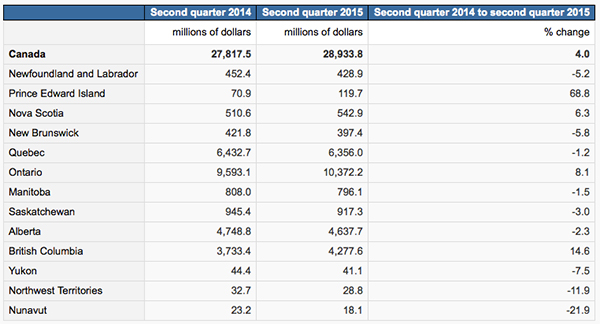

Q 2 Residential Construction Investment Up 4% Year over Year

Investment in residential construction totalled $28.9 billion in the second quarter, up 4.0% from the same quarter in 2014. From a national perspective, renovation spending (up 4.3% to $13.9 billion), investment in apartment and apartment-condominium buildings (up 9.9% to $3.9 billion) and acquisition costs for new dwelling units built (up 9.9% to $2.7 billion) were responsible for most of the 4.0% increase. Total investment in residential construction increased in four provinces: Ontario, British Columbia, Prince Edward Island and Nova Scotia. See the table below for statistics on each jurisdiction.

In Ontario, investment rose 8.1% to $10.4 billion in the second quarter compared with the same quarter of 2014. Spending on single-family dwellings, renovation, apartment and apartment-condominium buildings as well as acquisition costs related to new dwelling units built were the largest contributors to the advance.

In British Columbia, residential construction investment increased 14.6% in the second quarter to $4.3 billion. The advance came from higher investment in all dwelling types except mobile homes. Single-family dwellings, renovation of existing residential buildings, apartment and apartment-condominium buildings and acquisition costs accounted for much of the gain.

In Prince Edward Island, total investment in residential construction increased 68.8% to $120 million. The gain was mainly attributable to higher renovation spending.

In Nova Scotia, total spending on residential construction increased 6.3% from the same quarter a year earlier to $543 million in the second quarter. The increase was the result of higher investment in apartment and apartment-condominium building construction and, to a lesser degree, higher spending in renovation work.

The largest declines were registered in Alberta, Quebec and Saskatchewan.

In Alberta, investment in residential construction decreased 2.3% to $4.6 billion in the second quarter. Lower spending on renovations, single-family dwellings and mobile homes more than offset increased investment in apartment and apartment-condominium buildings and row houses, as well as acquisition costs.

In Quebec, spending in the construction of residential buildings declined 1.2% to $6.4 billion. The decline was mainly the result of lower investment in single housing, apartment and apartment-condominium buildings, and converted dwelling units, as well as lower acquisition costs. However, spending on renovation work was up 8.5% to $4.1 billion in the quarter.

In Saskatchewan, investment totalled $917 million in the second quarter, down 3.0% from the same quarter in 2014. The decrease occurred mostly as a result of lower investment in the construction of single-family houses and mobiles homes, as well as lower acquisition costs.

Source: http://www.statcan.gc.ca/daily-quotidien/150903/dq150903c-eng.htm?cmp=mstatcan.