2020 Planning

Nov 12, 2019

By David Gordon

We’re in the midst of meeting and planning season and with it comes the perennial question of “What’s the outlook for 2020?”

While no one has a crystal ball, it’s safe to say that many think their ball is “cloudy” for next year. It’s unclear what, if anything, the market will give in growth, hence succeeding in 2020 is dependent on the execution of your strategy and identifying where you can succeed.

Why cloudy?

Three reasons, all self-evident: a tariff environment that creates uncertainty for businesses, global economic concerns that have hampered the export market, and an election year.

Rather than dwell on things that none of us can control, all that can be done is play the cards dealt. Out of the three cards above, a decision regarding the tariff environment would enable businesses to make decisions. Keep the tariff permanent and businesses will decide how they want to manage their supply chains and “life will go on.” Remove them and companies will act accordingly, with most going back to status quo but probably still complaining.

Elections come regularly; life goes on as, regardless of the outcome, there will be market segments that represent growth opportunities… they may just change depending upon the party in charge.

Economic outlook

The short answer is… “I have no idea.” So, let’s look at what industry-oriented economic communicators are sharing

From Chris Sokoll at DISC

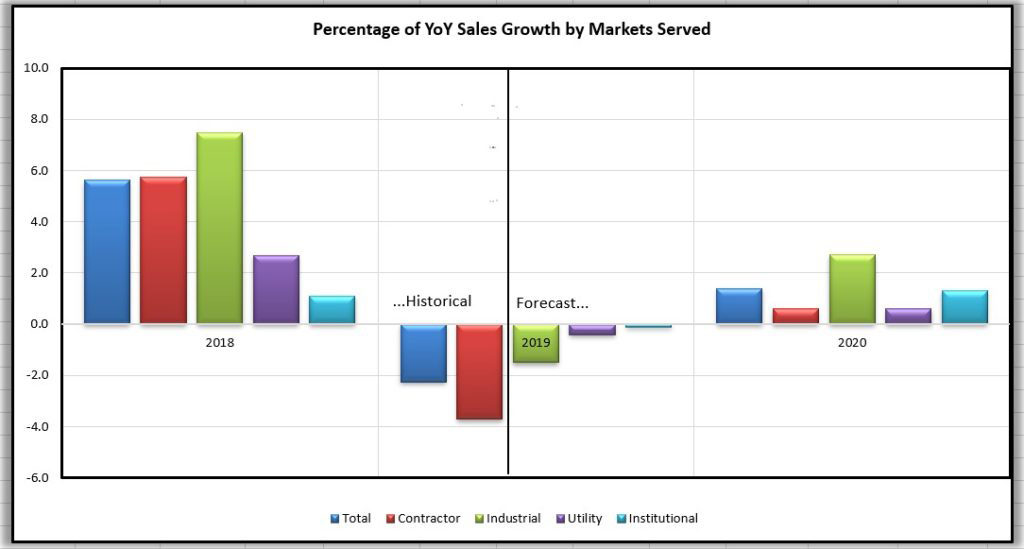

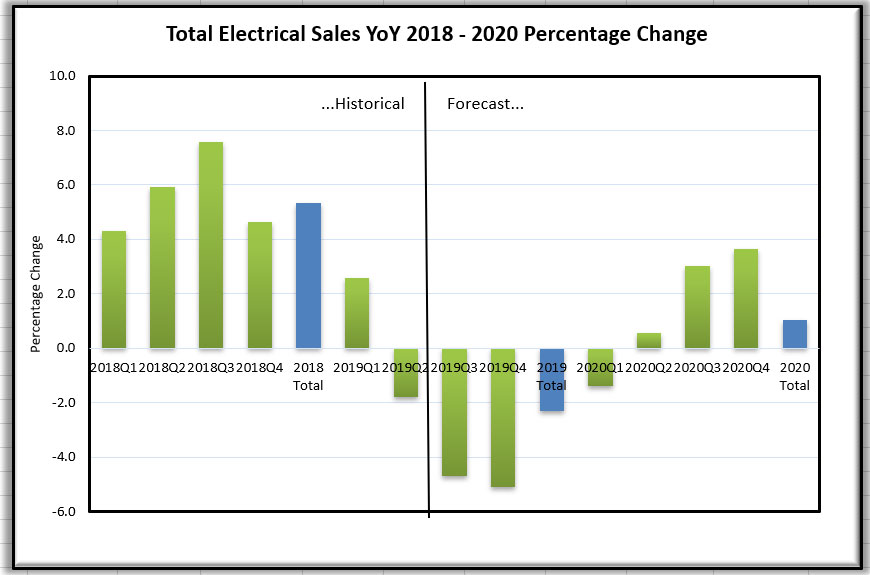

DISC Corp forecasts overall 2019 Electrical Distributor served markets to be down -2.2% year over year from a strong performance in 2018. Looking ahead, we are forecasting a modest 1.4% growth for 2020.

The primary drivers are a -3.7% year over year deceleration in the Contractor Market in 2019 that will not return to growth until Q3 2020. We are tracking the 2019 Industrial Market to end -1.5% behind 2018. Our 2020 forecast is for 2.7% growth in this market. Our 2019 Institutional Market performance is relatively flat at -0.1%, and we are forecasting growth of 1.3% for 2020. The Utility Market will end 2019 down -0.4% year over year, and the 2020 Utility forecast is in for a slight 0.6% increase.

