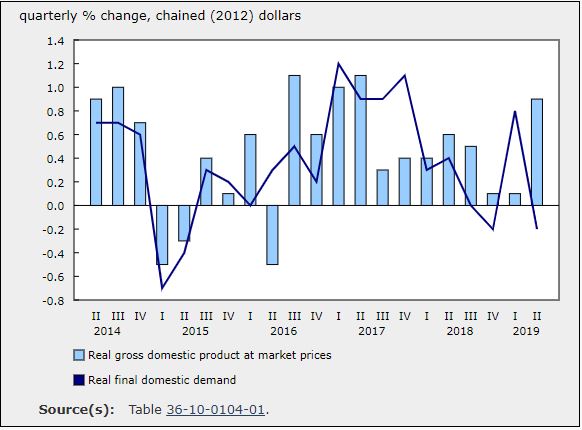

GDP Rose 0.9% in Q2 2019

Sept 13, 2019

Real gross domestic product (GDP) grew 0.9% in the second quarter, after edging up 0.1% in each of the previous two quarters. This growth was led by a 3.2% rise in export volumes, while final domestic demand edged down (-0.2%).

Expressed at an annualized rate, real GDP advanced 3.7% in the second quarter. In comparison, real GDP in the United States grew 2.0%.

Exports of goods rose 3.7% in the second quarter, following declines in previous two quarters. The increase was led by energy products, which grew 5.9% after a 3.0% decline in the first quarter. Exports of services rose 1.1%, maintaining the pace of the previous quarter. Import volumes declined 1.0%.

GDP growth was moderated by a 1.6% decline in business investment; notable declines occurred in outlays on machinery and equipment and engineering construction. Growth in consumer spending slowed to 0.1%.

Businesses accumulated $11.9 billion in non-farm inventories in the second quarter, and the economy-wide stock-to-sales ratio remained at 0.85. Cannabis stocks contributed to the $2.1 billion accumulation of farm inventories.

Exports drive growth

The second quarter increase in export volumes was broad-based. In addition to the growth in energy products, farm and fishing products rebounded 15.2%, following an 8.4% decline in the first quarter. Exports of non-metallic minerals rose 19.0%, the sharpest upturn since the third quarter of 2016, and exports of aircraft and related engines and parts grew 10.0%. Exports of travel services rose 2.4%, after a 1.4% increase in the previous quarter.

Exports of pulp and paper dropped 10.6%, the fourth consecutive quarterly decline.

Import volumes declined 1.0% in the second quarter, after a 2.1% rise in the first quarter. Imports of aircraft and associated engines and parts fell sharply (-32.1%), following a 41.1% rise in the previous quarter. Other notable declines occurred in pharmaceuticals and medicinal products (-3.9%) and in communication and audio and video equipment (-6.7%).

Imports of energy products rebounded 7.8% in the second quarter, after a 4.2% decline in the first quarter, while imports of motor vehicles and parts slowed to 1.4% growth.

Imports of services fell 1.8%, largely owing to a 4.0% decline in imports of transportation services.

Growth in household spending slows

Growth in household spending slowed to 0.1% in the second quarter, following a 0.7% increase in the first quarter. Outlays on durable goods fell 0.3%, largely as a result of a 1.4% decline in purchases of vehicles. Outlays on semi-durable goods slowed to 0.3%.

Outlays on non-durable goods edged down 0.1%, after a 0.8% rise in the first quarter. Outlays on services rose 0.3%, after a 0.5% increase in the first quarter.

Housing investment resumes growth

Following five consecutive quarterly contractions, housing investment rose 1.4%, on broad-based gains. Increases in multi-dwelling investments and conversions led the growth in new home construction (+0.9%). Higher resale activities boosted growth in ownership transfer costs (+3.8%), while renovation activities grew 0.7%.

Non-residential business investment declines

Business investment in non-residential structures and machinery and equipment fell 4.3% in the second quarter, following a 3.4% rise in the first quarter. The decrease was due mainly to a 9.3% decline in machinery and equipment investment, largely attributable to a 61.1% decrease in aircraft and other transportation equipment. Investment in computers and related equipment rose 7.7%, after a 1.7% decline in the first quarter.

Growth in business investment in non-residential buildings slowed to 1.1%, while investment in engineering structures declined 1.0%, the sixth consecutive quarterly decline.

Business investment in intellectual property products rose 0.6% in the second quarter, after a 1.3% decline in the first quarter. Mineral exploration and evaluation grew 1.3%, followed by software (+0.6%) and research and development (+0.3%).

Real gross national income continues to rise

Real gross national income, the real purchasing power of income earned by Canadian-owned factors of production, rose 1.3%, after a 1.1% gain in the first quarter. The GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 1.1%.

Canada’s terms of trade—the ratio of the price of exports to the price of imports—rose 0.9% in the second quarter, following a 2.7% increase in the first quarter. Export prices increased 1.3%, while import prices rose 0.4%. The price of exported crude oil and crude bitumen continued to increase, rising 15.2%, after a 31.8% boost in the previous quarter.

Corporate earnings and household disposable income grow

The growth in the gross operating surplus accelerated to 3.7% in the second quarter, after rising 2.1% in the first quarter. Growth in compensation of employees strengthened to 1.7% in the second quarter as both goods- (+1.5%) and services- (+1.8%) producing industries increased. This contributed to a 1.3% rise in household disposable income and a 1.7% increase in the household saving rate.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190830/dq190830a-eng.htm