Statcan Study Shows Steady Decline in Business R&D Spending

March 1, 2017

Businesses in Canada spent $16.0 billion on in-house research and development (R&D) in 2013, compared with $14.1 billion a decade earlier. However, business sector R&D in 2013 was below pre-recession levels, as the pace of spending in different R&D-performing industries changed significantly after the 2008-2009 recession.

Annual in-house spending on industrial R&D by businesses in 2013, measured in current dollars, was about $700 million lower than it was in 2007, as reduced spending by Ontario-based manufacturers was partly offset by higher R&D spending in Alberta’s energy sector. From 2007 to 2013, the overall number of R&D personnel employed by businesses in Canada declined 21.1%, reflecting fewer technicians and technologists working in R&D-performing manufacturing and service firms.

From 2007 to 2013, Canada’s ratio of business enterprise expenditure on research and development (BERD) to gross domestic product (GDP) fell from 1.06% to 0.85%. In contrast, the overall BERD-to-GDP ratio for countries that are part of the Organisation for Economic Co-operation and Development rose from 1.53% to 1.61% during the same period.

Lower R&D spending by manufacturers after the 2008–2009 recession

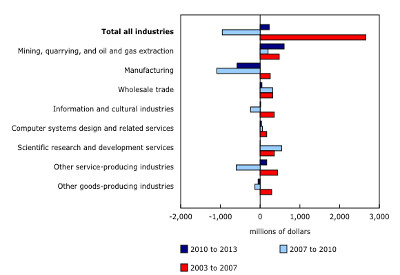

Prior to the 2008-2009 recession, support for higher spending on industrial R&D came from a range of economic sectors. In-house R&D spending by businesses rose from $14.1 billion in 2003 to $16.8 billion in 2007, as service-based firms, resource-based firms, and manufacturers all increased spending. By 2007, total business expenditures on industrial R&D were 17.5% higher than in 2001, when R&D spending in manufacturing was at its peak.

Annual R&D expenditures fell from $16.8 billion in 2007 to $15.8 billion in 2010, on lower spending by manufacturers. Businesses that manufacture communications equipment, semiconductors and other electronic equipment, and pharmaceuticals and medicines reduced their R&D spending during this period, while spending among aerospace manufacturers increased.

Overall in-house R&D spending by manufacturers continued to decline following the 2008–2009 recession. Annual industrial R&D expenditures by manufacturers in 2013, measured in current dollars, were $581 million lower than in 2010. Decreases in manufacturing R&D since the recession reflected a smaller number of companies performing R&D, and coincided with lower levels of capital spending and manufacturing output.

Higher R&D spending by energy companies

Higher in-house R&D spending by resource-based companies offset declines in manufacturing from 2010 to 2013. Energy companies accounted for over 80% of the $604 million rise in resource-based R&D from 2010 to 2013, reflecting increased activity related to heavy crude oil extraction and environmental remediation. Higher R&D activity in the energy sector coincided with gains in investment spending and output.

R&D spending shifting westward

Recent changes in the industry composition of in-house R&D spending affected the geography of business sector R&D in Canada. Ontario’s share of total R&D spending fell from 48% in 2007 to 44% in 2013, as manufacturing R&D in the province declined. Ontario’s BERD-to-GDP ratio fell from 1.4% in 2007 to 1.1% in 2013.

Quebec’s share of total industrial R&D spending was steady at 29% in 2007 and 2013, while the province’s BERD-to-GDP ratio declined from 1.7% to 1.4% over the period.

Alberta’s share of total industrial R&D, supported by higher spending in the province’s energy sector, increased from 9% in 2007 to 13% in 2013, while the province’s BERD-to-GDP ratio was stable at 0.6%.

Higher R&D spending by foreign-controlled firms in energy sector and services

From 2007 to 2013, higher in-house R&D spending by foreign-controlled firms, mainly from the United States, partly offset declines in spending by Canadian-controlled businesses. Both Canadian-controlled and foreign-controlled manufacturers reduced their R&D spending during this period, with foreign-controlled firms divesting out of manufacturing R&D at a faster pace. Foreign-controlled businesses were responsible for the growth of R&D in services, as spending by Canadian-controlled businesses decreased. Higher R&D spending by both Canadian-controlled and foreign-controlled companies supported the shift in R&D activity toward natural resources. In 2013, foreign-controlled businesses accounted for 39% of industrial R&D spending in resource industries.

Canada at 150: Business sector R&D spending

Provincial data on business sector R&D are available back to 1979, and highlight how R&D spending has responded to changes in economic conditions in different parts of the country.

During the late 1990s, Ontario’s share of business sector R&D was stable at around 55%, as spending in Ontario, Quebec and British Columbia increased. Following the downturn in technology markets in 2000-2001, the pace of R&D spending in Ontario moderated, as manufacturing output in the province slowed before contracting sharply during the 2008-2009 recession.

Alberta’s share of business R&D spending has increased since the onset of the commodities boom in the early 2000s. At over 12% in 2013, the province’s share of industrial R&D spending was about the same as it was in the early 1980s, before capital spending and provincial output declined as the boom in oil markets came to an end.

Quebec’s share of total business sector R&D rose in the late 1980s and has generally been stable at about 30% since the mid-1990s.

Source: Statistics Canada, www.statcan.gc.ca/daily-quotidien/170215/dq170215f-eng.htm.