Defining Canada

May 10, 2018

By John Kerr

In our work as publishers we have a wonderful perspective on the market here, its structure and its business models. Over the past few years we have witnessed a few key trends that may be a concern in the market here.

As consolidation has taken place the landscape in the supplier and channel continue to evolve. Bigger firms with more resources and scope and scale are being created while smaller firms from both the distribution and supply sides are being established. Clearly, they see a void.

And we sense this void is being closer to the market. Consolidation will always be there, and consolidation will always spawn new ideas and directions as the market reacts and shifts, but is consolidation hurting Canada’s ability to market and communicate effectively?

We are called on often to work with these Canadian teams to help them in defining Canada as a market first and helping them explain the differences in structure and makeup. It’s important to them to be able to explain the differences here, squash perceptions that Canada operates like the U.S. or Europe, and reinforce the adage of act globally think locally.

One great example we use is General Motors’ Latin American launch of Chevy Nova’s flop, where “no va” means “don’t go.” Another analogy we use is comparing Canada to Texas or California. This works well in setting the stage.

The first premise we look at is how and where the parent firm is in its local market development. Just because they have been doing certain things a certain way for years does not guarantee a quick cut and paste solution here. The first hurdle is to modify a product, get CSA, adjust pricing, and possibly rethink distribution.

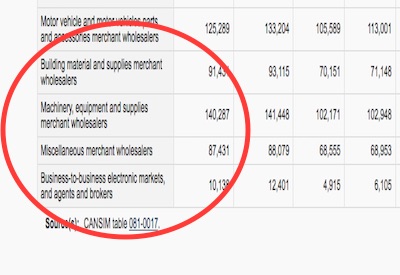

Our next discussion centres on Canada’s unique needs and how they differ from existing markets. We discuss the Canadian market in terms of the Total Available market and we look at the product offering to see the fit, look at the competition and what is the buyers or specifiers journey.

Then we focus on the markets, the segments, the potential channels and speed to market, and try to validate and build a path forward.

One common misunderstanding is U.S. and global media don’t cover Canada, while another is the channel is so consolidated in Canada one need only to lever an exiting offshore relationship.

Another common thing too here is Canadian firms are driven mostly by a sales focus, one that is customer facing and must carry the load and responsibility of selling and growing share without all the tools other subsidiaries may have at their disposal.

In Europe, the need to have solid and sophisticated marketing communications strategies that are designed specifically for a country don’t always migrate over here, while U.S. programs tend to be limited to south of the boarder and Canadian teams are not given all the resources they need to do what needs to be done.

Over the years there have been many success stories here and underlying every one of them has been a solid strategy to support and communicate, and to understand. So here are a few of those key success factors from those who are winning here and that could help you in your efforts to define Canada.

- Commit to the market — listen and understand the real needs

- Get involved and increase visibility

- Be dogmatic about why Canada is different and be prepared to do that every day

- Develop a solid and direct link to the end users

- Be tough on partnering — don’t be all things to all people

- Segment, segment and segment again — understand where the sweet spots for growth are and attack

- Be prepared to think beyond today’s job description to get done the things your need to build awareness, and understand that resources sometimes follow scale

John Kerr is Publisher of CEW and CEO of Kerrwil Publications. Photo source: Pixabay.