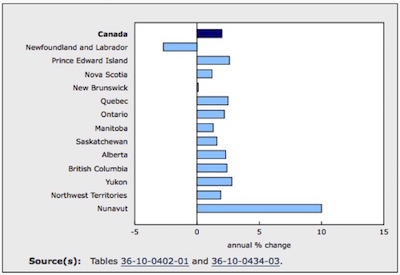

2018 GDP Grew 2% Nationally

May 9, 2019

In 2018, real gross domestic product (GDP) increased in nine provinces and in all territories. Real GDP declined in Newfoundland and Labrador. Nationally, real GDP by industry rose 2.0%.

Among the provinces, the strongest growth occurred in Prince Edward Island (+2.6%), followed by Quebec (+2.5%), British Columbia (+2.4%), Alberta (+2.3%) and Ontario (+2.2%). Growth was below the national average in Saskatchewan (+1.6%), Manitoba (+1.3%) and Nova Scotia (+1.2%). New Brunswick real GDP edged up 0.1%.

Newfoundland and Labrador

In Newfoundland and Labrador, GDP fell 2.7% in 2018, following a 0.9% increase in 2017. Goods-producing industries decreased 5.9%, while service-producing industries edged down 0.2%, the first decline in more than 20 years.

Construction activity fell 19.6%, as a 32.4% decline in engineering construction more than offset a 52.2% increase in non-residential construction partially due to progress at a new science building at Memorial University. Electric power engineering construction fell nearly 50% as work on the Muskrat Falls electric power project and related transmission system wound down. Oil and gas engineering construction declined for the fourth straight year with the completion of the Hebron oil field in 2017. These declines were moderated by increases in other engineering construction such as work on a new iron ore mine in Labrador.

Mining, quarrying, and oil and gas extraction decreased 0.8% in 2018 due to significant declines in both copper, nickel, lead and zinc ore mining and in iron ore mining. Oil and gas extraction rose 5.0% as production ramped up at the Hebron oil field.

Manufacturing was up 4.1%, driven almost entirely by the third consecutive year of strong growth in output of non-ferrous metal (except aluminium) at the Long Harbour Nickel Processing Plant. Machinery manufacturing increased 14.0%. Seafood product preparation and packaging declined 16.3%, as the fishing, hunting and trapping industry (-11.6%) fell for the sixth consecutive year. Electric power generation and power transmission grew 4.2% as a result of higher output at the Churchill Falls hydroelectric plant.

Retail trade was down 4.1% in 2018 as 9 of 12 retail trade subsectors declined. Transportation and warehousing declined 2.8% from lower water and truck transportation. The public sector increased (+1.5%), mostly from growth in federal government public administration (except defence).

Prince Edward Island

The Prince Edward Island economy increased 2.6% in 2018, the highest growth rate among the provinces. Goods-producing industries (+3.2%) outpaced service-producing industries (+2.4%) for the second year in a row. Higher output was recorded in 16 of 20 major industry groups.

Manufacturing output rose 4.9%, as a result of increases in aerospace products and parts, pharmaceuticals and medicines, and seafood product preparation and packaging. A difficult growing season and a cold wet harvest period produced a smaller potato crop, resulting in a 2.5% decline in crop production and a 6.0% decrease in fruit and vegetable preserving manufacturing. Fishing, hunting and trapping increased 4.5%.

Construction grew 2.6% after a significant increase from 2017. Residential building construction was up 3.1%, coinciding with a notable inflow of international immigrants in recent years. Transportation engineering construction rose 21.2% from continued work on the Cornwall Perimeter Highway project and recent growth in residential building development. Electric power engineering construction declined 32.9% with the completion of the Interconnection Upgrade Project to replace power cables between New Brunswick and Prince Edward Island in 2017.

In the service-producing industries, the public sector increased 2.8% and was one of the major sectors contributing to the total economic growth. Wholesale trade (+3.7%) and truck transportation (+2.9%) rose on higher goods production. Accommodation and food services (+3.1%) posted its lowest gain since 2012, due to slower growth for food services and drinking places. Retail trade was up 1.6% with increases in 9 of 12 sub-sectors.

Nova Scotia

Nova Scotia’s GDP rose 1.2% in 2018, the fifth consecutive year of growth. Output of goods-producing industries grew 1.0%, while service-producing industries increased 1.3% and accounted for more than 80% of total economic growth.

