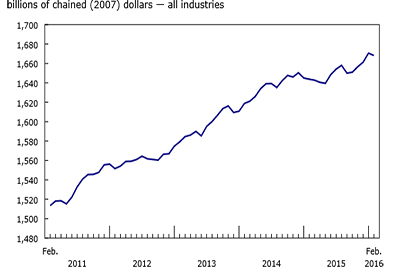

Real GDP Slowed to 0.1% in Q4 2018

Mar 3, 2019

Growth in real gross domestic product (GDP) slowed to 0.1% in the fourth quarter, the slowest pace since the second quarter of 2016. Real gross national income fell 1.0%, largely owing to lower export prices of crude oil and crude bitumen. Final domestic demand was down 0.4% as investment continued to fall. Annual growth was 1.8% for 2018, following a 3.0% increase in 2017.

In comparison, real GDP in the United States grew 2.9% in 2018.

The slowing of GDP in Canada in the fourth quarter mainly reflected a 2.7% drop in investment spending. Exports of goods and services (-0.1%) also edged down.

These declines were largely offset by higher inventory accumulation, as businesses accumulated $12.5 billion of non-farm inventory following investment of $3.5 billion in the previous quarter. The economy-wide stock-to-sales ratio increased from 0.825 in the third quarter to 0.840 in the fourth quarter.

Household spending slows and the housing market softens

Household spending slowed for the second consecutive quarter, edging up 0.2% in the fourth quarter following a 0.3% increase in the third quarter. Outlays for services rose 0.5%, led by life insurance and financial services (+0.9%), while outlays on goods declined 0.2%. Durable goods fell 0.5%, largely because of a 0.6% decrease in spending on motor vehicles. Outlays for semi-durable goods declined 0.3%, while non-durable goods were flat in the fourth quarter.

Housing investment fell 3.9% as the market continued to soften, with the largest decrease in new construction (-5.5%), followed by renovations (-2.7%) and ownership transfer costs (-2.6%).

Non-residential business investment continues to fall

Overall business investment in non-residential structures, and machinery and equipment fell 2.9%, the sharpest drop since the fourth quarter of 2016. Business investment in non-residential buildings declined 3.1%, while investment in engineering structures fell 4.3%, following a 3.1% decline in the previous quarter. Machinery and equipment investment decreased 1.2%, after a 3.9% decline in the third quarter.

These declines were moderated by a 6.1% increase in business investment in intellectual property products, following a 1.8% decline in the previous quarter. The increase was mainly attributable to mineral exploration and evaluation, which can be influenced by anticipated prices and potential new reserves.

On an annual basis, overall business investment rose 0.3% in 2018, despite a 2.3% decline in housing investment, which fell in tandem with higher interest rates and more stringent conditions for obtaining mortgages.

Export and import volumes edge down

Export volumes edged down 0.1%, following a 0.8% increase in the previous quarter. A 1.6% rise in services exports partly offset a 0.4% decline in goods exports. Exports were down sharply for forestry products and building and packaging materials (-3.2%). Exports were also down for metal and non-metallic mineral (-2.0%) and energy (-0.6%) products.

Increased exports of travel (+3.9%) and commercial (+1.8%) services more than offset lower exports of transportation services (-2.7%).

Import volumes were down 0.3% in the fourth quarter, after a 2.2% decline in the third quarter. Imports of basic and industrial chemicals, plastic and rubber products (-4.6%) were down sharply. Imports of motor vehicles and parts (-1.3%) and metal and non-metallic mineral products (-2.4%) were also down. Imports of energy products were flat, while aircraft, engines and parts rebounded 17.1%. Increased imports of travel services (+1.9%) and commercial services (+0.8%) pushed total service import growth to 1.2%.

Terms of trade decline and real gross national income falls

Canada’s terms of trade—the ratio of prices of exports to prices of imports—fell 3.6% in the fourth quarter, primarily because of a 34.3% price decline in crude oil and crude bitumen exports. This was the largest terms of trade decline since the first quarter of 2009. Lower export prices reduced corporate earnings, and gross operating surplus fell 5.4% (nominal terms), mostly in oil and gas industries.

Lower export prices led to a 1.0% drop in real gross national income (GNI), the real purchasing power of income earned by Canadian-owned factors. This was the sharpest decline in real GNI since the first quarter of 2015 (-1.5%). The GDPimplicit price index, which reflects the price of domestically-produced goods and services, fell 0.8% in the fourth quarter, after rising 0.6% in the third quarter.

Household disposable income increases

A 1.2% rise in compensation of employees (nominal terms) boosted household disposable income (+0.8%); this, coupled with lower nominal household final consumption expenditure, resulted in a small increase in household savings and the household saving rate (+1.1%).

Cannabis (legal and illegal) now included in the national economic accounts

With this release, cannabis (legalized on October 17, 2018) is fully integrated in the national economic accounts, including estimates of legal and illegal economic activities related to cannabis production, distribution and consumption for non-medical and medical use. Before this release, only economic activities related to legal use for medical purposes were recorded.

Expressed at an annual rate, household spending on cannabis totalled $5.9 billion (in nominal terms) in the fourth quarter, with illegal cannabis accounting for $4.7 billion and legal cannabis $1.2 billion. Cannabis accounted for 0.5% of total household spending, and non-medical cannabis accounted for 11.2% of spending on alcohol, tobacco and cannabis in the fourth quarter.

Annual gross domestic product growth slows in 2018

The economy grew 1.8% in 2018, compared with 3.0% growth in the previous year. The slowdown in 2018 was evidenced in most GDP components, with the exception of exports. The nominal growth of the compensation of employees was also higher in 2018.

Household final consumption expenditure slowed to 2.1% growth following a 3.6% increase in the previous year. Growth in overall business investment slowed to 0.3% following a 2.3% gain in 2017. The slowdown in 2018 reflected a 2.3% decline in housing investment and a 1.7% increase in non-residential construction and machinery and equipment investment. Exports volumes rose at a faster pace, accelerating from 1.1% growth in 2017 to 3.3% in 2018.

Growth in corporate earnings slowed considerably in 2018, as gross operating surplus grew 1.8% in nominal terms, following a 9.1% increase in 2017. Growth in compensation of employees was slightly higher in 2018 (+4.6%) than in 2017 (+4.3%).

Source: Statistics Canada, https://www150.statcan.gc.ca/n1/daily-quotidien/190301/dq190301a-eng.htm