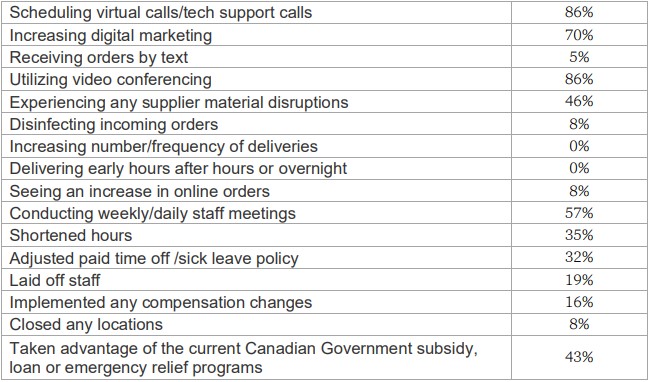

Agents were a bit more reserved in their personal comments on the current scenario, with many working hard to make sure any time they do have is spent at the client. Many indicated too, a move to be more proactive in online training and product knowledge while working hard to keep their teams in place and together. Of note 43% have indicated they have taken advantage of the Canadian Government programs.

The table below details the actions by agents.

Table 7: Agents Actions

So how does this effect the final numbers for this year?

The second quarter of the year has over the past several years as measured by Electro-Federation Canada and reported in PATHFINDER represented 24.7% of the year. Quebec has typically been about 1% higher while the Prairies 1% lower.

For the full line distributor in this quarter would approach $2 billion (Canadian) and for the entire market closer to $2.8 billion (Canadian).

While this study did not look beyond today, we sense it has given a view that may indicate a sense of the impact. With sales through Q1 in good shape compared to the year previous, we estimate the worse case scenario for a reduction of sales through to June could approach $600 million or a 9% contraction for the full line distributor segment on an annual basis. Remember this is a full line distributor segment view and assumes no contraction through the balance of the year or no further disruptions.

That said, our sister platforms Electrical Industry and Le Monde de L’Electricite are talking to electrical contractors frequently and the take-away from those discussions speaks to the slow introduction of staff back to work sites with a need to have staff working longer hours post the return to normal, taking advantage of the weather. Quebec as many know has shifted its summer break schedule already.

Another comment we hear too is many contractors feel they could in fact be short staffed as they try to push the pending work through the system before the year’s end. We have heard too as noted earlier many distributors are holding the line on product in inventory to have it ready for the possible increase in demand when the pendulum swings.

The market will be challenged to meet the bar set last year for sure, but it is possible, and the innovation and flexibility shown by the industry so far sets the foundation in place for that possibility.

John Kerr is Publisher of CEW; johnkerr@kerrwil.com