Manufacturing increased 3.9%, led by gains from plastics and rubber products (+11.8%) with a second year of double-digit growth. There were also notable increases in paper, pharmaceuticals and medicines, and machinery manufacturing. Seafood product preparation and packaging, as well as wood product manufacturing, declined.

Mining, quarrying and oil and gas extraction activity was up 25.8%. Gold and silver ore mining increased as the Touquoy gold mine completed its first full year of production. Oil and gas extraction fell significantly as the Deep Panuke gas field shut down in May and Sable Island ceased production at the end of 2018. The completion of the Maritime Link Project and the new gold mine in 2017 were important factors in the decline of the construction sector and more than offset a 9.7% gain in residential construction.

The public sector grew 1.6%, accounting for almost 25% of the total economic growth with increases in educational services, health care and social services, and federal government public administration. Professional, scientific and technical services and administrative and support services grew, while information and cultural services declined for the third consecutive year as some newspapers moved from daily to weekly publication. Retail trade edged up 0.2%, the most significant slowdown since 2014, due largely to a 7.4% decrease in motor vehicle and parts dealers.

New Brunswick

In New Brunswick, GDP edged up 0.1% in 2018, following an increase of 2.0% in 2017. Goods-producing industries fell 2.8% as all underlying industry sectors registered declines. Service-producing industries rose 1.1%.

Among service-producing industries, the public sector grew 2.2%, the largest increase since 2009, mainly due to higher output from health care and social assistance and public administration. Professional, scientific and technical services were up 3.9%, the largest growth since 2011, with increases in most subsectors.

Manufacturing decreased 3.8%, mainly due to a 16.1% decline in output in petroleum refineries following scheduled maintenance and an explosion at the oil refinery in Saint John. The other two largest subsectors, food products and paper manufacturing, declined while most of the rest posted increases.

Construction declined 0.6%, the result of a 3.5% decrease in engineering construction. Non-residential building construction was down 0.8% as a new headquarters in Saint John approached completion. Residential construction increased 1.8%.

Agriculture, forestry, fishing, and hunting decreased 2.3%, mainly as a result of a decline in fishing, hunting and trapping hampered by restrictions due to right whales preservation measures over fishing areas. Electric power generation and transmission declined 3.2% due to the impact of intensive spring flooding on hydro generation at the Mactaquac generating station on the Saint John River. Mining and quarrying fell 16.2% as the shuttering of the Picadilly potash mine resulted in the closure of the adjacent salt mine.

Lower output of goods production and construction contributed to declines in the wholesale trade sector (-3.9%). Retail trade edged down 0.3%, due to declines in health and personal care stores and gasoline stations.

Quebec

Quebec’s GDP increased 2.5% in 2018 following growth of 2.9% in 2017. This was the first time since 2008 where Quebec was among the top three provinces in terms of growth. The increase was broad-based as all 20 industry groups contributed to growth in 2018. Goods-producing (+2.9%) outpaced service-producing (+2.4%) industries.

The public sector was up 2.3%, its strongest growth since 2010. Professional, scientific and technical services increased 3.9%, mainly due to computer systems design and related services (which includes video game design and development services) and architectural, engineering and related services. Wholesale trade rose 3.4%, primarily due to a 9.8% increase in machinery, equipment and supplies wholesaling. Finance and insurance services rose 2.3% on strength in both financial services and in insurance carriers and related services. Retail trade was up 1.7%, the smallest increase in three years.

Manufacturing output was up 2.5% as 13 of 19 major manufacturing subsectors rose. Significant gains were recorded in industries such as aerospace products and parts, primary and fabricated metal products, chemical products, and machinery manufacturing. A labour dispute contributed to a decline in the production of alumina and aluminum.

Construction grew 2.2% with increases in both residential and non-residential building construction. Non-residential construction rose 8.5%, primarily driven by investment in commercial structures, theatre and performing arts buildings, and health care facilities. Engineering construction declined 1.9% with lower activity in electric power and other engineering projects. Transportation engineering increased as work on the new Champlain Bridge in Montréal continued.

Metal ore mining gained 11.5% on significant increases in iron ore and in gold and silver ore mining. Crop production rose 10.8%, almost entirely attributable to a significant increase in licensed cannabis production as producers prepared for legalization of cannabis sales and consumption on October 17, 2018.

Ontario

Ontario’s GDP increased 2.2% in 2018, the slowest growth rate since 2013. Service-producing industries grew 2.4% and accounted for 1.9 percentage points of the 2.2% of total economy growth, while goods-producing industries rose 1.3%.

