The Biggest Risks to Canada’s Economy In 2015 and Beyond

Paul Eitmant

Recently I read a May 22 article in the Huff Post “Business Canada” and Doug Carroll from USA Today. I found they both had some points of interest to the electrical Industry in North America.

Listed below are key points of interest:

• Carbon Bubble

• Opposition to Keystone XL and other Pipelines

• Elections, in Canada and Abroad

• Sinking Commodity Prices

• Debt Loads

• Global Instability and Terrorism

• Russia/China

• Oil Prices

We welcome 2015 at a rather tumultuous time for the global economy — from falling oil prices to hacker threats against a movie studio, to a crucial election in around the world.

The global economy is at a crossroads that could see it either finally escape the aftermath of the 2008-2009 financial crisis, or it could sink back into a slowdown. Personal and public debt loads are high, while the recovery in job markets and income levels has been disappointing and income disparities within countries are widening. Many of the biggest threats to Canada’s economy will sound familiar. They’ve been building since the Great Recession, but 2015 also poses a unique set of challenges that could affect Canadians this year.

The carbon bubble is the idea that if the world’s governments meet targets to limit climate change to 2 degrees Celsius by cutting carbon emissions, there will be a glut of fossil fuels on the market that cannot be burned.The concern is that when investors realize oil companies will have to leave much of the product they own in the ground, oil company stocks will collapse, leading to a crisis in the industry that could affect Canada. Among the people concerned about a carbon bubble is former Bank of Canada governor and current Bank of England governor Mark Carney.

Many in Canada’s oil sector have been holding their breath to see whether the U.S. approves the Keystone pipeline, which would see tarry bitumen from Alberta’s oil sands pumped south for export from the U.S.

After five years of relatively stable crude prices, oil prices have dropped nearly 50 per cent since June to their lowest level in five years. The drop is a double-edged sword for the Canadian economy. The IMF says it could boost global economic growth by as much as 0.8 percentage points above the expected 3.8 per cent. It’s also good news for consumers, whose savings at the gas pump could translate into more spending elsewhere.

However, if oil continues to hover between US$60 to $70 a barrel, it could expose weaknesses in oil-dependent countries and companies and even push some to default on debt obligations. The tanking price is bad for Canada’s oil sands, a major source of domestic economic growth and could push the loonie lower.(Per Mr. Getty – Business Canada)

Bottom line: oil will continue to be a benchmark in Canadian economy.

Chinese growth has been a massive driver of the global economy but is losing momentum, affecting the entire global supply chain. Investors are hoping that China’s GDP growth does not come in worse than the 7-per-cent rate it has predicted.

A chain reaction caused by the slowdown in China could be particularly concerning for Canada, which had been protected from the worst of the Great Recession, benefitting from Chinese manufacturing’s demand for commodities. In addition, the unrest in Hong Kong, one of the world’s financial hubs, is not over, posing a risk of more uncertainty in the region.

Russia’s ruble has sunk by about 40% in the past few weeks, and the country could soon find itself in recession, partly due to Western sanctions over its aggressive behaviour in Ukraine.

As a G8 country, it is a large source of demand for Canadian exports. The country already slapped retaliatory sanctions on Canada in 2014 and the lack of trade could hit Canada’s overall trade figures.

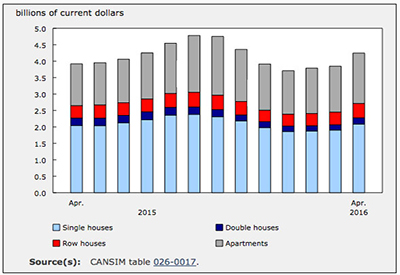

We all know that, Housing Starts in Canada decreased to 181.81 Thousand in April of 2015 from 189.50 Thousand in March of 2015. Housing Starts in Canada averaged 183.27 Thousand from 1977 until 2015, reaching an all time high of 291.60 Thousand in March of 1978 and a record low of 90.70 Thousand in August of 1982. Housing Starts in Canada is reported by the Canada Mortgage And Housing Corporation.

Housing Starts in the United States increased to 1.135 million in April 2015 from 944,000 in March 2015. Housing Starts in the United States averaged 1.447 million from 1959 until 2015, reaching an all time high of 2.494 million in January of 1972 and a record low of 478,000 in April 2009. Housing Starts in the United States are reported by the U.S. Census Bureau.

When you compare the percentages, the U.S. has a significant gain and Canada degreased during the same time period.

Read more from Paul Eitmant in CEW:

– A New Player in the Canadian Gray Market

– The Cost of Bad Leaders

– NAFTA Still a Good Show

– On Being an Effective Coach

– Networks and Lighting Standards – Follow Up – One Year later

– How Healthy is Your Business?

– Social Media: Is It the Future for the Electrical Industry?

– Customer Service: A Key to Success

– The Right Price to Get the Order — the Last Look

– The Good Old Boys Club “Changing of the Guard”

– Who’s Next Within North America’s Electrical Distributor Channel?

– Generation Y – Next Generation – Never to old to Learn!

– LEDs: the Fastest Growing Product/Market for 2015