Millennials Will Be Key Drivers of Future Value for Energy Providers: Accenture Research

August 31 2016

Millennials’ strong interest in new products and services will drive the most future value for energy utilities, but they are much more demanding consumers, according to international research conducted by Accenture. At the top of their list: connected living solutions, solar and other digital products and services.

Accenture’s seventh annual survey of energy consumers explores the views of almost 10,000 respondents across Canada and 16 other countries. The research, The New Energy Consumer: Thriving in the Energy Ecosystem, found that a large demographic, Millennials, bring a strong influence on key consumer engagement trends amid an increasingly complex set of competitors vying for energy products, services and experiences. A sampling of findings appears below.

Millennials want to be the first to sign up for new energy products and services. 24% of this demographic are classified as early adopters, compared with 17% among the 35-54 age range and 7% of those over 55.

Millennials are more interested in experimenting with new technologies (22%), compared with other age groups (15% for those aged 35-54 and 6% for those aged 55 or over).

Millennials are very receptive and far more likely to consider distributed energy resources (DER) products and services after receiving related information: 87% compared to 60% among those over 55. Almost 80% said they’d be more satisfied if offered an in-home digital assistant and monitoring service that suggested customized new products and services offers, compared to 62% of respondents over 55 years of age.

Millennials are more interested in home energy management. 61% are likely to sign up for an application to remotely monitor and control home elements in the next five years vs. 36% of those over 55. Notably, 56% of Millennials, twice as many as people over 55, are likely to sign up for solar panels in the next five years.

A generation more demanding of their energy providers

Millennials view energy and engage in a far deeper way with energy providers and from a completely different vantage point. While there’s obvious demand for new products and services in this space from them, they want information, and they want everything to be instantaneous and accessible on their terms.

Millennials’ expectations when it comes to use of digital channels are also higher. For example, they attach more importance than older demographics to a personalized experience across digital channels as well as access to the latest digital technologies that enable them to interact with their energy providers. Moreover, 83% would be discouraged from signing up for additional products and services if their provider could not provide a seamless experience.

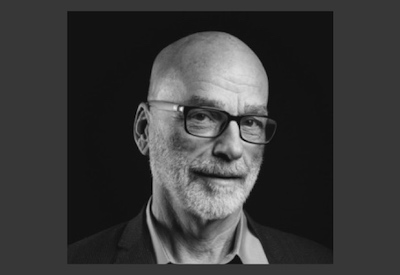

“Energy providers must take these and other insights about these groups to heart, to unlock value, because consumers’ preferences and behaviours are rapidly changing the market landscape,” says Tony Masella, Managing Director of Accenture Energy Consumer Services. “Successful energy providers will place design thinking at the heart of their business and view customer and retail operations as a strategic asset.”

Engaging with this growing influential group

The survey showed that utilities have substantial opportunities to engage with Millennials as they gain in influence over other consumers. For example, 41% of Millennials interact more frequently with their energy provider using social media, and they would also be more satisfied if they could log into their provider’s portal via social media credentials.

The survey also showed that new value propositions are of higher interest to Millennials; 77% would be interested in an online personalized marketplace to select and purchase energy-related products and services. Additionally, just over a third would be interested in automated home solutions and would be willing to pay for them.

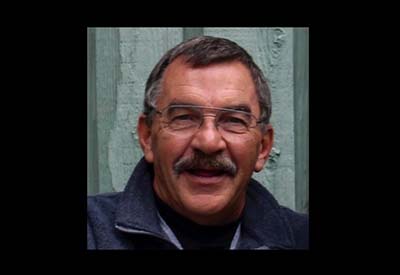

“Customer strategies must take a broad view of the trends shaping today’s consumers, and more importantly, the consumers of tomorrow,” says Masella. “To thrive, energy providers must move quickly to architect their transformation, build new capabilities to seize new opportunities, achieve scale, and continuously innovate using digitalization, automation and multi-faceted operations.”

About the research

The multi-year New Energy Consumer research program is designed to help utilities understand emerging consumer needs and preferences, to identify new challenges and opportunities and to bring focus to the critical competencies required to succeed in the evolving energy marketplace. The program draws upon primary research insights from end consumers around the world, leading practices from industry and cross-industry providers, and technology adoption analysis.

Methodology

Accenture’s seven years of global research surveys are based on questionnaire-led interviews with end consumers. Surveys were conducted online in native languages. The selected countries represent a range of regulated and competitive markets. In 2016, a total of 9,537 interviews were conducted in 17 countries, including

• 532 in Canada

• 1,358 in the United States

• 647 in the United Kingdom

• 500 in Australia, Brazil, China, France, Germany, Ireland, Italy, Japan, Malaysia, the Netherlands, Philippines, Portugal, Singapore and Spain

For residential consumers the survey sample was statistically representative of the general population in each country, with the exceptions of Brazil, China, Malaysia and Philippines, where the sample was representative of the urban populations. The surveys included attitudinal, behavioral and demographic questions.

Find out more: http://www.accenture.com/newenergyconsumer2016.