Chart provided by DISC

The DISC Corp quarterly sales forecast is for continued weakness through the balance of 2019 and into Q1 2020. This weakness is fuelled by uncertainty with trade policy and expanding tariffs, slowing employment growth, weaker construction and near zero commodity inflation. Our 2020 forecast is for a return to low growth in Q2 with expansion advancing in Q3 and Q4 ending the year at 1.4% above 2019 sales.

Chart provided by DISC. DISC Corp has been analyzing and forecasting the Electrical Distributor served markets for more than 30 years. Their proven methodologies provide valuable market insights to distributors, manufacturers, agents and financial analysts; www.disccorp.com

Trade policy uncertainty and tariffs impact the electrical distribution industry in two ways. The first is the impact to cost of goods for those items with tariffs that are imported, as well as component parts in equipment that manufactures must pass on to the distribution channel. This impact varies by the imported product tariff schedules. Secondly there is multi-source economic research that ties capital spending directly to trade policy uncertainty. DISC is forecasting equipment spending slowing from 5.6% YoY in 2018 to an average of 2.7% between 2020-2023. Structures share a similar trend slowing from 4.1% in 2018 to -0.5% average 2020-2023. With a large global footprint, the manufacturing sector takes the brunt of the impact of capital spending declines tied to trade policy uncertainty.

In a recent ITR Economics blog posting, Jackie Greene, Director of Economics writes, “Parts of the US economy are in recession, and more will follow. US GDP is slowing” ([https://blog.itreconomics.com/blog/where-is-good-news). And “The projected 2022-23 recession…” And here’s a link to their five year US economic outlook… spoiler alert… according to ITR, US industrial production hit its peak in 2019 for the next five years (https://promotions.itreconomics.com/five-year-planning-form).

From a newsletter from the National Association of Manufacturers https://www.ecianow.org/assets/docs/Stats/NAM/Economic Report10212019.pdf):

• Respondents felt positive in their outlook for the next six months. Housing starts fell 9.4%, down from an annualized 1,386,000 units in August to 1,256,000 units in September. Despite pulling back sharply from the best reading since June 2007, the single-family data continued to be encouraging.

• Manufacturing production declined 0.5% in September, falling for the sixth time year to date but following a gain of 0.6% in August.

• New residential construction permits have jumped 7.7% year-over-year, which should bode well for accelerated housing activity over the coming months. For their part, homebuilder optimism rose to a 20-month high in October.

The FMI US Engineering and Construction Outlook, Q3 Report (https://www.fminet.com/outlook/fmi-u-s-construction-outlook-third-quarter-2019-report/) highlights

• total engineering and construction spending for the US is forecast to end up <1% in 2019

• FMI’s Nonresidential Construction Index (NRCI) at 50.4 is the lowest score recorded in more than seven years

• the FMI report also shares performance by market segment

FMI also conducts the CIRT Sentiment Index, which is a survey of members of the Construction Industry Round Table. The survey is conducted quarterly. Some key takeways from the Q4 Report (https://www.fminet.com/reports/2019-cirt-sentiment-index-fourth-quarter-report/?):

• pronounced decrease in the CIRT Sentiment Index as well as some decline in the Design Index. The CIRT Sentiment Index fell from 64.9 to 57.6, whereas the Design Index reflected a less dramatic loss, from 63.2 to 60.9

• the downward trend in the scores represents the elusiveness of the market leading into 2020

• the report highlights outlook sentiment by market segment.

Some additional info:

• Early feedback we’ve heard from lighting manufacturers is that the 2020 Dodge Analytics construction outlook is for a flat year.

• Acuity, as mentioned in their recent quarterly/end of fiscal year call, projected a slow 2020.

• Grainger agreed with analysts that 2020 is currently projecting to be flat for the MRO market.

Bottom line

From a national perspective, 2020 appears to be a flat year. Which, from a distributor perspective, does not mean that the year needs to be a flat year as the adage that “every market is a local market” is always true. And yes, you can control a portion of your destiny.

It’s important to gather pertinent local data… and not to only listen to your salespeople who will talk to their key customers who never say they will be down (and, unless they are a very large contractor with business already under contract, they really don’t know what they will win).

The market will giveth and the market will taketh

As a distributor, the question is, what is your strategy to:

• take share within current accounts

• continue to differentiate your company to ensure your customers WANT to do business with you

• profile and penetrate those customers who are rarely called upon but represent opportunity

• determine if your sales and marketing organization has the ability and willingness to pursue new accounts, or if you and they are satisfied in calling on the same people and surrendering business to competition because “it’s too tough”

• anticipate customer needs so that you can better serve them and build a moat around your business with them

• utilize marketing as your “12th man” (since we’re in football season) to engage customers as an alternative sales organization

• engage customers and utilize more modern, perhaps untraditional, marketing techniques

And if you are a manufacturer

• Are you arming your sales organization with what it needs to win at “the customer” level with “customer” being defined in the terms of “following the money”?

• If you think you have a brand, do others know what it stands for? Can your salesforce communicate it?

• Are you easy to do business with or putting up barriers to your channel? Are you a “supplier of choice” or a “supplier of reluctance”?

• Considering segmented strategies to accelerate growth with those who want to accelerate with you and serving others to maintain the cash flow business?”

In a market that will be challenging for many, there are opportunities for some.

What are you forecasting or are you hearing as economic forecasts?

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. He can be reached at 919-488-8635 or dgordon@channelmkt.com.