Public sector services grew 3.0% and accounted for most of the growth in service-producing industries. Professional, scientific and technical services rose 4.9%, mainly due to increases in computer systems design and related services and in other professional, scientific and technical services. Finance and insurance industries were up 2.4%, the lowest growth rate since 2012, primarily due to slower gains at financial investment services and depository credit intermediation and monetary authorities.

Wholesale trade increased 2.9%, primarily due to an 8.9% rise at machinery, equipment and supplies wholesalers. Transportation and warehousing rose 3.9%, mainly from increases in air transportation and warehousing and storage. Retail trade increased 2.0% with gains in 8 of 12 sub-sectors.

Activity of real estate agents and brokers fell 15.7% partly due to the new mortgage stress test introduced on January 1, 2018.

Manufacturing output was up 1.7%, with 10 of 19 subsectors showing increases. The largest contributions to the increase came from machinery, fabricated metal products and food manufacturing. Transportation equipment manufacturing was down 1.7%, the third decrease in four years, as motor vehicle manufacturing declined 7.0% in part related to reduced American demand for models built in Canada.

Construction output edged up 0.2% as increases in non-residential construction and repair construction were partly offset by decreases in residential construction. In addition, engineering construction declined 0.9% as work wrapped up on major transportation projects in Toronto and Ottawa. Mining and quarrying declined 5.3% as a 17.1% drop in copper, nickel, lead and zinc ore mining more than offset an increase in gold and silver mining. Crop production rose 11.5%, mainly due to a ramp-up in licensed cannabis crop production.

Manitoba

Manitoba’s GDP increased 1.3% in 2018, following a 3.1% gain in 2017. Goods-producing industries grew 1.1%, led by manufacturing and construction, while service-producing industries were up 1.4%.

Manufacturing rose 3.6% with increases in 12 of 19 subsectors. The main contributions to the growth came from transportation equipment, in particular heavy-duty truck (including buses) and aerospace products and parts, as well as food products, machinery, chemicals, and plastic products. Primary metal products manufacturing declined 12.9% as a result of the permanent closing of the Thompson smelter in July.

Construction industries grew 4.5%, primarily due to a 10.6% increase in engineering construction. Electric power engineering construction ramped up 8.3% as the building of the Keeyask power station on the Lower Nelson River continued. Oil and gas engineering construction increased 67.1%, partly due to a major pipeline replacement project. Non-residential building construction was up 2.2%.

Mining, quarrying and oil and gas extraction was down in 2018. Oil and gas extraction (except oil sands) increased 8.8% but was completely offset by a 19.1% decline in copper, nickel, lead and zinc ore mining due to the closure of the Birchtree nickel mine in Thompson in 2017. Crop production excluding cannabis fell 3.5% on lower output of soybeans and potatoes due to a wet and cold harvest season. The canola harvest hit another record, exceeding the output of 2017. Electric power generation and transmission declined 9.2% due to the impact of less favourable water conditions on hydro power generation.

Among service-producing industries, the public sector expanded 1.6% with contributions from all components. Transportation and warehousing was up 2.9% from increased rail, truck and pipeline transportation. Retail trade edged up 0.4%, with 5 of 12 subsectors showing gains. Wholesale trade declined 0.9% from decreases at wholesalers of building materials and supplies and miscellaneous products (including industrial and farm chemicals). Finance and insurance edged up 0.1% as declines in financial investment services and insurance carriers partially offset an increase in depository credit intermediation and monetary authorities.

Saskatchewan

In Saskatchewan, GDP was up 1.6% in 2018, following an increase of 2.3% in 2017. Goods-producing industries grew 2.3%, while service-producing industries gained 1.2%. Saskatchewan is one of only two provinces in which goods-producing industries contributed more to growth than service-producing industries.

Mining, quarrying and oil and gas extraction grew 2.7% as continuing strength in international exports for potash led to high production. Potash mining increased 9.8% as Bethune mine, the first new potash mine to open in the province in 40 years, completed its first full year of production. Oil and gas extraction rose 2.3%. Other metal ore mining fell 37.8%, following a decline of 21.7% in 2017 as weak market conditions resulted in the indeterminate closure of the McArthur River and Key Lake uranium mines.

Manufacturing output increased 4.2%, with significant gains in pesticide, fertilizer and other agricultural chemicals, grain and oilseed milling, fabricated metal products, transportation equipment, and machinery. Output of primary metal products and wood products fell.

Crop production grew 2.2% following a decline of 4.7% in 2017. Despite less than ideal harvesting conditions, the harvested area increased 14.0% for wheat resulting in higher production.

