Study Explores Investment intensity in Canada and the U.S., 1990 to 2011

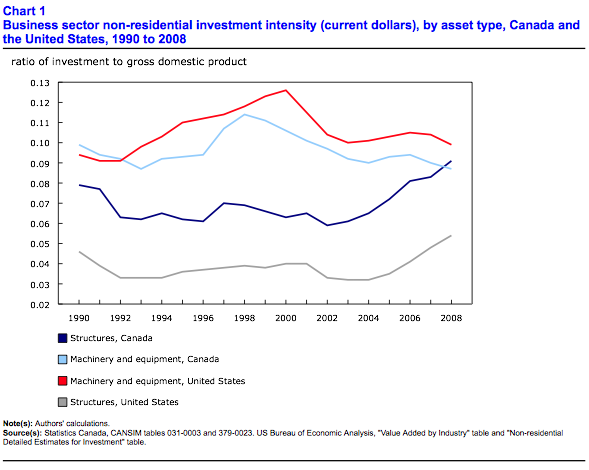

Non-residential investment intensity for the business sector was, on average, 15% higher in Canada than in the U.S. between 1990 and 2011.

This gap between the two countries occurred largely because Canadian businesses had higher investment intensity in buildings and engineering structures, including pipelines, rail lines, dams and mining facilities.

Investment intensity is measured by the ratio of investment to gross domestic product. It captures the extent to which current resources are devoted to future production via investment in long-lived assets. It also reflects an economy’s commitment to providing tangible long-lived assets to support production. Increases in the amount of capital per worker made available to workers via investment in these assets are the primary contributor to gains in labour productivity. Canada’s investment intensity in non-residential structure assets was, on average, 80% higher than the U.S.’

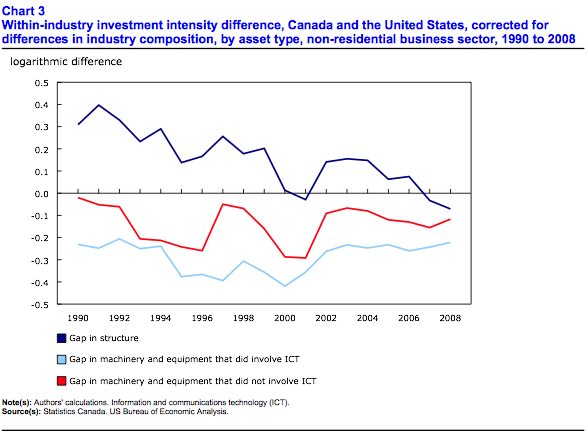

At the same time, Canada’s investment intensity was similar on average to the U.S.’ for machinery and equipment that did not involve information and communications technology. Notably, Canadian investment intensity was about 30% lower for machinery and equipment that did involve information and communications technology.

Measures of aggregate investment intensity for structures — machinery and equipment that did involve information and communications technology as well as machinery and equipment that did not — will vary across countries if there are differences in industrial structure and can change in response to industrial restructuring.

Compared with the U.S., Canada specialized more in mining, oil and gas and utilities industries, all of which invested heavily in engineering structures and machinery and equipment that did not involve information and communications technology. In contrast, industries that are information and communications technology-intensive, such as information, professional services, and finance insurance and real estate, were less important in Canada than in the U.S.

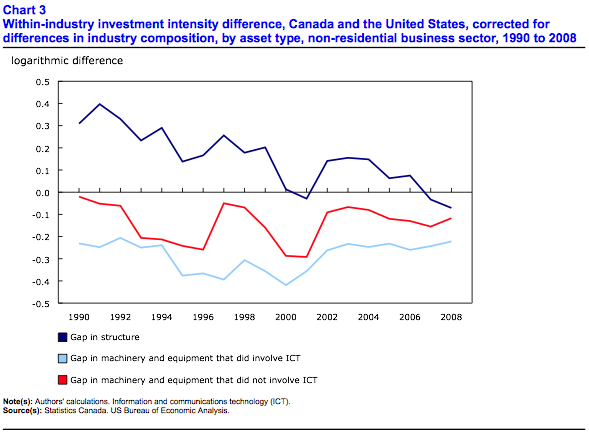

Overall, differences in industrial structure between the two countries accounted on average for

• 70% of the Canada-U.S. gap in structures and buildings

• 26% of the gap in information and communications technology investment over the time period studied

Throughout the 1990-to-2008 period, Canada also had a relatively constant small positive advantage in investment intensity for machinery and equipment that did not involve information and communications technology. But that advantage disappears when industry structure is taken into account.

Moreover, changes in industrial structure in the post-2000 period widened the gap in information and communications technology investment intensity since information and communications technology-intensive industries, such as information, professional services, and finance, insurance and real estate, grew more slowly in Canada than in the U.S.

The trend in aggregate within-industry differences excluding differences in industrial structure indicates that the two countries moved closer to one another over the period. The gaps in within-industry investment intensity between Canada and the U.S. declined post 2000 for the two asset types (engineering and buildings, and machinery and equipment that did involve information and communications technology) where the uncorrected averages were diverging over the period studied. The positive within-industry gap in buildings and engineering structure declined, as did the negative gap for machinery and equipment that did involve information and communications technology.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/141021/dq141021a-eng.htm?cmp=mstatcan.