Total construction activity declined 0.2% as an 8.0% increase in engineering construction was more than offset by decreases in both residential (-12.3%) and non-residential (-13.4%) building construction. Oil and gas engineering increased 36.7% as new desulphurization equipment was installed at the Consumers’ Co-operative Refineries Limited refinery and work ramped up on a pipeline replacement project. Electric power engineering construction declined 11.3% as the Chinook power station moved closer to completion and other engineering construction declined 20.7% with the opening of the Bethune potash mine.

Among service-producing industries, the public sector rose 2.2%. Higher goods output contributed to the 2.9% rise in transportation and warehousing with increased demand for rail and truck transportation. Wholesale trade services grew 1.4%, mainly due to farm product wholesalers and miscellaneous product wholesalers who benefited from higher exports of potash. Retail trade services decreased 1.4% as 8 of 12 subsectors declined. The activity of offices of real estate agents and brokers declined for the seventh consecutive year.

Alberta

In Alberta, GDP advanced 2.3% in 2018 following the rebound of 4.6% in 2017. Goods-producing industries (+3.1%) and service-producing industries (+1.8%) contributed equally to total growth. The energy sector accounted for almost half of the total growth in the economy in 2018, despite the recent decline of oil prices and the widening price gap between West Texas Intermediate and Western Canadian Select.

Mining, quarrying and oil and gas extraction increased 6.4%. Oil and gas extraction grew 7.9% due to strong growth from both oil sands extraction and oil and gas extraction. Support activities for oil and gas extraction rose 2.2% despite a decline in activity in the second half of the year after a strong start. Capacity constraints limited pipeline transportation to a 2.9% increase. Coal output fell 23.9%.

Manufacturing output was up 2.3% with 11 of 19 subsectors showing increases. The main contributors to this growth were in chemicals, machinery and food products. Crop production declined 5.0%. Difficult weather conditions during the harvest season resulted in a smaller canola crop as both yields and harvested area were down.

Construction activity was down 0.7%. Residential construction declined 3.8% as re-building work in the Fort McMurray area following the 2016 forest fire eased. Engineering construction increased 1.0% mostly due to an increase in other engineering construction. Oil and gas engineering construction edged down 0.3% and has fallen by more than 50% since 2014.

Transportation and warehousing expanded 5.0% due to higher output from air, rail and truck transportation and warehousing and storage. In an effort to deliver more product to the United States, oil producers turned to rail transportation. Between January 2017 and December 2018, the volume of crude oil exported by railcar increased substantially. Wholesale trade grew 4.0% due to higher activity in seven of nine subsectors led by wholesalers of machinery, equipment and supplies.

Retail trade services were down 0.6% with an even split of increases and declines among the 12 subsectors. Offices of real estate agents and brokers fell 8.5%, the third decline in four years. Professional, scientific and technical services (-0.6%) posted a decline for the fourth consecutive year.

British Columbia

In British Columbia, GDP increased 2.4% in 2018, the fifth consecutive year above national growth. Goods-producing industries (+3.3%) grew faster than service-producing industries (+2.2%), which posted its smallest increase since 2012.

Mining, quarrying and oil and gas extraction rose 10.5%, largely due to the 22.2% increase in oil and gas extraction, almost entirely from natural gas. Output would have been even higher if not for a rupture in a natural gas pipeline in October 2018. The opening of a number of new gas plants in recent years has contributed to a 42.9% increase in natural gas production since 2015. The 2.1% rise in copper, nickel, lead and zinc ore mining did not offset the declines registered in the previous two years.

Construction output increased 3.1% after growing 10.8% in 2017. Residential construction was up 3.7%. Non-residential building construction expanded 13.2% following three years of consecutive declines as work picked up on office buildings and health care facilities. Engineering construction edged down 0.4% following growth of 37.9% in 2017 as work continued from many ongoing projects in 2018. Electric power generation, transmission and distribution declined 7.7% partly due to the impact of persistent dry weather on water inflows to hydro power stations.

Manufacturing grew 2.1% with 11 of 19 subsectors showing increases. The growth in transportation equipment manufacturing came mainly from boat and shipbuilding (+16.4%) as shipyards benefited from the federal government’s National Shipbuilding Strategy to build ships for the Royal Canadian Navy and the Canadian Coast Guard. Output from petroleum refineries fell 22.6%, due to a major maintenance project at the province’s largest refinery. Wood products manufacturing (-0.4%) declined for a second consecutive year due to lower activity at sawmills.

Public sector services rose 2.9%, with contributions from all components. Real estate and rental and leasing services were up 1.5%, although offices of real estate agents and brokers fell 25.2%. Home resale activity was impacted by provincial and federal government programs including the introduction of the speculation tax on residential properties, the increase of the property transfer tax applied to purchases by non-Canadian citizens or non-permanent residents in the Lower Mainland of British Columbia and the new mortgage stress test introduced at the beginning of 2018.

Transportation and warehousing services increased 3.8%, led by air, truck and support activities for transportation. Finance and insurance industries grew 2.7%, the lowest growth rate in the past five years. Wholesale trade services rose 2.5% as eight of nine subsectors registered higher activity. Retail trade grew 1.1%, the slowest growth rate since 2012, with declines at motor vehicle and parts dealers and health and personal care stores moderating increases in 9 of 12 subsectors.

Yukon

In Yukon, GDP increased 2.8% in 2018, following an increase of 2.9% in 2017. Goods-producing industries increased 1.2% and service-producing industries grew 3.3%.

Mining, quarrying and oil and gas extraction declined 27.0%. Metal ore mining fell 37.5% as the only operational metal mine in Yukon (Minto mine) was placed in care and maintenance status. Gold and silver ore mining declined 19.3%, while support activities for mining fell 6.7%.

The construction sector (+25.2%) registered a second consecutive year of strong growth. Engineering construction increased 77.7% and was the largest contributor to growth as construction of the Eagle gold mine ramped up. Non-residential building construction decreased 17.2% after growing 77.4% since 2015 as the finishing touches were put on the Whistle Bend Continuing Care Facility and the new facilities at Whitehorse General Hospital opened in January 2018. Residential construction was up 0.9%.

Wholesale trade services expanded 41.6%, primarily due to wholesalers of machinery, equipment and supplies largely related to construction activity at the Eagle gold mine. Transportation and warehousing rose 7.0% as truck transportation and support activities for transportation benefited from higher output in construction and wholesaling. Retail trade increased 3.0% with 8 of 12 retail subsectors showing growth. Higher tourism activity contributed to growth in air transportation.

Northwest Territories

In the Northwest Territories, GDP grew 1.9% in 2018 following an increase of 3.9% in 2017. Goods output rose 2.8%, while service output was up 1.5%. Engineering construction activity contributed the most to total economic growth.

Total construction increased 11.4% following two years of declines. Engineering construction increased 36.0%, the result of major projects, including additions and repairs to the electric power and transmission infrastructure, upgrades to the transportation system and the replacement of a segment of pipeline that runs under the Mackenzie River. Non-residential construction (-42.6%) declined with the completion of the Hay River arena, Yellowknife school expansion and near completion of the Stanton Territorial Hospital. Residential construction (-12.5%) declined for the second consecutive year.

Mining, quarrying and oil and gas extraction activity contracted 1.1% as diamond mining fell 4.8% after two years of strong growth. Following repair work on a pipeline, oil and gas extraction at Norman Wells resumed.

Public sector services increased 1.5% mainly due to contributions in education, health care and Aboriginal public administration. Transportation and warehousing rose 5.6%, primarily due to pipeline transportation related to the resumption of production at Norman Wells and air transportation. Retail trade was up 0.8%, while wholesale trade was down 0.3%.

Nunavut

In Nunavut, GDP increased 10.0% in 2018 following similar growth in 2017. Construction (+47.5%) and mining, quarrying and oil and gas extraction (+14.9%) contributed the most to the growth.

In construction, engineering construction grew 55.8% as work on the development of the Meliadine and Amaruq gold mines continued. Non-residential construction rose 52.9% partly due to the building of Nunavut Arctic College, the naval re-fueling station at Nanisivik and a few new schools.

Iron ore mining (+29.8%) was the main contributor to the expansion of the mining, quarrying and oil and gas extraction sector. Iron ore-carrying vessels made a record 71 trips during the summer and fall shipping seasons. Gold and silver ore mining increased 3.5%.

Services-producing industries increased 1.5%. Public sector services grew 2.9% with growth in all components. Transportation and warehousing was up 4.7% as higher construction and mining activity contributed to higher output in air transportation—to move workers in and out of work sites—and to higher output in truck transportation. Retail trade was up 0.8%. Wholesale trade fell 15.9%, attributable to a 23.8% drop in the wholesaling of machinery, equipment and supplies following two consecutive years of strong growth.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190501/dq190501a-eng.htm